Capture Big Dividend Increases From These 3 REITs

The right income stocks can be game changers for investors, rewarding them with exponential profits every year. In this article Tim Plaehn recommends three stocks that have histories of regular payment increases which gives investors expanding incomes. These stocks are the kind you can buy and hold forever.

A great time to buy into or add to a REIT position is just before a dividend increase is announced. With those REITs that have a history of steady dividend growth, a company will declare a new dividend rate, pay that rate for a year and then announce a new, higher rate after four level quarterly payments or 12 monthly dividends.

Each REIT follows its own schedule as to when a new dividend rate may be announced. Some companies will increase the dividend near the end of the year. Others will do so with the fourth quarter earnings announcement in February or March and start paying a higher rate at the end of the first quarter. Another tactic is to announce dividend increases in the middle of the year. Whatever pattern an individual REIT uses, it tends to be repeated year after year.

For investors, dividend increases offer several different opportunities. If you have a short term trading focus (such as the trade recommendations in my 30 Day Dividends newsletter), the anticipation of or actual announcement of a dividend hike can drive up the share price in a relatively short period of time.

Buying a REIT of interest before the next rate hike can produce a share price increase that puts your holding quickly into the positive gain territory. Having that positive result sitting in your brokerage account helps you stick with your dividend-focused investment strategy and sleep well at night. As an example, one of our core holdings in The Dividend Hunter is healthcare REIT Ventas, Inc. (NYSE: VTR) and it has a history of an average 9% increase in its dividend, with the new rate announced every December. The VTR share price started climbing soon after the third quarter dividend was paid at the end of September. Investors who knew the dividend hike was coming were able to pick up a 20% share price gain over the last 2 1/2 months.

Out of my REIT dividend tracking database here are three REITs that should announce significant dividend hikes early in 2015. REITs that are steady and meaningful dividend growers often carry a lower than average yield. With this type of REIT you are investing for total return, share price gains driven by dividend increases plus the cash dividends.

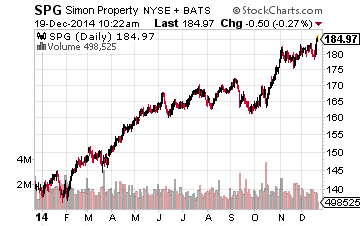

Simon Property Group (NYSE: SPG) with a $58 billion market cap is by far the largest REIT. SPG got so large through the profitable growth of its portfolio of outlet malls. Over the year that ended with the 2013 third quarter, SPG had increased its dividend by 10%. CEO David Simon has stated the dividend will be increased again in the first quarter of 2015. The next dividend amount and probable increase will be announced on about January 31st. Even though it yields just 2.8%, the dividend growth has propelled SPG to an 18% total annual return for the last three years.

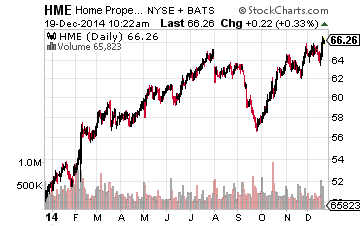

On February 1, 2014 Home Properties, Inc. (NYSE: HME) announced a higher quarterly dividend rate for 2014, increasing the payout per share by 4.25%. The next dividend hike should come on or about February 1, 2015. HME is not a fast dividend growth REIT, but the company has grown its quarterly rate by 25% over the last four years. The shares currently yield 4.4%. This REIT should produce a total return, share appreciation plus dividends, of 10% year after year.

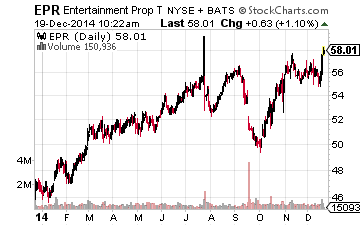

EPR Properties (NYSE: EPR)is a monthly dividend REIT that boosts that monthly per share payment every January. EPR is a niche REIT, focused on entertainment related properties like movie theaters and golf complexes. EPR should announce its January dividend any day now. This REIT carries a current yield of 6.0%. I recommended EPR to my subscribers of The Dividend Hunter several months ago.

For the January issue of The Dividend Hunter, I will add another REIT poised to boost its dividend after the first of the year. The REITs listed above should do very well in the early part of 2015, and subscribers get to read in depth about the ones that I believe provide the best cash income plus dividend growth potential.

Disclosure: I currently do not have positions in the stocks discussed here.

I've just released the latest update to my new more