Consumer Confidence Declined Again In January

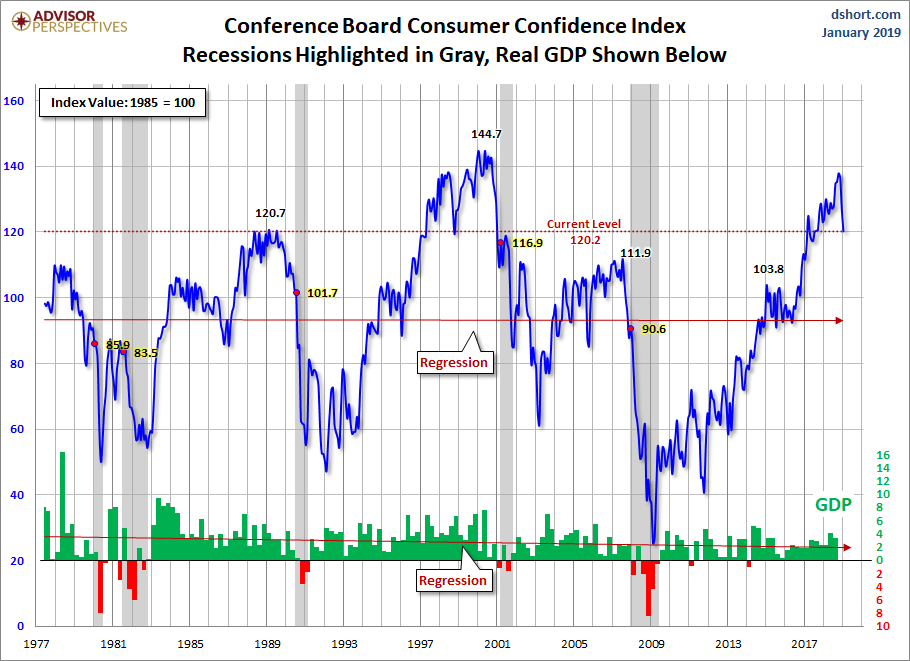

The latest Conference Board Consumer Confidence Index was released this morning based on data collected through January 17. The headline number of 120.2 was a decrease from the final reading of 126.6 for December. Today's number was below the Investing.com consensus of 124.7.

"Consumer Confidence declined in January, following a decrease in December," said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. "The Present Situation Index was virtually unchanged, suggesting economic conditions remain favorable. Expectations, however, declined sharply as financial market volatility and the government shutdown appear to have impacted consumers. Shock events such as government shutdowns (i.e. 2013) tend to have sharp, but temporary, impacts on consumer confidence. Thus, it appears that this month’s decline is more the result of a temporary shock than a precursor to a significant slowdown in the coming months."

Putting the Latest Number in Context

The chart below is another attempt to evaluate the historical context for this index as a coincident indicator of the economy. Toward this end, we have highlighted recessions and included GDP. The regression through the index data shows the long-term trend and highlights the extreme volatility of this indicator. Statisticians may assign little significance to a regression through this sort of data. But the slope resembles the regression trend for real GDP shown below, and it is a more revealing gauge of relative confidence than the 1985 level of 100 that the Conference Board cites as a point of reference.

For an additional perspective on consumer attitudes, see the most recent Reuters/University of Michigan Consumer Sentiment Index. Here is the chart from that post.

And finally, let's take a look at the correlation between consumer confidence and small business sentiment, the latter by way of the National Federation of Independent Business (NFIB) Small Business Optimism Index. As the chart illustrates, the two have tracked one another fairly closely since the onset of the Financial Crisis, although a spread appears infrequently, with the most recent spread showing up 2015 through 2017.