CBO Rates Ryancare

In this article, I will review the latest charts which show the speculative craze the stock market is in. Then, I will update you on the latest information on the GOP’s healthcare plan. On Tuesday, the NFIB will release its latest survey on business optimism; it has been the poster child for the positive survey data. It’s not that I don’t believe small business owners. I do believe them when they say their current business is weak; I simply disagree with the opinion that the future will see improvements.

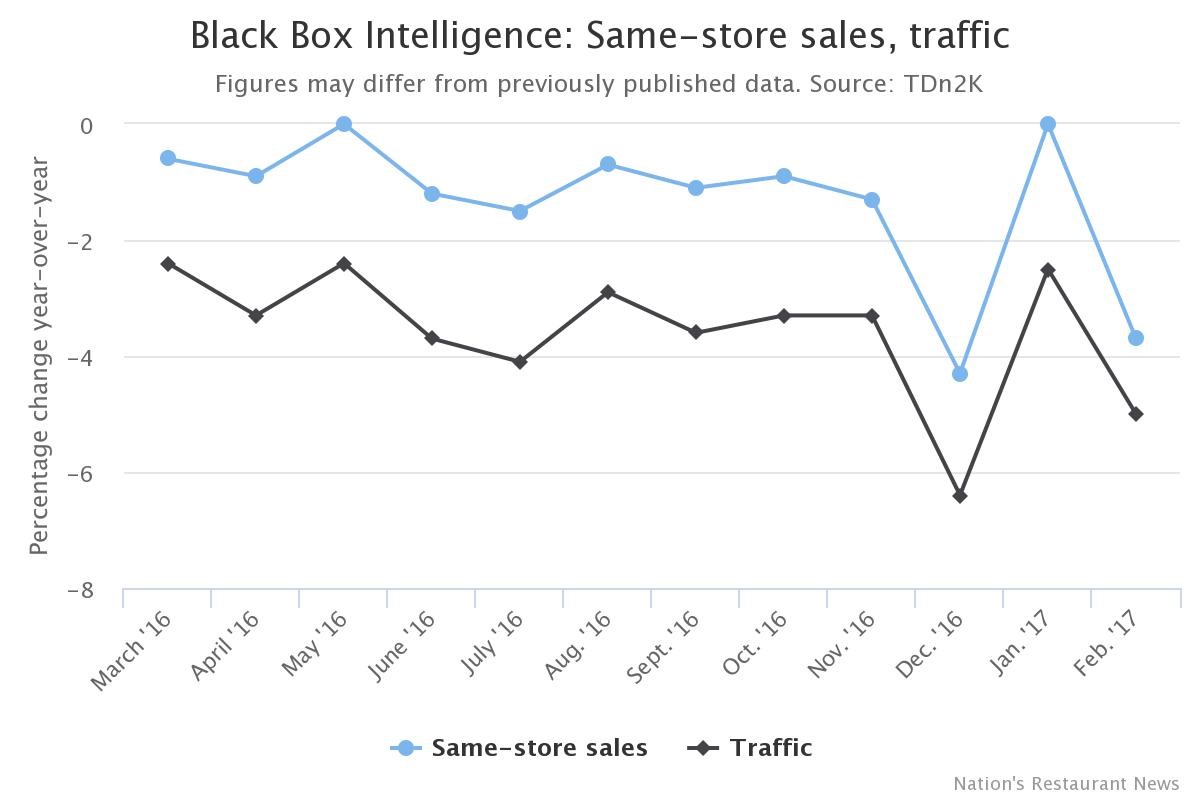

Restaurant Sales Plummet

As you can see from the chart below, restaurant sales have dipped lower in February. Restaurant same store sales fell 3.7% and traffic fell 5.0%. This makes February year over year sales one of the weakest months in the past 4 years. It continued the trend of negativity. Even with the blip higher in January, same store sales have still averaged a 2.7% decline in the past three months. One bright side for restaurants is the recent decline in oil prices may encourage consumers to eat out more. Restaurants will need all the help they can get because guests’ checks in February only grew 1.2% which was the slowest growth in four years. On the negative side, the tightening lending standards for credit cards means consumers will have less flexibility with their disposable income which will crimp the amount of times they can eat out.

