Buy These 3 Stocks Surging Higher

Investors need to be vigilant with their money, and right now there is a major tide shifting in the market. Energy and commodities are dead and big multinationals are weighed down by the strong dollar. If you’re looking for growth opportunities in this market, you need to own these three stocks.

It has been a turbulent third quarter so far for investors. Even as the market continues to be stuck in a historically narrow trading range, as it has throughout 2015, volatility has increased markedly with a notable increase in days equities going down or up one percent or more. China, as I predicted months ago, has emerged as a major concern for global markets. Negative import and export growth, as well as falling vehicle sales in the Middle Kingdom, show that the economy is growing far below the “official” seven percent GDP target.

This is a primary reason commodities and energy have been absolutely crushed over the last year and are likely to continue to be severely challenged in the quarters ahead. I continue to be substantially underweight both the materials and energy sector. The slowdown in China is also just one more challenge the global economy and markets are going to have to overcome.

Not that domestic economic conditions are anything to write home about right now. First half GDP growth came in at just under 1.5% as the weakest post-war recovery continues more than six years after the recession “officially” ended in June 2009. Year-over-year earnings & revenue growth for the S&P 500 are actually negative for the first half of 2015 due primarily to tepid global growth, a strong dollar, and the collapse of profits in the energy sector as crude prices have collapsed.

The only of the 10 industry sectors in the market to show double-digit earnings growth this quarter was healthcare. Given healthcare sub-sectors like biotech are up more than 50% over the past year, this performance seems fully priced into the market.

There are two other parts of the economy that appear to be doing extremely well right now. First, domestic auto sales continue to boom and could move past previous pre-crisis peak levels this year. Unfortunately, it is hard to invest in this sector via normal proxies like General Motors (NYSE: GM) and Ford (NYSE:F). I still own both names, but the stock of each manufacturing icon is currently being held down for the time being by the slowdown in China despite blowout domestic vehicle sales. I am happy to collect my four percent dividends on each until sentiment improves.

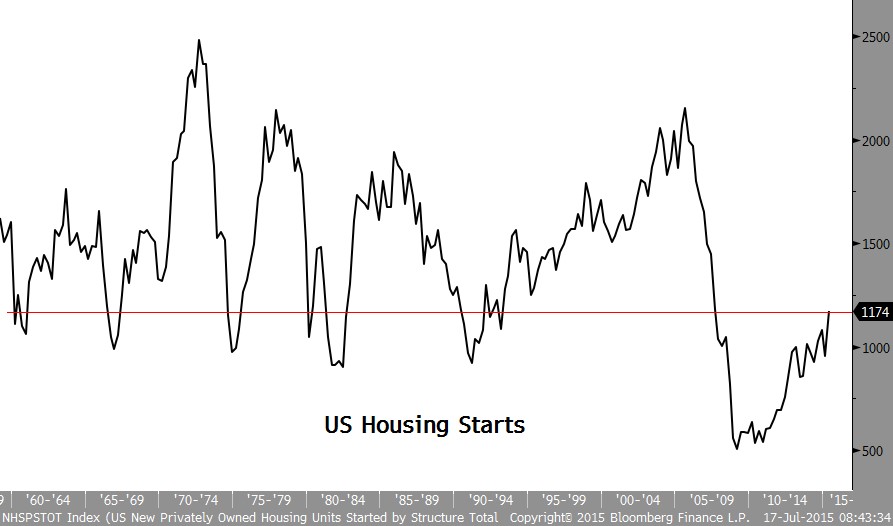

The other quickly improving part of the economy is housing. Housing starts are solidly over the one million annual level, homebuilder sentiment is at ten year highs and building permits in June posted their strongest numbers in eight years. This increasing housing activity is starting to show up in the results of myriad homebuilders.

