Bulls, Bears, Owls And Pigs

Everyone knows the distinction between a bull and a bear. There are enough conflicting indicators out there right now that a pretty forceful argument can be made for either position.

The Bulls are convinced that we've now had our one huge correction and every pullback is just a chance to buy more. The best is yet to come. After all…

- The market recovered swiftly and conclusively from its 2020 lows. That shows that investors want to own American. We can get on with the party.

- The dithering, withering Fed tells us printing money at obscene rates will lead only to temporary inflation. Don’t fight the Fed. (Even when they are wrong?)

- Corporate earnings are coming in above forecasts. They will continue to do so as we power out of our Covid funk.

- We have a federal government that wants to shower us with money rather than suggesting we really should get out of our yoga pants and get back to work.

- We are likely sitting atop the biggest economic expansion in history. (Thanks boomers, and thanks millennials.)

- It's the economy, stupid.

Bears see the same information and interpret it a bit differently. Honest people can view the same event and interpret it differently without compromising their integrity. Bears see the same scenario and say no way can this continue. Because…

- All this backing and filling and spinning of wheels shows the market cannot get out of its sideways digression. If it cannot go up, it will go down.

- The Fed is on LSD. Their continued buying of trillions of dollars of bonds and dispensing goodies like a Bad Santa will soon bring all the current gains back to earth.

- Of course corporate earnings are coming in above forecasts. Look at the dates of the year-on-year comparisons and remember the dismal despair of this time last year! The hurdle to beat is now so low that a 4-year-old could leap over it.

- China wants to eat our lunch.

- China is eating our lunch.

- The supply chains are broken and inventories are too low to support continued expansion. Besides, China controls all the good stuff.

- Trees don't grow to the ionosphere and no one has repealed the business cycle. Expansion and contraction are both real concepts.

- The next generation of investors do not invest. They meme and moan.

- It's the economy, stupid.

So much for Bulls and Bears. What about the Owls? Owls tend to make a good living in the market because they invest as if the market might fall on some days and rise on others and that some sectors will rise more while others will fall more.

Owls will own some income, be it quality dividend-paying blue chips, REITs, preferred shares, convertible preferreds and bonds, etc. But Owls will also stay attuned to the sectors that are in ascendancy and those that are in decline.

If the Technology Sector is the place to be, you can be certain that Owls will have some of their funds in that sector. If Tech gets ahead of itself and begins to falter but, say, Materials are beginning to move (and from a much lower base), the Owl will begin moving funds out of the stalled or declining sectors and into Materials.

Owl investors also understand that the market breathes in and the market breathes out, just like every living organism on earth. Sometimes, even in the middle of a massive decline, it takes a pause. Likewise, in the middle of a stellar rise, it also takes a breather. I know this intuitively, but I have never seen it more perfectly illustrated than in a recent podcast from institutional research firm The Leuthold Group.

(While Leuthold’s research is for institutional investors, the company also offers mutual funds as well as their first ETF for individual investors. These have typically been Steady-Eddie funds. The Leuthold Group - Funds).

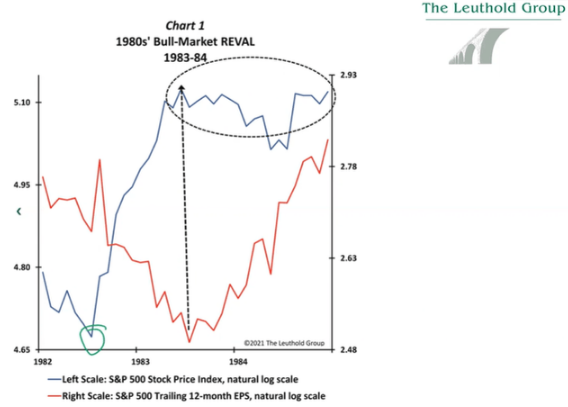

The following was the first chart in a recent presentation by Jim Paulson, Leuthold’s Chief Investment Strategist. He then went on to show three more charts, all from more recent periods of major decline, that looked almost exactly like this one!