Are There Any Shorts Left?

As I mentioned equity bullishness has reached a fever unlike we’ve seen since the 1990s. The chart below shows the level of short interest in the S&P 500. It hit a record low on March 7th. This isn’t surprising because the VIX has an 11 handle and market hasn’t seen a 5% correction in months. The shorts sellers have long gone home. An earnings recession, low GDP growth, and two shocking elections could not bring the market down. The Fed raising rates this year may be the catalyst for the downturn in stocks, but short sellers won’t be profiting off it.

Anecdotally, the notable short-seller Andrew Left who runs Citron Research was just hit hard by Intel’s (INTC) acquisition of Mobileye (MBLY) as he was betting against Mobileye. The stock was up 28% today as Intel paid 30 times sales to buy the firm according to Citron Research. This example is not to pick on Andrew Left, but to show how difficult it has been to short stocks. Short sellers provide a great counter to the sometimes-unwarranted optimism longs have. When shorts go extinct, bubbles can get out of hand.

The chart below shows the irrational exuberance in today’s market. It is the price to sales ratio of the S&P 500 divided by the VIX. It is at the highest point ever. The reason why investors like to look at sales ratios is because they ignore the vacillations in profit margins. Sales ratios aren’t great for valuing individual stocks because some companies can have above average profit margins for lengthy time periods like Apple (AAPL). The main use case I have for sales ratios is when a company isn’t profitable yet. The theory behind using them for the overall market is that margins are expected to eventually regress to the mean.

Ryancare Gets Mixed Results From CBO

The big news today regarding the House GOP’s plan to replace Obamacare was that the Congressional Budget Office scored the GOP’s plan. As a reminder, healthcare reform needs to be passed before the tax plan and infrastructure plans are passed. The GOP is working on the toughest issue first which is risky because it could derail the other parts of the agenda.

The CBO is generally considered to be a non-biased voice on the effectiveness of various fiscal plans and their cost. There were a few main aspects to the way the CBO scored the plan. The first is that the plan will save the government $337 billion over the next ten years compared to the status quo. There will be $1.2 trillion less in spending and an $883 billion decline in revenues. The spending cuts come from the decline in Obamacare subsidies and the rollback in funding for Medicaid starting in 2020. Obamacare taxes being cut is what lowers the revenue received. I consider this aspect of the scoring a win for Paul Ryan’s healthcare plan because it is in tune with the cost savings which Paul Ryan has been claiming are necessary to lower the deficit in the long-run. I think any plan which helps cut spending is good for the stock market because if the government doesn’t act now, spending will get out of control.

The second part of the plan is the change in the cost of healthcare insurance premiums. The CBO stated premiums in 2018 and 2019 would rise 15% to 20%, but they would fall 10% by 2026. This is another win for Paul Ryan’s plan. It gives him ammo in the debate with Rand Paul because one of Rand’s points was that premiums would increase under this plan.

The final aspect of Ryan’s plan which was mentioned by the CBO is that 24 million less Americans would have healthcare insurance because of the ending of the individual mandate and the states rolling back their expansion of Medicaid eligibility. This is going to energize the Democrats in Congress. However, Democrats were going to oppose this plan no matter what, so it doesn’t affect its chances of being passed. On an overall basis, the CBO scoring makes Ryan’s plan more likely to be passed which is bullish for stocks. The one way the conservatives can counter this plan would be for them to come out with their own plan and have it scored by the CBO to compare the two.

Conclusion

I showed how restaurant same store sales declines counter the optimism shown by small business owners. I wouldn’t be surprised to see another stellar NFIB survey released Tuesday. Secondly, I showed how short sellers are on the endangered species list, which is bearish for stocks. Finally, I explained why Paul Ryan’s plan being scored by the CBO in a somewhat favorable way improves its chances of being passed which is bullish for stocks. To be clear, I still think it won’t pass; I’m merely saying the odds improved.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more