By One Measure, Q4 Earnings Are The Weakest In 7 Years

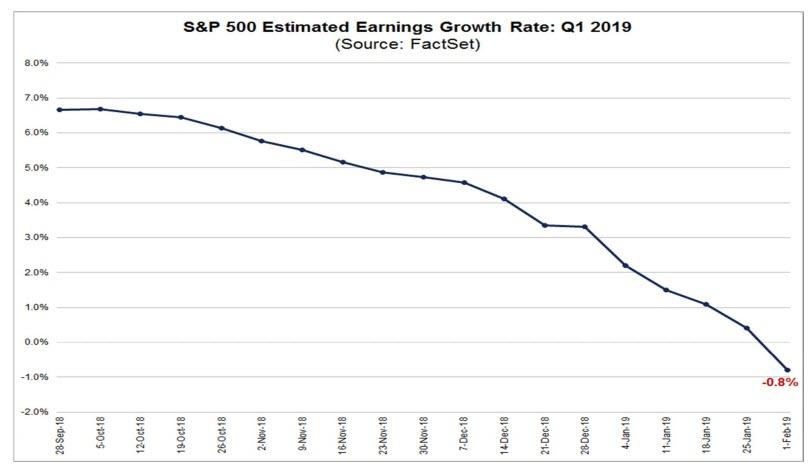

Over the weekend we reported that the era of "peak profits" has finally arrived, with consensus now expecting S&P500 earnings to post the first year-over-year decline since 2016.

(Click on image to enlarge)

And while the future of corporate profits is increasingly nebulous - despite the Q1 EPS decline consensus still expects Q2-Q4 to post earnings growth leading to another full year of rising EPS - problems are emerging amid already reported earnings.

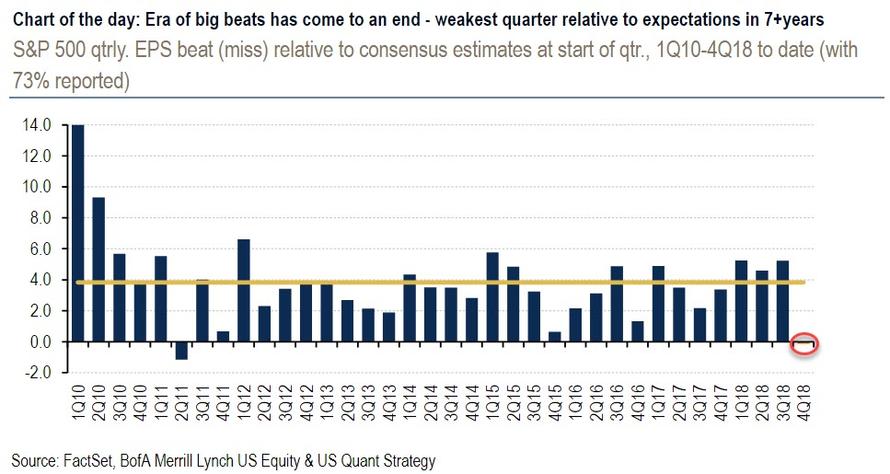

Here are the facts: with 73% of S&P500 companies having now reported earnings, so far, 60% of companies have beaten on EPS, 53% on sales and 37% on both. While this is not only below the long-term average, it is also the lowest at this point of earnings season in four years. Commenting on earnings, BofA notes that it expected fewer and lower beats this quarter vs. recent quarters, given the deterioration in economic data surprises/the fall in the ISM indices in 4Q, plus weaker results from the early reporters.

And that's precisely what has taken place: as BofA's Chart of the Day shows, the "Era of big beats has come to an end" and Q4 has seen the weakest quarter for actual results relative to expectations since Q2 2011.

(Click on image to enlarge)

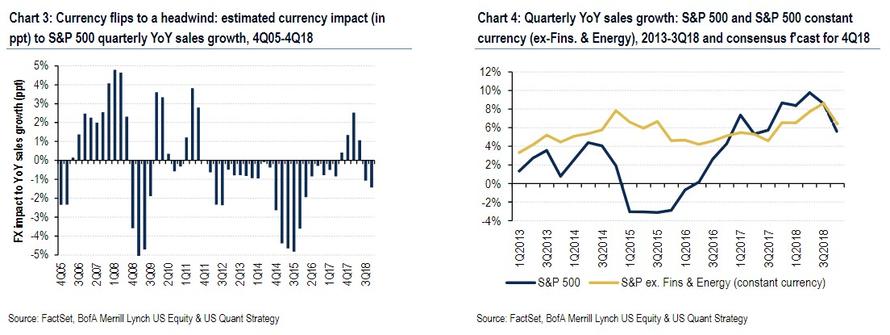

4Q sales are coming in 0.6% below start-of-January levels, and suggest sales growth of +5% YoY (vs +9% in 3Q). BofA estimates FX was a 1.4% headwind to YoY growth (vs a 1.1% headwind last quarter), the largest since mid-2017. Excluding FX/oil impacts, constant-currency sales growth for the S&P 500 ex. Fins. & Energy is expected to decelerate slightly less, to +6% YoY (vs +9% YoY in 3Q).