What Mr. Paulson is demonstrating is that, historically, falling corporate earnings, like those that plunged in 2020, are initially accompanied by falling stock prices. No surprise there. But then, when investors believe the bottom is in, they tend to buy before earnings recover.

Further, after earnings are really roaring ahead again, there is a congestion period where there are as many investors selling for gain as there are investors who had remained on the sidelines now buying. This has created, in every prior decline, a sideways market that goes on for many months. This sideways motion convinces some Bears the market rise is over.

Big mistake. At least over the past 40 years, these sideways markets deconflict over a few months - and the next move is decidedly up. I think this is eminently logical from demonstrated investor behavior in the past.

Here is one more reason to believe that it will happen again. The lopsided House of Representatives elections of 2020 are behind us. We are less than a year from the heavy campaigning of the mid-year elections that will be decided next year. With all the disparities of the current one-sided rush to spend, spend, spend and then tax, tax, tax, Congress will be at the center of the 2022 mid-year elections. I believe a Congress with more diverse opinion will result. This can only be good for investors and the nation.

What To Do Now

At this point, I believe you want to have some cash-equivalents and income holdings to take advantage of any new opportunity. I am buying some Utilities for this purpose, primarily via ETFs. Even though they are interest-rate sensitive (that part could hurt,) I own them because they provide steady income and, more importantly, no one else wants to own them right now. They are the ugly cousin to cool high tech and “tomorrow’s reality” stocks. Yet they are essential to our well-being and are fairly priced.

I feel the same about the Energy companies, both traditional and next generation. What brokerage firm is recommending stodgy old energy these days? I like buying what is unpopular as long as the market is moving sideways anyway. I pay a lot less for it. It often means better cash flow from dividends. And I can always move into the more popular sectors when I see the market begin to perk up again.

I also think Real Estate is a good place to be as long as I do not overpay for what has already moved up so far it is priced to perfection. Until rates rise above 3-4% (and they will again!) and stay there, real estate companies of all stripes will continue to do well. Just be careful of one-trick-pony REIT advisors. Many REITs are already overpriced.

What NOT To Do Now

There is one more animal I haven't discussed - Pigs. The old Wall Street saw says it all: "The Bulls make money, the Bears make money - but the Pigs get slaughtered."

Don't be a Pig.

Nobody believes they are being a Pig when their piggishness is clearly evident to the dispassionate observer. An example? I have a young friend who bought Bitcoin cheap. Really cheap. OK, not spending close to $4 billion for a pizza cheap, but he did buy for around $6,000. I suggested he sell a little when Bitcoin hit $60,000. He called a while later to tell me I was "Old School" as Bitcoin blew through $60,000 and was going “to the moon!”

Never argue with a True Believer. Whether it is politics, religion or investing, they are never wrong. He is convinced that the current pullback is just a chance to buy more. (If only his entire net worth was not already wrapped up in Bitcoin. To him, diversification means buying a different crypto.)

I believe in the value of blockchain technology. But a currency designed to provide off-the-books money laundering and tax evasion is unlikely to pass muster when governments decide to issue their own digital currency or, as China is doing now, quash the product entirely.

It’s true that “even a blind pig can find an acorn every now and again,” but that pig is going to have a dozen painful bumps on his head for every acorn found. If you have big profits in a holding and are watching it stall or decline, you might hold – or you might at least place a reasonable trailing stop order. If your “This is The One” stock rises further, your trailing stop will follow it higher. If not, you will sell and be able to buy back anytime you like.

I'll take real dollars saved over the possibility of maybe-profits lost any day.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in MANY over the next 72 hours.

Disclaimer: I do not know your personal financial situation, so ...

more

"The Bulls make money, the Bears make money - but the Pigs get slaughtered." - one of my favourite quotes.