Bulish Haramis Attempt To Establish Swing Lows

There was a reluctance on the part of traders to react to the bearishness of Friday' trading, although today's buying came on significantly lower volume. The 'inside day' of Monday's trading ranks as a bullish harami over the last two trading days - a bullish pattern.

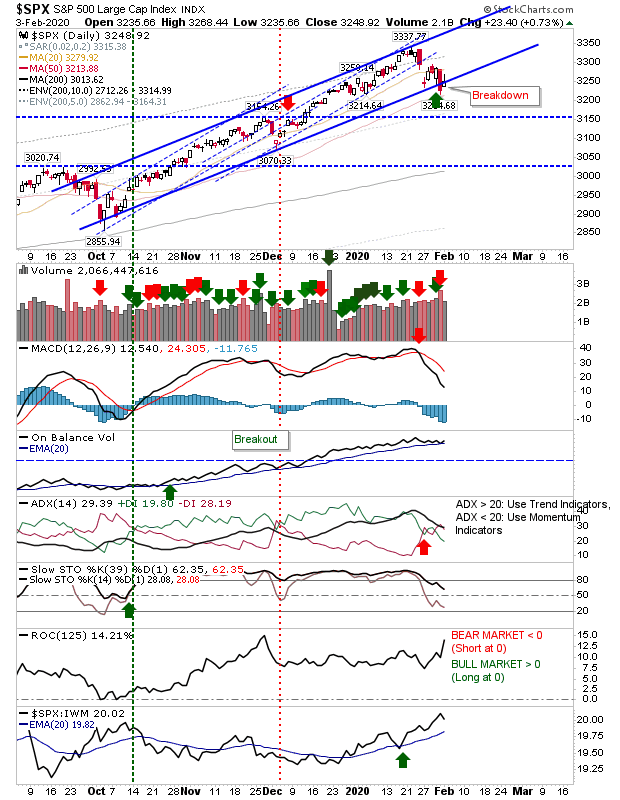

For the S&P, this buying didn't contribute much to arresting Friday's selling volume as many of the indices failed to recover channel support. Relative performance remains strong (versus Small Caps) although other technicals are drifting, the MACD in particular. Some could argue today's buying marked a return to channel support, but it's not a substantial recovery.

The Nasdaq enjoyed twice the gain of the S&P, but it too found itself just about making it back to channel support.

Small Caps are a long way from returning to channel support but there is a minor horizontal support level which is protecting against further losses. All technicals are bearish as intermediate and long term stochastics converge at an oversold condition.

Collectively, today's action is an attempt to establish a ground zero for buyers to establish a launch point for a new rally but its probably still a little early. With the flu epidemic in its early days, the risk to the global supply and consumer chain remains up in the air and until infection counts peak it would remain difficult to time call a tradable bottom.