(Click on image to enlarge)

The problem is that analysts already trimmed expectations more than usual heading into the quarter, and as shown in the top chart, results are now barely coming in line with those lowered expectations, with beats from Energy, Comm. Services, Industrials and Health Care offset by weaker-than-expected earnings from Financials, Materials, and Tech.

(Click on image to enlarge)

Meanwhile, forward-looking earnings guidance has been cut sharply. As a result, 2019 consensus EPS growth expectations have fallen from 7% at the start of January to in line with BofA's forecast of 5% today, suggesting estimate cuts may slow from here.

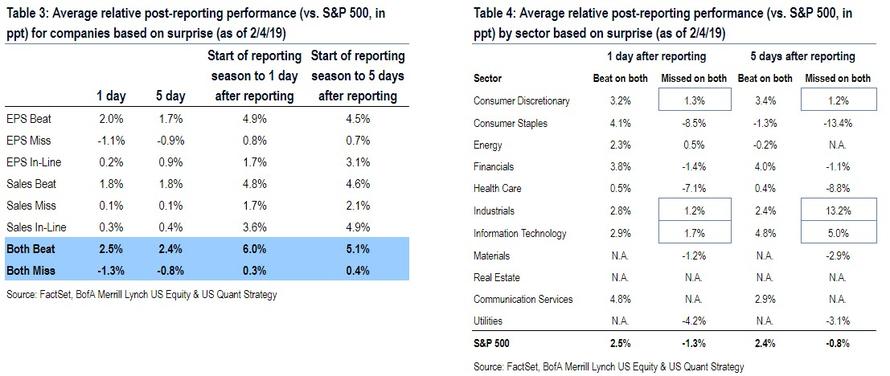

Additionally, the sharply cut expectations - which are barely being beat- has resulted in a generally favorable response to earnings reports. EPS and sales beats have outperformed by 2.5% the next day, which would be the biggest reward since 3Q15. On the other side, misses have underperformed by 1.3%, less than the historical average underperformance of 2.4%. In Industrials, Tech, and Discretionary, misses have actually outperformed the next day (particularly in Industrials). This is following a severe valuation de-rating in many areas of the market in 2018, particularly in global/trade-sensitive areas. Of course, if consensus outlook rerates lower, the market will soon realize it rewarded companies for an EPS rebound that will not happen, and a delayed selloff may ensue.

(Click on image to enlarge)

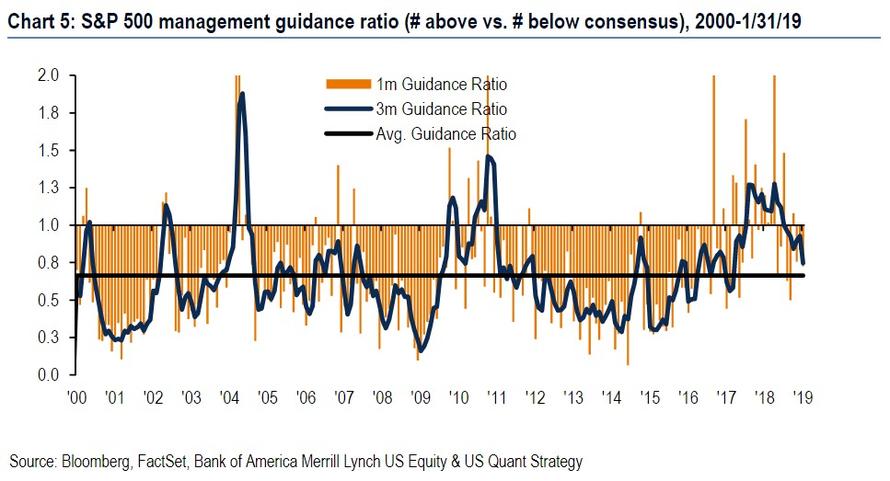

Going back to guidance, BofA notes that while it is weaker than average, management typically tends to set a low bar in January. Specifically, in Q4 the ratio of above-consensus vs below-consensus earnings guidance was 0.73 - a four-month low, but above the typical January average of 0.53. This puts the three-month ratio at 0.75 - the lowest in nearly two years, but still above the long-term average of 0.66.

