Business Spending Suffers Longest Contraction Since 2015

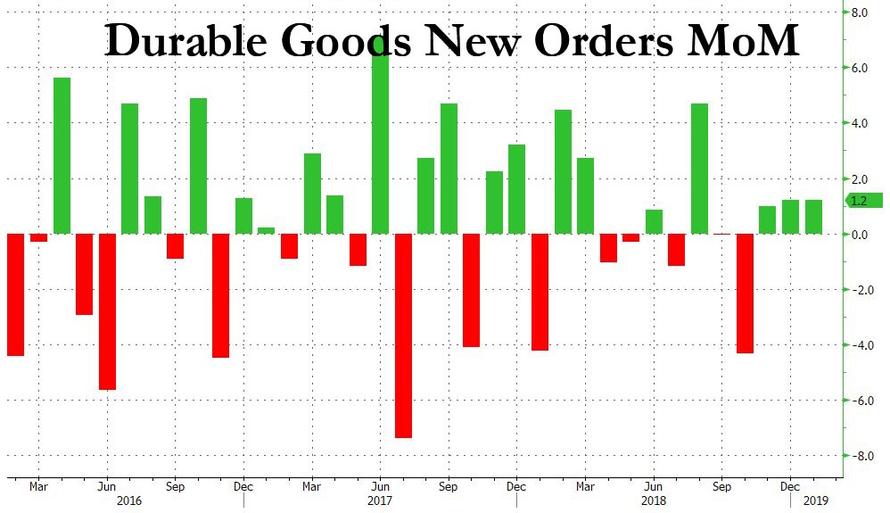

After no January Durable Goods report as the government was shut down one month ago, today we got a double whammy of a Durables report, with both November and December data, and as many had warned, it was disappointing, rising just 1.2%, below the 1.7% expectations, if up from 1.0% in November (revised up from 0.7%).

(Click on image to enlarge)

However, much of the upside was once again due to transportation orders, read Boeing defense and airplane spending. Indeed, new orders for nondefense aircraft and parts soared 28.4%, by far the biggest contributor of December spending. Ex airplanes, under the hood things were even uglier:

- New orders ex-trans. rose 0.1% in Dec. after 0.2% fall

- New orders ex-defense rose 1.8% in Dec. after being unchanged

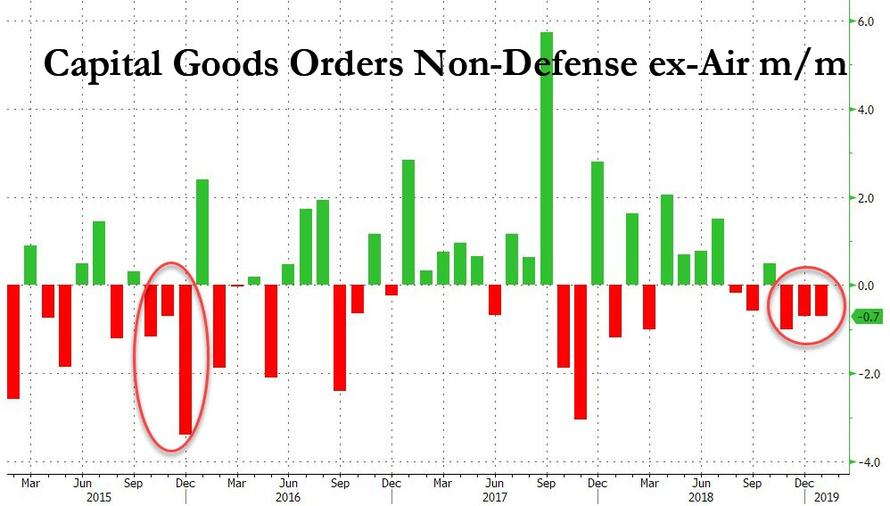

Most importantly for those following the buyback vs capex debate, non-defense capital goods orders ex-aircraft, i.e. core capex spending, fell 0.7% in Dec. after falling 1.0% in Nov (revised lower from -0.7%).

This was the third consecutive month of declines, the longest stretch of contraction since late 2015 when China nearly dragged the entire world into a recession and only the early 2016 Shanghai accord saved the world from what would have been a certain contraction.

(Click on image to enlarge)