CAPE And Expected Returns By Country

Back in February, I used data from Swiss consultancy firm Wellershoff & Partners Ltd to compare stock values across all major world markets and forecast returns over the next five years. (See “Global Stock Values: Where to Park Your Cash for the Next Five Years.”)

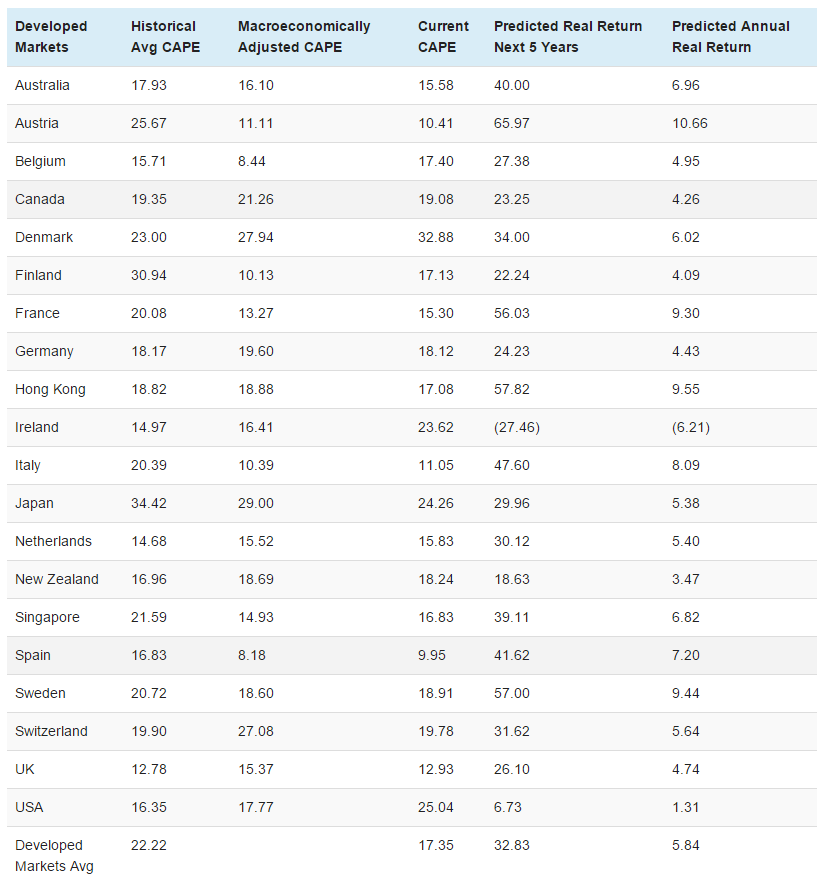

Wellershoff used the standard cyclically-adjusted price/earnings ratio (“CAPE”) for each country and adjusted it for macroeconomic variables such as interest rates and economic growth. They then forecast returns going forward by seeing how the markets performed over subsequent five-year periods when priced at similar CAPE valuations in the past. (For the quants in the room, Wellershoff runs a regression analysis. If you want to dig into the numbers, they explain their methodology here.)

Today, we’re going to look at updated CAPE data from Wellershoff to see what it might suggest for future returns. As always, past performance is no guarantee of future results, but this at least gives us precedent.

So with no more ado, let’s jump into the data:

Most global stock values suggest solid, if not quite spectacular returns, over the next five years. A few exceptions jump off the page, however. Ireland is priced to actually lose 6.2% per year over the next five years, and New Zealand is priced to deliver returns of only 3.5%. And by Wellershoff’s estimates, the U.S. is priced to deliver a skimpy 1.3% in annual returns. All estimates are real, after-inflation returns.

Taken as a whole, developed markets are priced to deliver returns of about 7% per year over the next five years. This is not a “back up the truck” opportunity, but it’s not bad either, particularly given how unappealing bonds and cash are at current yields.

So, what’s the takeaway here?

To the extent you can, you should underweight US stocks and overweight developed Europe. In particular, Austrian, French, Italian and Spanish stocks are priced to deliver very decent returns in excess of 8% per year. For direct access, you can consider the iShares MSCI Austria ETF (EWO), the iShares MSCI France ETF (EWQ), the iShares MSCI Italy ETF (EWI) and the iShares MSCI Spain ETF (EWP). Or for a convenient one-stop shop, you can try the Cambria Global Value ETF (GVAL), an actively-managed ETF run by Meb Faber. While the Cambria ETF does not rely exclusively on CAPE valuations in its country selection, CAPE is a major analytical factor.

Disclaimer: This article is for informational purposes only and should not be considered specific investment advice or as a solicitation to buy or sell any ...

more