"Bullard Bomb" Sparks Quad-Witch Chaos, Yield Curve Collapse

The week explained (by CNBC narrative)...

Wednesday - Fed was shockingly hawkish

Thursday - on second thought the Fed was dovish

Friday - these hawk monsters know nothing

Because St.Louis Fed Chair Jim Bullard uttered some truth bombs...

..."it's natural that [The Fed] has tilted a little bit more hawkish,"

...there "is some upside risk on the inflation forecast,"

"Fed Chair Powell has opened the taper discussion this week."

..."little concerned about housing market froth", noting that The Fed "is leaning toward idea that it may not need to be buying MBS," adding that "we don't wanna to get back in the housing bubble game... that caused us a lot of distress in 2008."

And that left chaos in its wake as reflation bets were derisked en masse. And if The Fed's policy is to ensure 'financial stability', then they failed this week (even if Bullard's goal was to blow the "froth" off the hyped-up-inflationary asset values).

Source: Bloomberg

Did Powell just "meddle with the primary forces of nature" one too many times?

Small Caps and The Dow were the week's biggest losers. Nasdaq managed to hold gains on the week...

Dow suffered its worst week since Oct 2020.

Some serious gamma swings this week...

Dow, S&P, and Small Caps all broke below their 50DMAs...

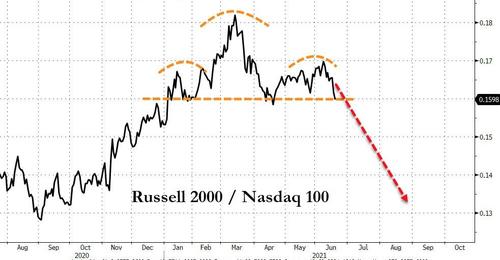

The Russell's underperformance took it back to its lowest relative to Nasdaq since mid-April...

Which put a different way leaves Russell 2000 at a critical support point once again...

Source: Bloomberg

FANG stocks surged to a new record highs as the chaos hit...

Source: Bloomberg

The rotation out of Value (into Growth) was dramatic...

Source: Bloomberg

And momentum got hit this week...

Source: Bloomberg

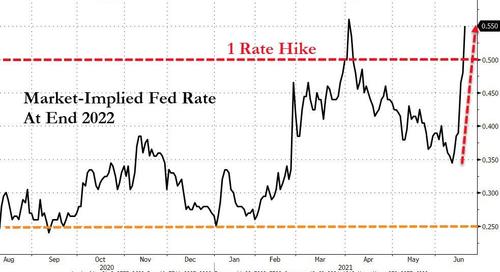

Bullard's extremely hawkish comments sent rate-hike expectations soaring to price in at least one hike before the end of 2022...

Source: Bloomberg

Total chaos reigned over the bond markets with 2Y and 5Y yields biggest weekly rise since Nov 2019...

Source: Bloomberg

30Y Yields biggest weekly drop since Dec 2020 (2Y yields are above Fed Funds rate for the first time since April 2020)...

Source: Bloomberg

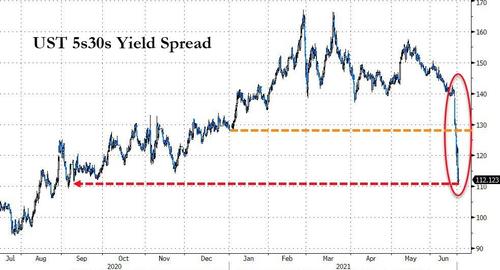

Biggest weekly yield curve (5s30s) flattening (-27bps) since Sept 2011...

Source: Bloomberg

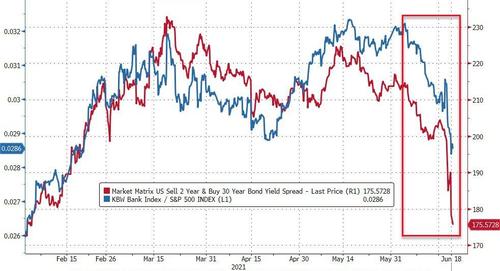

The yield curve collapse crushed financials...

Source: Bloomberg

And Citi led the big banks on the week (down 12 straight days - longest losing streak since 2018)...

Source: Bloomberg

Mortgage rates were notably higher this week as the curve flattened and longer-end yields tumbled...

Source: Bloomberg

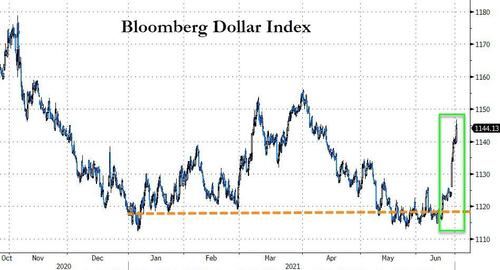

The Dollar screamed higher after The FOMC statement - its biggest weekly gain since April 2020...

Source: Bloomberg

Commodities worst week since March 2020...

Source: Bloomberg

Bear in mind what we said a month ago about China's deflationary impulse...

Source: Bloomberg

Cryptos had an ugly week (but not on the level of extremes in other assets). ETH underperformed BTC once again...

Source: Bloomberg

Gold was clubbed like a baby seal, suffering its worst week since March 2020...

Dr.Copper crapped out (worst week since March 2020)...

But crude was higher for the 3th straight week (amid lots of vol)..

Soybeans were crushed to their worst week since 2014 (despite the bounce today)...

Notably as commodities crashed around the world, NatGas was up on the week with European natural gas prices (TTF one-month forward) settle at their highest level in more than 12½ years (equivalent to ~$10.2 per mBtu) on low inventories and high CO2 prices (h/t @JavierBlas)

Source: Bloomberg

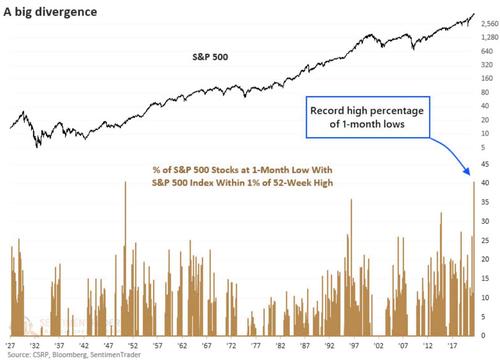

Finally, there has never before been so many S&P 500 stocks plunging to 1 month lows, while SPX is trading this close to all time highs

And then there's this insanity - the S&P 500 is 2% off all-time record-highs.. and FEAR is at its most extreme since October...

Probably nothing!

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

It is an Interesting analysis. And certainly fear is helping drive it. Of course with a collection of drunken clowns heading towards the cockpit of the airliner there does appear to be a valid reason for that fear. It appears that the leaders have no clue about what to do, or any understanding about actions and results of actions.