Consumer Credit Storms Above $4 Trillion, As Credit Card Debt Hits Record High

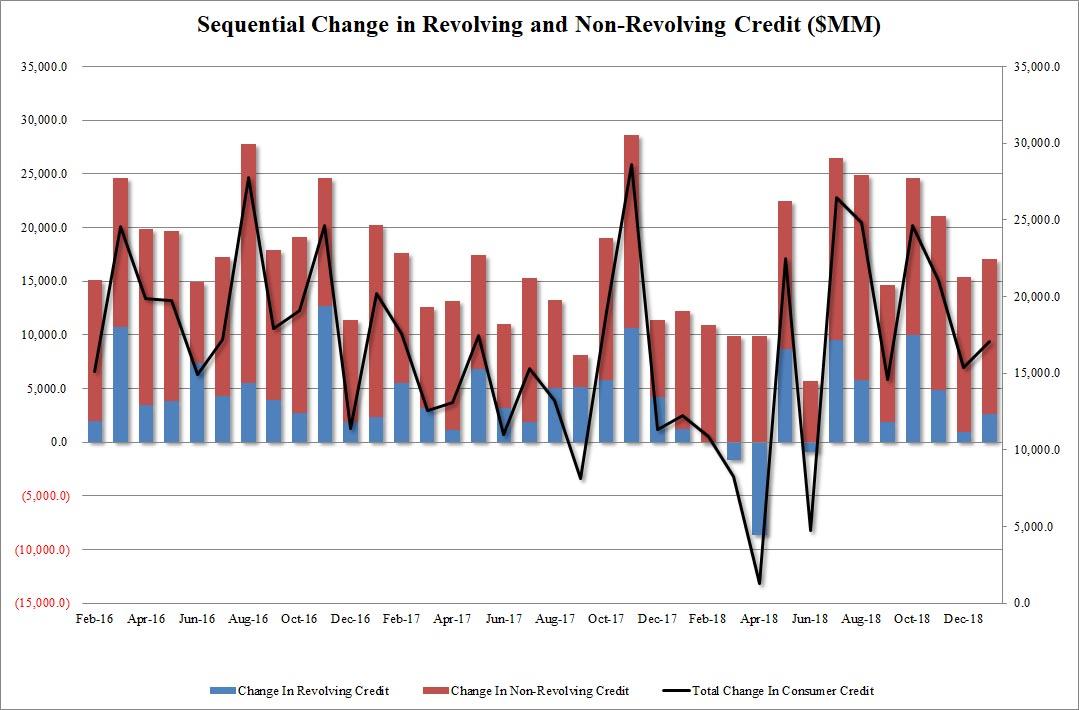

After a few months of wild swings, in January US consumer credit normalized rising by $17 billion, in line with expectations, following December's $15.4 billion increase. The continued increase in borrowings saw total credit storm above $4 trillion and hitting a new all-time high of $4.034 trillion on the back of an America's ongoing love affair with auto and student loans, and of course credit cards.

(Click on image to enlarge)

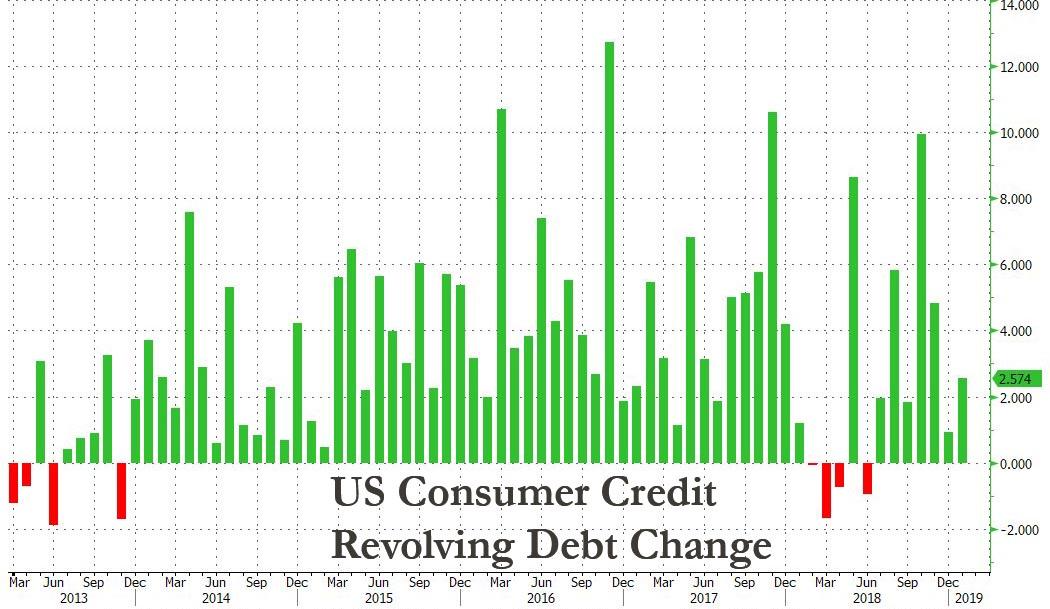

Revolving credit increased by $2.6 billion, a rebound from December's downward revised $939 million, and rising to $1.058 trillion, a new all-time high in total credit card debt outstanding.

