Can A Weak Australian Currency Blow Investment Dollars Toward Mining Companies? Morgans' Wilson Singles Out 3 Gold Companies Making Headway

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

A weak Australian dollar has pushed up gold prices down under and made gold mining companies with low all-in costs more attractive to investors. In this interview with The Gold Report, Morgans Senior Analyst James Wilson shares the names of ASX-listed gold, iron and graphite companies worth watching.

The Gold Report: You are based in Australia where iron ore and coal are the dominant mined commodities. A recent Morgans research report said, "We need to see demand-linked data improve, or at least stop getting worse, for the Chinese steel industry for us to gain any confidence" in iron ore market fundamentals. Has there been any improvement?

James Wilson: Companies with resilient supply, coupled with the remarkable cost-out performance of Vale S.A. (VALE:NYSE), BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK), Rio Tinto (RIO:NYSE; RIO:ASX), Fortescue Metals Group Ltd. (FMG:ASX) (FSUGY), Roy Hill (private) and subsidized Chinese domestic iron ore production, will lower the long-term sustainable price level needed to encourage new investment in iron ore supply. We estimate this has reduced the long-term sustainable iron ore price from US$85/ton (62% Fe) to US$65/ton, capping the upside potential of any eventual recovery. As a result, we expect those miners burdened with high levels of debt like Fortescue or large leverage to iron ore like Rio Tinto will remain under pressure. Our preference remains with BHP, which maintains competitive exposure to iron ore but is significantly boosting free cash flow across its business, coupled with attractive leverage to oil and gas, one of our preferred commodity exposures.

TGR: The World Gold Council says Australia is second only to China in global gold production. How is a weak Australian dollar compared to the U.S. dollar changing the fortunes of the country's gold miners?

"A weak Australian dollar means strong leverage for domestic gold producers."

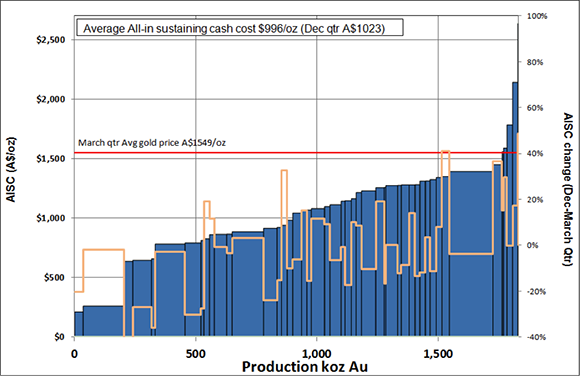

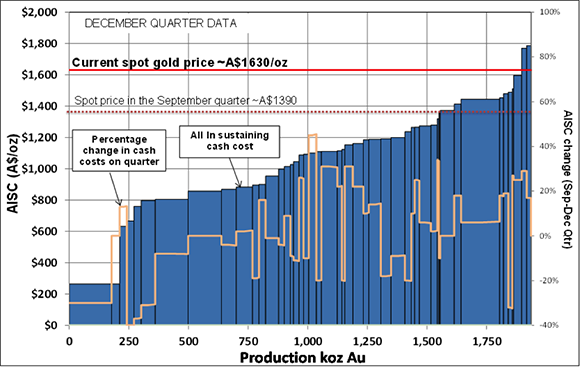

JW: A weak Australian dollar means strong leverage for domestic gold producers. At the start of the June quarter, the gold price in Australian dollars hovered around AU$1,500 an ounce ($1,500/oz), which is great considering the average "all-in sustaining cash cost" was around AU$960/oz in the March quarter compared to AU$1,023/oz in the December quarter. The bottom line is that cash margins are looking quite healthy for our Aussie miners. We are certainly seeing investment dollars directed toward predominantly Aussie domestic producers and explorers, too. One good example is Gold Road Resources Ltd. (GOR:ASX) (ELKMF), which recently raised $39 million for its Gruyere development project in the Yamarna Belt in Western Australia.

TGR: Which metrics (i.e., cash flow per share, all-in sustaining cash costs) are the most telling as you pore over the numbers of the gold producers?

JW: All-in sustaining cash costs is our favorite metric, but it is not totally transparent, so the figures are always a bit rubbery. That being said, it has been a great way to track the sector costs on a more level playing field than previously.

Source: Morgans

Source: Morgans

TGR: What Australia-listed companies are developing gold projects with strong stories?

JW: I mentioned Gold Road earlier. It is probably the most interesting story. The company is a big takeover target thanks to its large resource base of 5.5 million ounces and growing. The company plans to use the funds it just raised to complete a prefeasibility study by March 2016 with a definitive feasibility study calendared for the end of that year.

"Cash margins are looking quite healthy for our Aussie gold miners."

Evolution Mining Ltd. (EVN:ASX) (CAHPF) is doing great. We currently have an Add rating. The company recently made its third deal in two months by announcing that it would acquire the Cowal gold mine in New South Wales from Barrick Gold Corp. (ABX:NYSE; ABX:TSX). This is a transformational deal. Combined with the recent acquisition of the La Mancha assets in Kalgoorlie, it will make Evolution the second largest gold producer on the Australian Securities Exchange. I think the company's focus on costs will yield further upside value in the not too distant future. We are looking for future exploration upside at Cowal, La Mancha and Cracow, which along with possible increases in the gold price and further weakness in the Australian dollar could result in further upgrades to our price target of $1.40.

Crusader Resources Ltd. (CAS:ASX) (CHLXF) is also doing well. We recently visited the Juruena site in Brazil and believe it has significant potential for a near-term, small-scale operation. Drilling has continued to intercept high-grade zones at Querosene and an initial resource estimate is in the works. We are looking forward to Crusader connecting with a bigger funding partner to capitalize on the opportunity in the historic mining area. The company continues to operate a cash flow positive iron ore operation where operating costs have continued to fall due to cost improvements. A new deal with Vale could expand the operating footprint at Posse. The company is also moving forward with development at the Borborema project where plans for a more affordable 1.5–2 million tons per annum operation could be released by the end of the year.

"We are seeing investment dollars directed toward predominantly Aussie domestic producers and explorers."

TGR: What are some Australian graphite companies you have been following?

JW: There are not many to choose from on the Australian Securities Exchange, but we have been following Metals of Africa Ltd. (MTA:ASX) thanks to its location along strike from the Montepuez Central project in the massive Balama deposit of Syrah Resources Ltd. (SYR:ASX) (SYAAF) in Mozambique. Metals of Africa recently announced a high-grade, near-surface assay with large average flake size.

We have also been taking a look at Magnis Resources Ltd. (MNS:ASX) (URNXF) recently. This is a near-term graphite producer working in southeast Tanzania.

TGR: Please complete this sentence: In the mining sector, 2015 will be remembered as the year of the. . .

JW: . . .patient investor!!!

TGR: Thank you for your insights.

James Wilson is a senior analyst at Morgans. He is a qualified geologist who spent his early career in regional exploration in Western Australia with CRA & Great Central Mines before moving on to exploration and mining feasibility roles in West Africa, North Africa and China. He has since specialized as a mining analyst, joining Morgans in 2010.

James Wilson is a senior analyst at Morgans. He is a qualified geologist who spent his early career in regional exploration in Western Australia with CRA & Great Central Mines before moving on to exploration and mining feasibility roles in West Africa, North Africa and China. He has since specialized as a mining analyst, joining Morgans in 2010.

Disclosure:

1) The following companies mentioned in the interview are sponsors of Streetwise Reports: Syrah Resources Ltd. The companies mentioned ...

more