Can We Learn Something From Daily VIX Trends (1990-2021)?

Investors - especially less-experienced ones - tend to pay too much attention to return and not enough to 'risk', 'diversification', 'timely and correct trading strategies' etc. And that is especially true when markets are close to their tops. When confronted with too many stories and people who were successful with their investments it is hard to imagine that things could change. However, already since the mid-1980s, those with an academic investment background know that the incredible 'Overreaction'- or 'Mean Reversion' effects are very powerful. In 1985 professors Werner de Bondt and Richard Thaler already showed that a simple strategy of putting all your money in a basket of 'losers' (defined as the least performing stocks over the last 3-5 years) performs better than a basket of 'winners' over the next 3-5 years. And still, we see that most investors tend to extrapolate trends into the future.... partially this is correct because shorter-term momentum variables do indicate that trends can continue for some time. But sooner or later the short-term trend is broker and mean reversion starts. When at the end of a prolonged bull market longer-term variables start to become more important, it is often via the VIX that we get important indications of this 'nervousness'.

Introduction: A Historical Analysis of VIX Trends

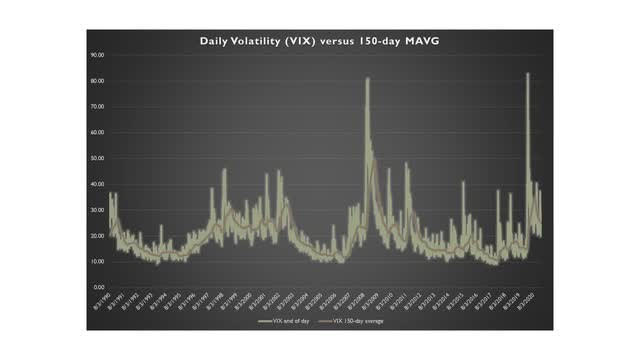

In the chart below we present the daily closing values of the VIX Index. VIX is the volatility index of the Chicago Board of Options Exchange (CBOE). It is in a way a kind of ‘nervousness’ indicator for investors. Periods with a VIX below 20 are times during which investors feel ‘kinda okay or even very optimistic’. Periods during which volatility drops and is moving rapidly in the direction of this below-20 zone are normally good periods for equity markets as well.

On the other hand, beware of periods during which VIX is above 40, or is moving in that direction!

Our chart is clearly showing a few important historical periods. We start with relatively high levels in the early 1990s (nervousness after the 1987 stock market crash not totally gone), but things improve until we enter the second half of the 1990s. Debt crises in Emerging Markets countries, the Year-2000 issue (will computers in which ‘year’ was defined with two digits go crazy when moving from 99 back in time to 0?) translated into higher VIX levels and more nervousness. And doubts regarding what was in those days the first big ‘Tech’ boom (“In the future, everything will be different because Tech can create scalable products that do not require enormous reproduction costs like average products do’’) translated into the bad market environment of the first years of the new century. Around 2003 this improved. And guess what … VIX is again telling the story.

Daily VIX and its 150-day Moving Average; the period 1990 – 2021 (3)

Just like how we can clearly see that the 2007-2009 Global Financial Crisis - with among other things the bankruptcies of Lehman Brothers, Bear Stearns and gigantic bail-outs for other financial firms who were pre-occupied with the creation and running of money machines that were built on structured, highly-levered complex financial solutions that were not in any way borne by sufficient collateral in the physical world - was not a sudden, totally unexpected thing... The underlying volatility trend was pointing in the wrong direction already before the actual crash!

And we can also see how things improve rapidly from 2010 onward when looking at the moving average of VIX. But we also see the sudden spikes in daily VIX that happen off and on in this long bull market, which seemed to stress that old macroeconomic business cycle theory is ‘over and out’ (wasn’t there a 7-year bear-bull cycle anymore?).

And then came COVID-19. Volatility spiked, and came rapidly down again end of Spring 2020. However, we can see that we are NOT moving down into a quiet and peaceful below-20 zone. We are lingering in the 20-30 zone, with every little sign of disappointment – be it related to fighting COVID or economic or geopolitical news – translating into an upwardly-creeping VIX again.

Where Do We Go From Here?

However: when looking at the stock market trend globally since March 2020 we see that the market was extremely good. As if investors – and among them millions of (often relatively young and inexperienced) new investors – simply want to reject the idea that cycles still exist. And that things were different this time. Interest rates are close to zero, so that millions of new investors do not come to the stock market simply because of their larger market savviness or risk appetite than their predecessors, but simply because there is no value in savings accounts anymore. ‘Crypto and stocks gives you the chance to score some outrageous positive return, with interest rates and fixed income giving you the certainty of making nothing!’ That is how the line of reasoning goes. In such a setting it is not that strange that things like the GameStop case or the Crypto boom happen.

And the other part of their 'line of reasoning' is often 'Tech-related'. Things are different this time .. Tech will change the world .. Haven't we heard that all before? And is technological innovation now really that different from technological advances in the past? Was the automobile less innovative at a time that people were either walking, or moving around on horseback? The tricky thing with technological innovation is that we always find new things that happen during our life fantastic step forwards, while finding that what was there when we grew up just 'logical'.

But in the end we are not convinced … Cycles in market nervousness were always there … with - after a long period of good returns and rewards for those who dared to be in the market and ride it a long time across the (in that period mostly) minor waves – then sooner or later the beginning of profit taking by those ‘frontrunning winners’. Exactly at a time when the market is being flocked with newcomers who often lack the historical background information and/or knowledge and investment discipline to ride the - now larger! - waves and cycles.

Taking into account that stock market levels are close to their historical top, we have to be careful. I am not saying that we will go from boom to bust across the globe in one big bang-type of event. But prudent investors should diversify and not forget about market segments where 'value and growth at a reasonable price' is still available. Be it in your own country or elsewhere. Especially (super)large caps do now seem to be plagued by the fact that the millions of newcomers without proper analytical tools and background information are often steered into large caps (the stocks they know about…the so-called good companies… what can be wrong about investing in good companies?).

Be careful and diversify (and you could even make crypto a small part of that diversification play!). And take a closer look at mid-, small- and micro-caps. And do not underweight what is going on in Asia. Maybe you were always successful with a strategy focusing on the big markets of North America and Developed Europe. But where these countries are still struggling with second or sometimes third COVID waves, Asian economies were less affected. China, Japan, Korea, Taiwan, Southeast Asia and India have interesting stocks too! No matter what you think of individual stocks or markets, now is the time to be truly global .. funny enough at a time when the old liberal model of Globalization is having bad times. But isn’t that exactly what proper diversification is about? The larger the difference between underlying circumstances between countries, asset classes and sectors, the more diversification-related free lunches you can get. Unfortunately, too many investors seem to ignore this. And that is worrying me.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Additional disclosure: We do not intend to translate the ...

more

Good read, thanks. Hope to see more by you.