Complete Catalog Of Chaos And Carnage

Image Source: Unsplash

Wow, what an incredible day across the entire marketplace. And by incredible I mean nothing good at all. Predictable, though. All the warning signs and warned-about fragilities playing out as expected, escalation up and down each curve or equity index.

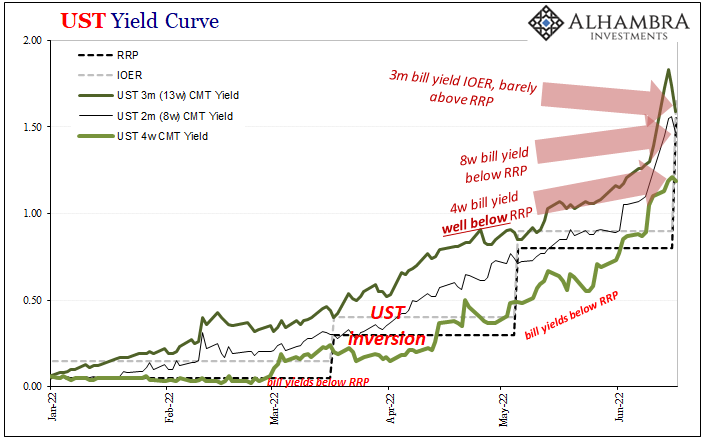

To start with, I still don’t really know where the bills are right now! That it is even a question tells you a lot about how chaotic and wild trading got (what about tomorrow when repo/derivatives unwind?), how screwed up the situation is, and how little it has to do with Jay Powell’s fantasyland rate hikes.

Federal Reserve Chairman Powell like Treasury Secretary Janet Yellen both say there’s nothing to suggest recession, everything’s going along swimmingly apart from the CPI. The risks, they claim, invoking Dear Volcker, are decidedly one-sided tipped toward inflation.

Nothing to suggest recession? No sign of a broader slowdown?

One pricing service puts the 4-week bill close to 106 bps. The Treasury believes it ended around 119 bps. Another service says, get this, 88 bps. I guess it depends upon which specific CUSIP is weighted as what when figuring equivalent yields from bootstrapped prices.

Even if we take the highest of those, 119 bps, today is the day when the Fed’s rate hikes take effect. IOER is set to 165 bps as of this afternoon, while RRP paid out 155 bps. In other words, as has become dangerously common (see: NYSE) collateral isn’t just scarce, it’s a total wreck.

The 8-week bill yield is definitely below RRP and IOER, while the 3-month yield is somewhere around RRP but certainly less than IOER; and this latter one despite what’s supposed to be an upcoming aggressive series of rate hikes over the next three months.

These bills are yielding less than the current so-called double floor.

And that’s just where the madness began. The 10-year Treasury rate first jumped to 3.50% reversing yesterday’s deflationary bid, before then reversing all over to decline in a Collateral Day-type plunge down more than 20 bps to finish under 3.30%.

