China’s Disappointing Trade Data Kicks Off The Aussie

AUD/USD opened the week at 0.7200 as Pacific traders turn to Chinese trade data to help consolidate the Aussie further as forex markets approach an event-heavy week. The data broadly missed the mark, sending AUD firmly lower.

(Click on image to enlarge)

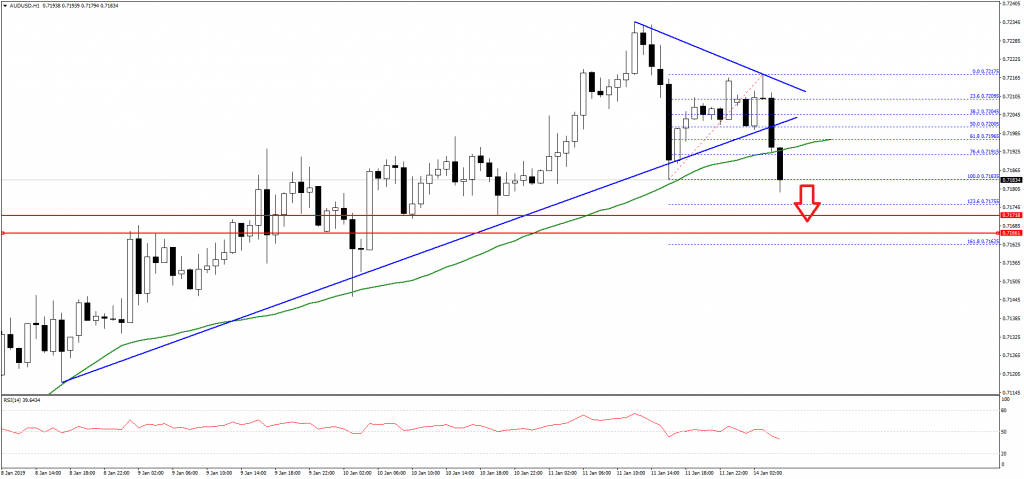

The Aussie dollar traded higher recently and broke the 0.7200 resistance against the US Dollar. However, the AUD/USD pair faced a solid selling interest near 0.7235-0.7240 and later started a downside move.

The pair declined below the 0.7200 support and the 50 hourly simple moving average. Moreover, there was a break below a major bullish trend line with support at 0.7200 on the hourly chart, opening the doors for more losses.

On the downside, the next main support for buyers is near the 0.7175 level and the 1.236 Fib extension level of the last wave from the 0.7183 low to 0.7217 high.

On the other hand, if the pair moves higher, the previous supports near the 0.7200 level may act as a resistance. A proper close above 0.7210 and the 50 hourly SMA is needed for buyers to gain traction in the near term.