Canadian Dollar Price Outlook: USD/CAD To Threaten January Lows

The Canadian Dollar has rallied more than 1.1% against the US Dollar since last week’s high in USD/CAD with price now approaching the monthly range lows ahead of major U.S. event risk over the next few days. These are the updated targets and invalidation levels that matter on the USD/CAD charts.

USD/CAD DAILY PRICE CHART

(Click on image to enlarge)

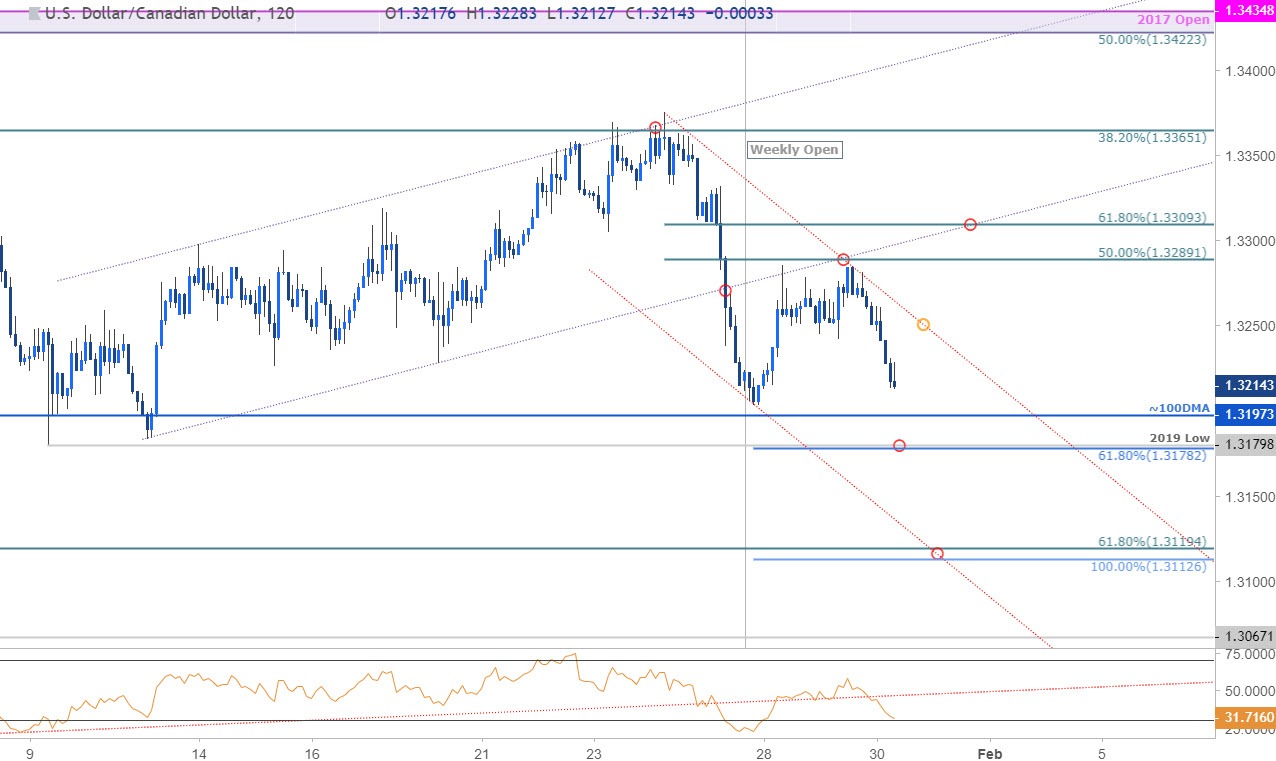

Technical Outlook: In my latest USD/CAD Weekly Technical Outlook we noted price had, “broken below medium-term uptrend support after rebounding off critical resistance and leaves the risk for further losses in price. We’ll continue to favor fading strength while below 1.3435.” A break below a near-term bear-flag formation last week has fuel further losses with price setting a clear weekly opening-range just above the 200-day moving average / monthly range lows at 1.3180/97 – weakness beyond this threshold is needed to keep the short-bias viable.

USD/CAD 120MIN PRICE CHART

(Click on image to enlarge)

Notes: A closer look at price action show USD/CAD trading within the confines of a descending channel formation extending off last week’s high with an early-week recovery reversing sharply today from near-term confluence resistance at 1.3290. Initial support targets rests at ~1.3197 backed by 1.3178/80- look for a reaction there IF reached. A downside break targets subsequent support objectives at 1.3113/19- an area defined by the 61.8% retracement of the September advance and the 100% of the recent decline (converges on parallel support over the next 48-hours). Near-term bearish invalidation now lowered to 1.3309.

Bottom line: Look for a break of the weekly opening-range for guidance here with our broader focus lower sub-1.3309. From a trading standpoint, I’ll continue to favor fading weakness while with this near-term channel targeting a break of confluence support at the monthly opening range lows. Keep in mind we have the FOMC on tap later today with U.S. Non-Farm Payrolls looming on Friday. Stay nimble and expect volatility.

USD/CAD TRADER SENTIMENT

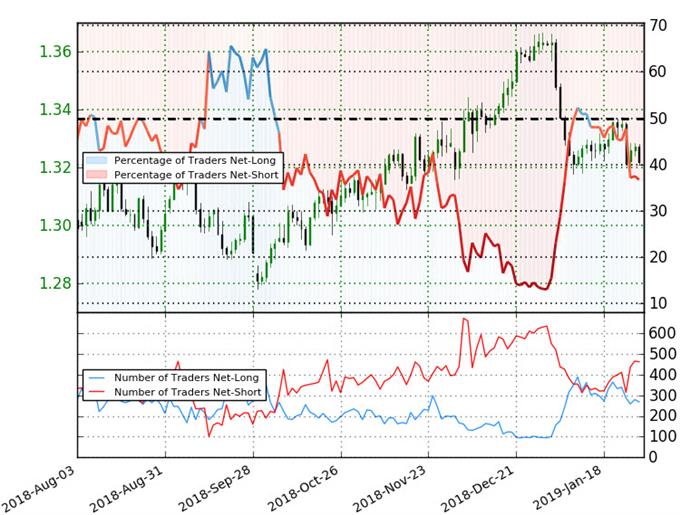

- A summary of IG Client Sentiment shows traders are net-short USD/CAD - the ratio stands at -1.72 (36.7% of traders are long) –bullishreading

- Traders have remained net-short since January 17th; price has moved 0.3% lower since then

- Long positions are4.7% higher than yesterday and 31.5% lower from last week

- Short positions are 2.9% lower than yesterday and 10.8% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise. Traders are less net-short than yesterday but more net-short from last week and the combination of current positioning and recent changes gives us a further mixed USD/CAD trading bias from a sentiment standpoint.

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more