Calm And Boredom Before The Storm Tomorrow? Not In The Least!

Currency market participants look cautious before tomorrow’s big day of the Fed pronouncements. Looks reasonable but even guarded moves can give telling signs. Of where the action is now and where it’s likely to go next, to paraphrase one famous Canadian ice hockey player. Remember, one doesn’t have to shout in order to be heard. Also, we still keep an eye on the candidate for opening new positions. Emerging throughout the currencies arena, here are the clues to share.

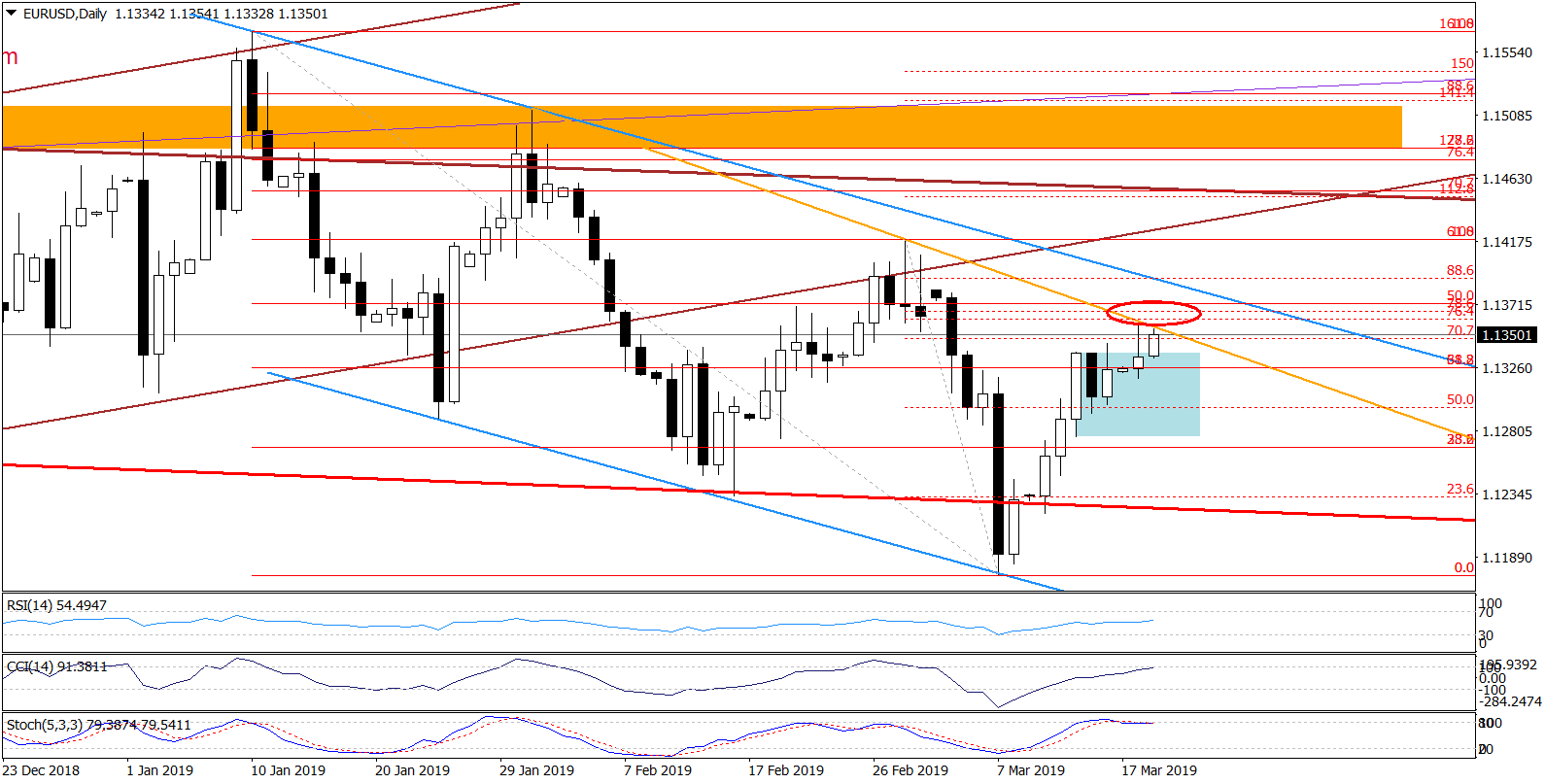

EUR/USD – Powerful Resistances So Close Ahead

(Click on image to enlarge)

We wrote the following yesterday:

(…) After not overcoming the upper line of the blue consolidation on Friday, EUR/USD broke above it earlier today to trade at around 1.1355 at the moment of writing these words. It suggests that we’ll see a test of the orange declining resistance line or even the strong resistance area marked with the red ellipse in the coming days. Why do we say a strong resistance area? It’s because it was created by the 76.4%, 78.6% Fibonacci retracements based on the March downward move and the 50% Fibonacci retracement based on the entire January-March declines.

The technical picture hasn‘t changed much and EUR/USD trades at around 1.1360 at the moment of writing these words. That‘s exactly where the declining orange resistance line is. After yesterday‘s reversal at it (evidenced by the long upper knot), the pair is currently touching the orange line again.

The CCI is at the bearish divergence between the indicator and the exchange rate still. Stochastics remains flat after its climb above 80, which suggests that the space for further increases may be limited and reversal later this week should not surprise us in the least.

These yesterday‘s parting comments also remains up-to-date:

(...) Should we see currency bulls hesitating and weak in the above mentioned strong resistance area, we’ll consider reopening short positions.