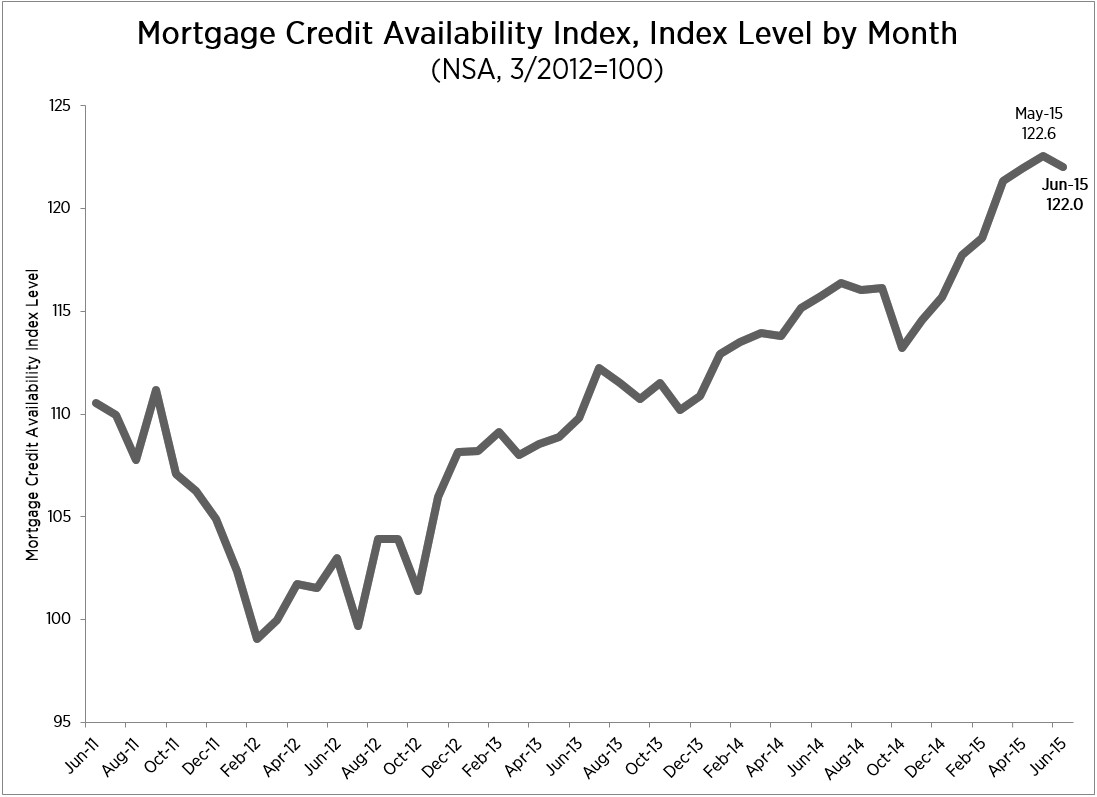

More importantly, this is a trend that should last at least several years and I am overweight the homebuilding sector as I believe it is one of the best and few “pockets of value” within the market right now. There are many reasons I believe housing will be an important growth engine for the economy over the next few years. First, mortgage credit standards are finally starting to loosen which should boost demand further.

