China's Capital Outflows Are Suddenly Soaring Again... And Why This Is Great News For Cryptos

Officially, China has maintained quasi-capital controls for years: on paper, no individual is allowed to move more than $50,000 out of the country in any given year while Chinese companies can exchange yuan for foreign currencies only for approved purposes.

Unofficially, China's capital controls had been skirted for years, leading to massive capital outflow from the nation over the past decade, leading to such aberrations as massive luxury housing bubbles in places such as Vancouver, London, New York and San Francisco, and seemingly middle-class Chinese politicians and oligarchs sporting Swiss bank accounts funded in the hundreds of millions (or billions).

In fact, as we detailed in 2017, Beijing has an interesting way of dealing with capital outflows. While they closely monitor many methods, they don’t actively pursue shutting them down. They often watch from afar, and if capital reserves aren’t impacted, or their reputation isn’t damaged, they allow them to continue. The PBoC announced in 2017 they were going to deploy a massive anti-money laundering framework, designed to further halt capital outflows. As we said at the time, we’ll have to see if they were serious, or if this was just to win reputation points with international countries.

Well, two years later, we may have the answer. After an apparent lull in outflows, potentially driven by the reforms cracking down on capital flight, there are signs that China is facing an exodus of cash once again...

Amid all the headlines about China's surplus with the US and the ongoing trade tensions, there was a message hidden in China's trade data...

It is that capital outflow probably accelerated significantly last month. It's a reminder of why the PBOC would probably be reluctant to let the yuan decline significantly. That would encourage even further outflows and risk a vicious circle.

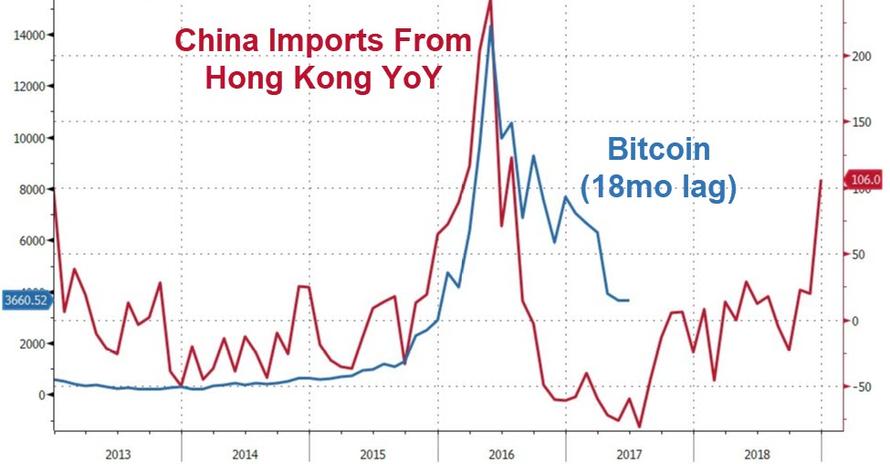

While China's total imports fell 7.6% in dollar terms from a year earlier, its purchases from Hong Kong surged 106%.

(Click on image to enlarge)

Critically, Elsa Lignos, global head of FX Strategy at RBC in London, notes that this outlier resembles the jump in 2015-2016 when mainland companies used inflated invoices to take money out of the country.

The timing of the sudden shift is telling as it coincides with a lagged reaction to a sudden devaluation- just as we saw in 2015/2016...

(Click on image to enlarge)

The logistics of the over-invoicing scam are extraordinarily simple - Mainland Chinese will 'overpay' for goods or services delivered from a Hong Kong merchant with a pre-agreement that the Hong Kong-based 'exporter' will - for a fee - allow the mainland Chinese 'importer' to have access to his cash but now outside of China's government-imposed firewall controlling capital flight.

And the last time this occurred at this kind of scale, it sent Bitcoin from $200 to $20,000...

(Click on image to enlarge)

While some have argued that Bitcoin is not the most efficient method of funds transfer or storage once the mainland Chinese cash has reached Hong Kong (claiming hot money brokers reportedly cheaper), we suspect the ease of use may well mean the cryptocurrency sphere is facing an 18-month period of excess demand from Chinese capital desperate for its freedom.

So, in summary, recent 'odd' strength in the yuan is perhaps a signal that China is doing everything in its power to not give the impression that it is panicking...

(Click on image to enlarge)

The truth is that it is one viral capital outflow report away from an outright scramble to enforce the most draconian capital controls in its history, which - as every Cypriot and Greek knows by now - is a self-defeating exercise and assures an ever accelerating decline in the currency, which authorities are trying to both keep stable while also devaluing at a pace of their choosing. Said pace never quite works out.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more