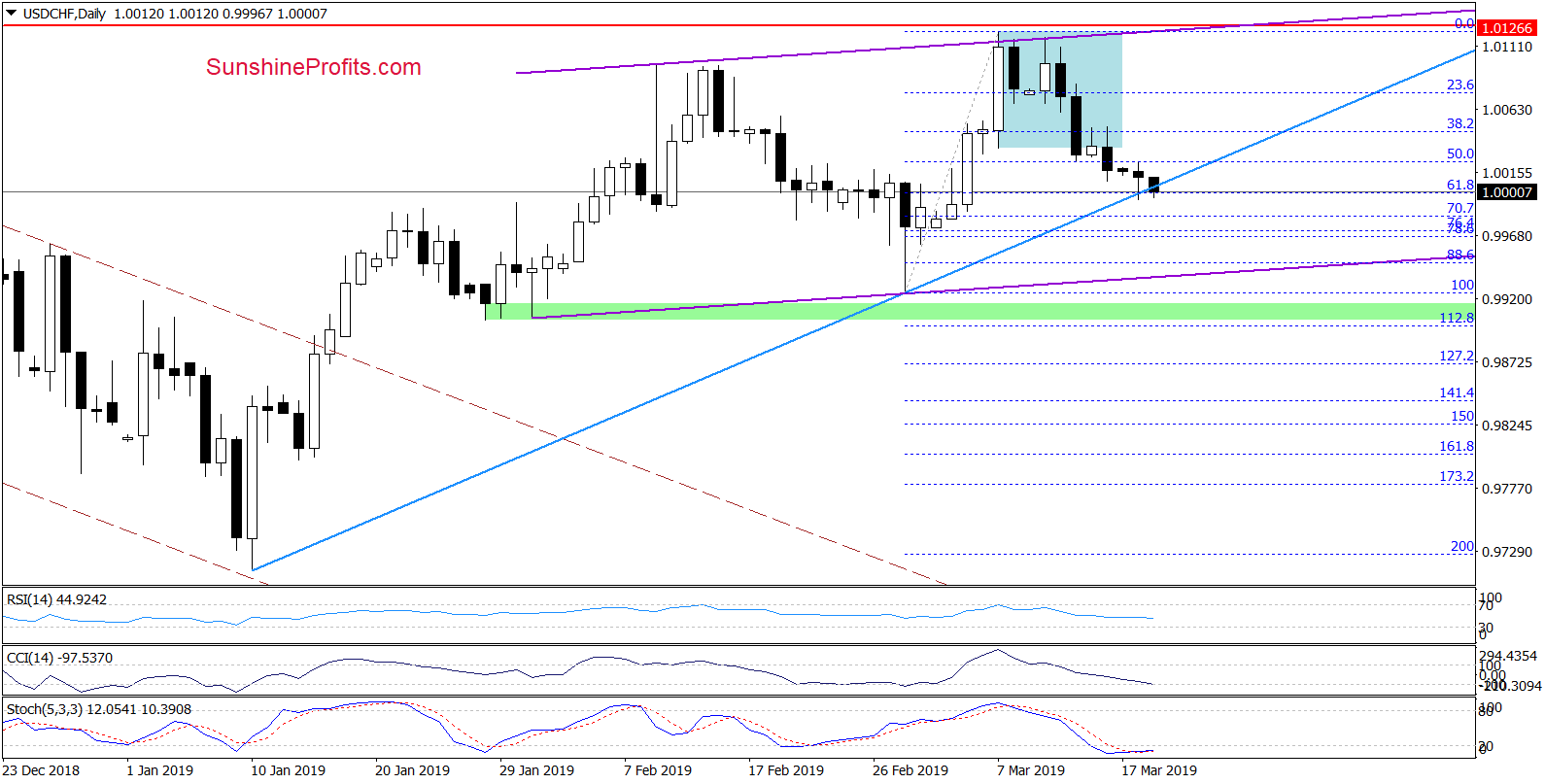

USD/CHF – Resting on the Support

(Click on image to enlarge)

On Friday, we shared this observation about the bulls’ fight to keep the price action confined to the blue consolidation:

(…) If they succeed and USD/CHF closes today’s session back inside the consolidation, further improvement in the coming week would not surprise us in the least. If they fail however, today’s upswing could turn out to be just a verification of the breakdown below the blue consolidation, which could translate into a test of the blue rising support line based on the January and February lows further down the road.

It turned out to be a breakdown below the blue consolidation in the end. Sooner or later, every sideways trend comes to an end. The bulls’ weakness triggered further deterioration and yesterday, the rate predictably tested the medium-term blue support line based on previous important lows.

Despite the tiny drop below this line, the bulls managed to close yesterday’s session above it. Earlier today, the sellers pushed the pair lower once again. This suggests a fierce fight around the blue line later in the day today.

If the bears win, USD/CHF will likely test the 70.7% Fibonacci retracement or even the support area created by the 76.4% and the 78.6% Fibonacci retracements. Nevertheless, the current position of the daily indicators suggests only limited space for further declines and a reversal in the coming days looks very likely.