(Click on image to enlarge)

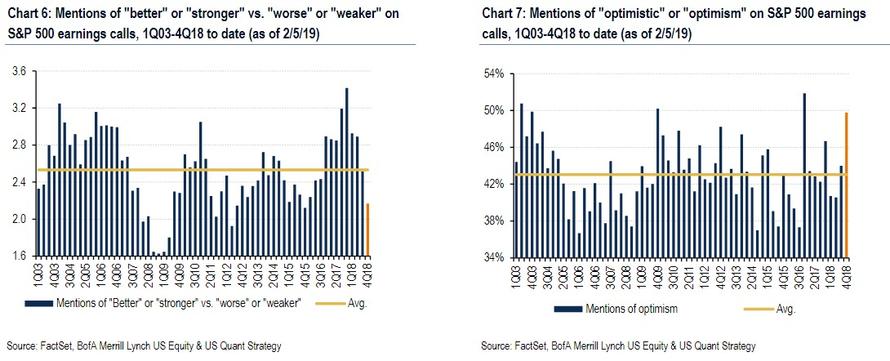

Guidance in January was weakest in Industrials and Tech, and strongest in Consumer Discretionary and Real Estate. The tenor of conference calls has been mixed: mentions of "better" or "stronger" vs "worse" or "weaker" are the lowest since 4Q15, as corporates see slowing trends. Ironically, mentions of "optimism" are tracking near record highs - see the charts below.

(Click on image to enlarge)

As we discussed over the weekend, consensus has increasingly lowered their expectations for full-year 2019 EPS. This suggests estimate cuts could slow from here unless we see further deterioration in economic data or a worsening of trade tensions.

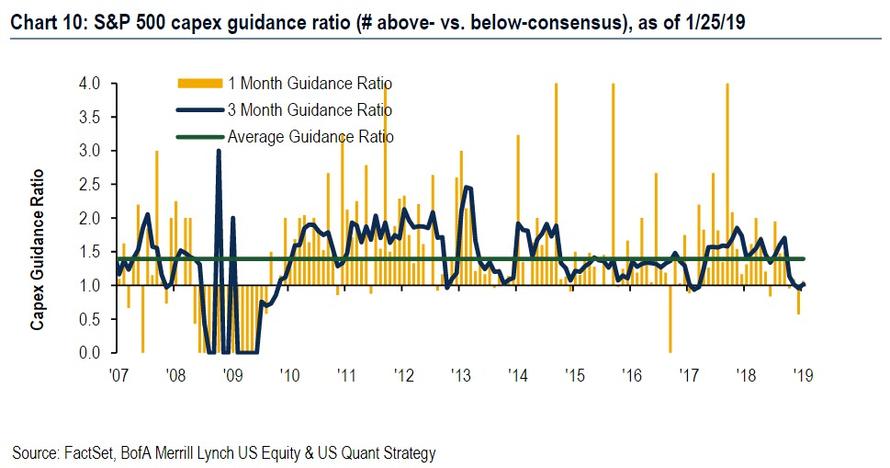

One potentially politically sensitive issue is that a sharp slowdown in capex growth is likely amid uncertainty around trade/tariffs, the government shutdown, global growth, etc, which has begun to impact companies' spending plans. In January, the ratio of above- vs below-consensus guidance on planned capex was 1.1x, putting the three-month ratio at 1.0x - an uptick from December, but still near a two-year low and below the long-term average of 1.4x. 4Q capex growth for reported companies is tracking +11% YoY (vs +13% for the full index in 3Q), or +9% for the median company (vs +13% in 3Q). As BofA notes, a fall-off in capex poses risk to Tech and Industrials, the two sectors with the weakest earnings guidance ratios in January. Indeed despite strong earnings, both Facebook and Google were hit following earnings reports that showed sharply higher spending; any deviation from this would likely result in a hit to the top and bottom line.

(Click on image to enlarge)

Finally, looking at the unknown unknowns ahead, trade remains a key risk but has so far negatively impacted only around 10% of the index. A slowdown in capex also poses risk to Tech and Industrials, where reported capex in 4Q is so far healthy but decelerating, while as noted above capex guidance has fallen to multi-year lows.