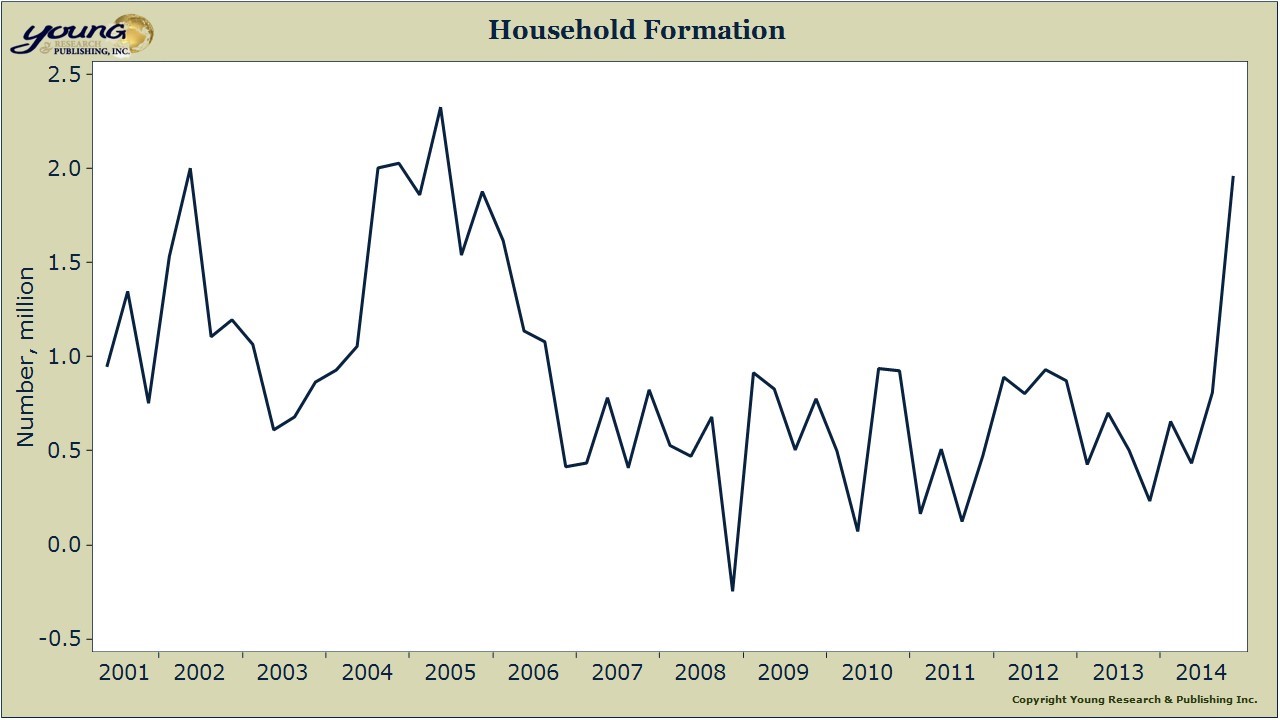

Second, after diving substantially during the financial crisis and its immediate aftermath; household formation is finally getting back to normalized levels again. Thanks to better job growth and growing consumer confidence, millennials are moving out of their parents’ homes, marriage rates are increasing and couples are deciding to have kids again at rates that prevailed before the deep economic decline. This too is positive for housing demand.

Finally, annual housing starts have been substantially under their three-decade average since the housing boom became a housing bust just before the financial crisis. This has created significant pent-up demand for housing that will play out over the years to come.

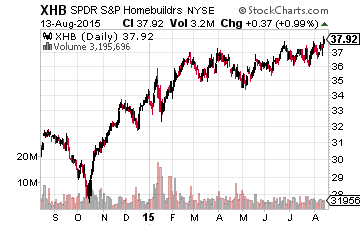

Investors looking to get exposure and diversification in this space can simply buy the SPDR Homebuilders ETF (NYSE: XHB). I tend to like some of the smaller names in this space as I think this fragmented industry will be consolidated substantially over the next few years. The over $5 billion recent merger announcement between Ryland (NYSE: RYL) and Standard Pacific (NYSE: SPF) might have been the opening salvo within a larger consolidation wave.

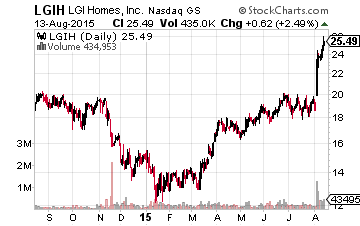

I continue to like and hold LGI Homes (NASDAQ: LGIH )which is up substantially since I first profiled this small homebuilder here on these pages in early June (Notation 1) and has been a stalwart performer for the Small Cap Gems portfolio as well. The company continues to quickly expand its geographical footprint and just reported another blowout quarter which triggered an additional rally in the shares.

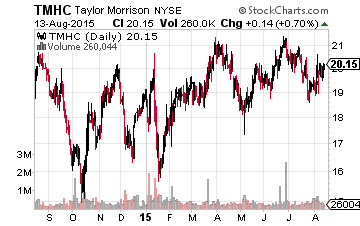

Taylor Morrison (NYSE: TMHC), the nation’s seventh largest homebuilder just beat earnings estimates and looks like a solid value here at under 10 times trailing earnings and the stock just got upgraded at Stern Agee. Tri Pointe Homes (NYSE: TPH) also just beat the quarterly consensus. Earnings at this homebuilder should double this year to approximately $1.20 a share in FY2015 and move up another 20% in FY2016. The stock fetches right around 10 times forward earnings in a market with an overall market multiple of approximately 17 times forward earnings.

While I remain concerned about the overall market and the economy, housing is one area that looks primed for years for accelerating growth. The selections above are a couple of good ways to play these developing trends.

Positions: Long F, GM, LGIH, TMHC & TPH