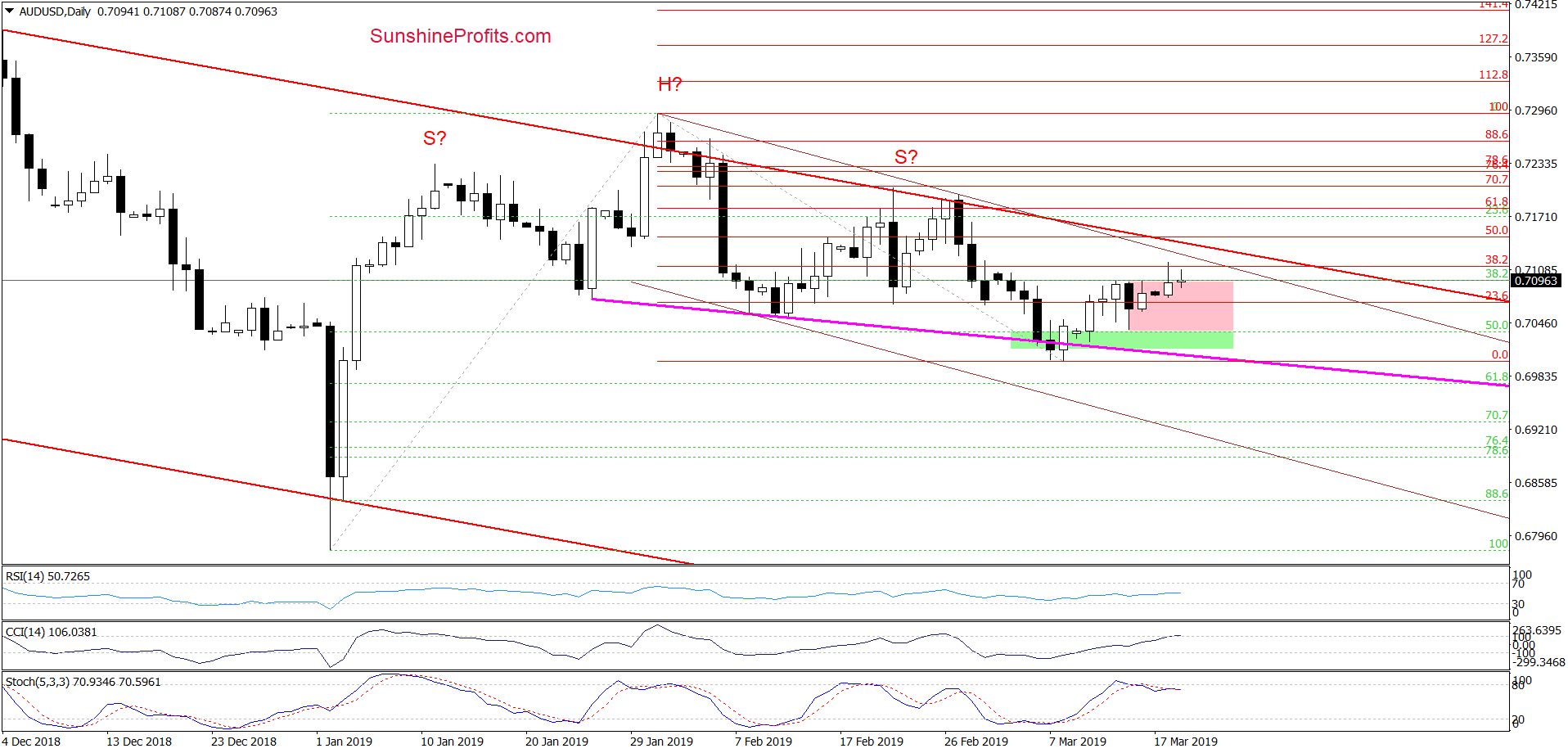

AUD/USD – Sending Subtle Bearish Hints while Still Consolidating

(Click on image to enlarge)

Many recent trading days in this pair have been marked by indecision, making short-term gyrations likely. There was simply no lasting move of significance that would tip the scales in the favor of the bulls or the bears and translate into a basis for such a move’s continuation.

As a result, the pair got trapped in the pink consolidation. Yesterday, currency bulls tried to take AUD/USD above its upper border, but the 38.2% Fibonacci retracement (based on the entire February-March downward move) stopped them and the rate reverted back to the consolidation.

Earlier today, we saw such an attempt to move higher once more. Again, it looks to have fizzled out as the pair trades at around 0.7095 at the moment of writing these words. Looks like that as long as there is no successful breakout above the 38.2% Fibonacci retracement preferably followed by a breakout above the upper border of the red declining trend channel, a bigger move to the upside is not likely to be seen.

Additionally, the bearish positioning of the CCI and the Stochastic Oscillator suggest that a downward-aiming reversal is likely just around the corner. Should we see any more of the bulls’ weakness, we’ll consider opening short positions.