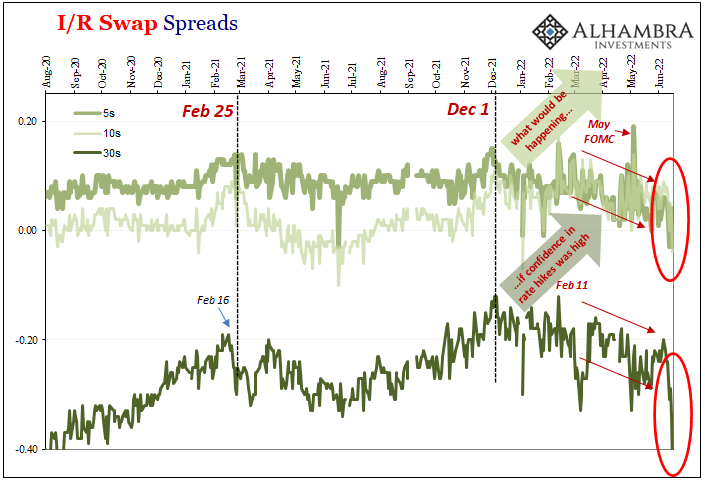

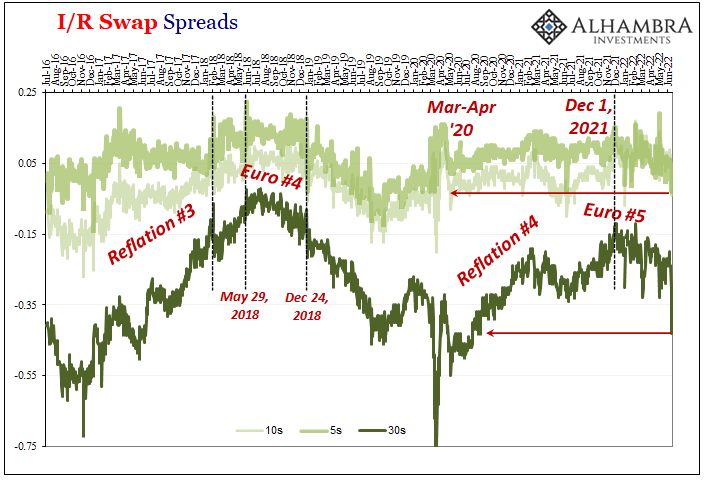

Over in the swap market, several of these wrong-way mileposts were set. The 10-year swap spread fell below zero for the first time since January. At the 5-year tenor, the spread compressed to -3 bps, its lowest since March 2020. The 30s dropped below -40, their worst also going back to mid-2020.

This kind of action is a direct rebuke, like T-bills, saying the market is not pricing inflation risks of any sort, nor much about rate hikes, and it is not because the market thinks the Fed will be successful in its politically-motivated, theatrical policy acting.

Remember, swap spreads like these are key, dependable indications of outright deflationary money: collateral scarcity and constrained balance sheet capacities. This is the real stuff, not the FOMC and its unemployment rate, Phillips Curve fetish.

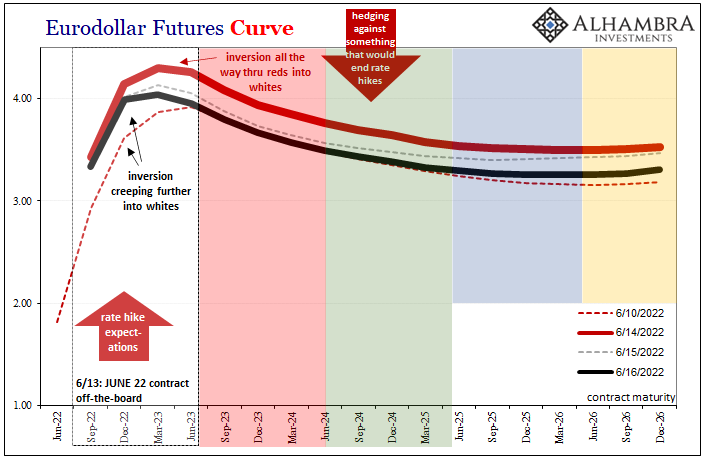

IRS corroborate and correspond closely with eurodollar futures. Both took a decidedly contradictory turn (against the inflation narrative) on December 1 and haven’t looked back. After today’s trading, the December 2022 contract is priced just under 5 bps above the March 2023, meaning inversion this far into the whites is just a small trade away.

The FOMC’s dots say rate hikes to 2024, when the market – all of it – says they are increasingly unlikely to make the end of this year.

All of these together illustrate how the question being weighed and priced into the real monetary system, across all financial markets, is no longer “if” but “when.”

A complete catalog of chaos and carnage.

We have a winner! First central bank to start chickening out despite almost double-digit consumer price increases is...the Bank of England.

— Jeffrey P. Snider (@JeffSnider_AIP) June 16, 2022

Many, many more will follow in what will shortly be a crowded field of headless CB chickens.https://t.co/kw9IU5C6Ee pic.twitter.com/lYKpYUSTp2

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more