Chinese Weapons

Possible Non-tariff Responses to Counter U.S. Tariffs on Chinese Imports

The Trump Administration’s threat to launch a new set of tariffs on $200 billion of Chinese exports have the possibility of changing Chinese tactics in this latest phase of the U.S.-China trade war. Since the U.S. exports to China amounted to $127 billion in 2017, any tit-for-tat tariff introduced by China will not equal the value of Chinese exports subject to U.S. tariffs. China must seek other ways in which go toe-to-toe with the United States in this epic battle. While there are measures that operate through the currency and capital accounts in international trade, they are more subtly applied and their effects take longer to influence international trade.

Currency manipulation is an effort to keep exports cheap by intervening in the foreign exchange market. To some analysts, it is the most important tool a country has to affect the flow of trade. Last year the Trump Administration accused China of currency manipulation. The term is loaded because governments have different ways in which to affect the international value of their currency. For example, lowering domestic interest rates to promote domestic growth can often lead to a weaker currency. It was not too long ago that governments in emerging markets took exception to a looser U.S. monetary policies that contributed to the weakening of the dollar. Notwithstanding, currency manipulation is hard to prove since it may occur as a by-product of other economic policies. The question is whether a country has kept its currency artificially cheap to boost exports.

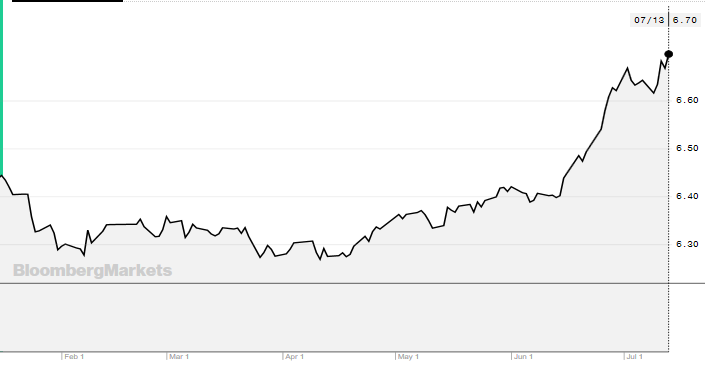

Since April this year, the yuan has steadily depreciated and now stands at (Yuan/USD) 6.70 compared to just under 6.30 at the beginning of the year (Figure 1). It is not really possible to isolate the cause of this currency decline. The steady increase in the Fed funds rate cannot be ruled out as a cause of the fall in the yuan. Also, it is unlikely that Chinese authorities directly intervened in the currency markets, since a weaker yuan encourages capital outflows to the detriment of the domestic economy. Nonetheless, it is most telling that the U.S. Administration no longer makes reference to China as a currency manipulator. To date, the nearly 7 % decline in the yuan serves to offset some of the effectiveness of U.S. tariffs on bilateral trade flows.

Possible Non-tariff Responses to Counter U.S. Tariffs on Chinese Imports

The Trump Administration’s threat to launch a new set of tariffs on $200 billion of Chinese exports have the possibility of changing Chinese tactics in this latest phase of the U.S.-China trade war. Since the U.S. exports to China amounted to $127 billion in 2017, any tit-for-tat tariff introduced by China will not equal the value of Chinese exports subject to U.S. tariffs. China must seek other ways in which go toe-to-toe with the United States in this epic battle. While there are measures that operate through the currency and capital accounts in international trade, they are more subtly applied and their effects take longer to influence international trade.

Currency manipulation is an effort to keep exports cheap by intervening in the foreign exchange market. To some analysts, it is the most important tool a country has to affect the flow of trade. Last year the Trump Administration accused China of currency manipulation. The term is loaded because governments have different ways in which to affect the international value of their currency. For example, lowering domestic interest rates to promote domestic growth can often lead to a weaker currency. It was not too long ago that governments in emerging markets took exception to a looser U.S. monetary policies that contributed to the weakening of the dollar. Notwithstanding, currency manipulation is hard to prove since it may occur as a by-product of other economic policies. The question is whether a country has kept its currency artificially cheap to boost exports.

Since April this year, the yuan has steadily depreciated and now stands at (Yuan/USD) 6.70 compared to just under 6.30 at the beginning of the year (Figure 1). It is not really possible to isolate the cause of this currency decline. The steady increase in the Fed funds rate cannot be ruled out as a cause of the fall in the yuan. Also, it is unlikely that Chinese authorities directly intervened in the currency markets, since a weaker yuan encourages capital outflows to the detriment of the domestic economy. Nonetheless, it is most telling that the U.S. Administration no longer makes reference to China as a currency manipulator. To date, the nearly 7 % decline in the yuan serves to offset some of the effectiveness of U.S. tariffs on bilateral trade flows.

(Click on image to enlarge)

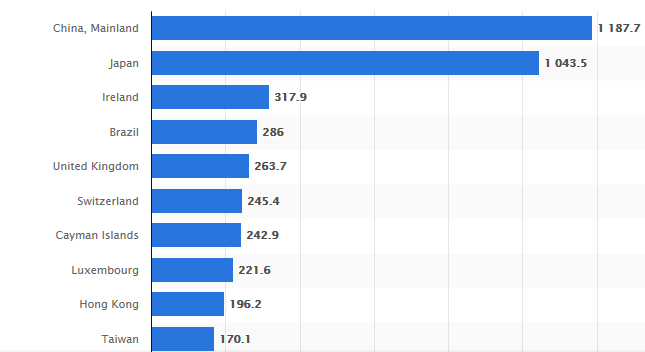

Surpluses on current accounts generate a build-up of foreign reserves. China prefers to use its large surplus of cash to purchase U.S. Treasuries and mortgage-back securities. China (mainland and Hong Kong) have amassed over $1.3 trillion in liquid U.S. financial assets, by far the largest foreign holder.

(Click on image to enlarge)

As powerful a weapon as this cash hoard seems it must be deployed carefully in any standoff with the United States. Over the past few years, foreign governments and their sovereign wealth funds have been overwhelming the largest customers at U.S. Treasury auctions. As the United States issues more debt to fund its Federal government, overseas buyers have willingly stepped up. As a result, this has been cited as one of the major factors behind keeping long-term interest rate at historically low levels. For China to be an active net seller of Treasuries could lead to higher U.S. long-term rates. Or, alternatively, what happens if the Chinese decide to curb their appetite for U.S. financial assets and do not show up at bond auctions to the extent they have in the past? At this juncture, there is no evidence that the Chinese are pursuing either policy. All will depend on how far the Trump administration pushes the Chinese.