(Click on image to enlarge)

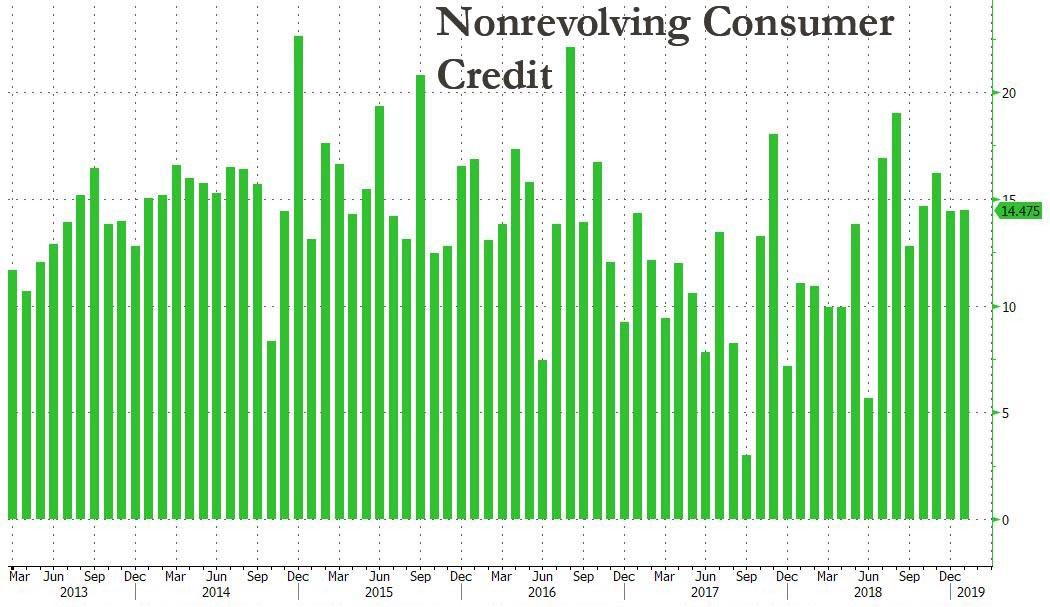

There was barely a change in the monthly increase in non-revolving credit, i.e. student and auto loans, which jumped by $14.5 billion, up from the $14.4 increase in December, and bringing the nonrevolving total also to a new all-time high of $2.977 trillion.

(Click on image to enlarge)

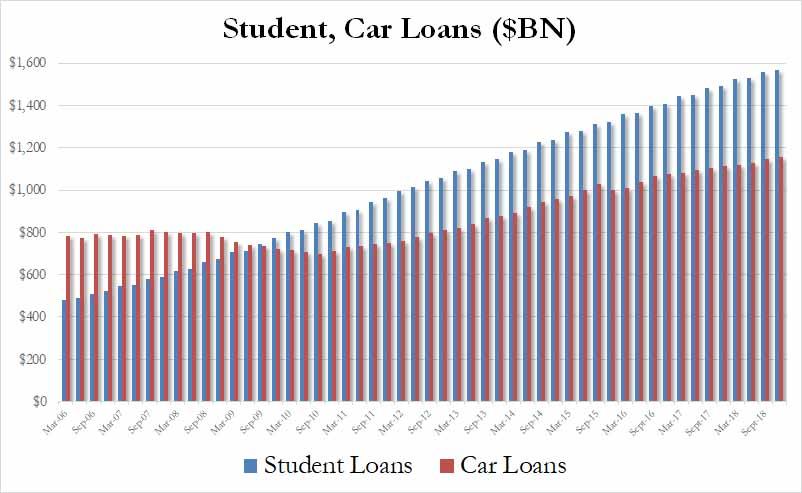

And while January's rebound in credit card use may assuage some concerns about the sharp slowdown in spending at the end of 2018 and start of 2019, and the subsequent plunge in retail sales, as the household savings rate surged by the most in years, one place where there were no surprises, was in the total amount of student and auto loans: here as expected, both numbers hit fresh all-time highs, with a record $1.569 trillion in student loans outstanding, an impressive increase of $10.3 billion in the quarter, while auto debt also hit a new all-time high of $1.155 trillion, an increase of $9.5 billion in the quarter.

(Click on image to enlarge)

In short, whether they want to or not, Americans continue to drown even deeper in debt and enjoying every minute of it.