Bonds, Stocks, & Silver Surge Over Xmas Week But Dollar Dives To 5-Month Lows

"They're keeping the rates down so that everything else doesn't go down... The only thing that is strong is the artificial stock market." - Trump, 9/5/16

It's been a year of buying everything:

-

S&P's best year since 1997

-

Gold's best year since 2010

-

Bond's best year since 2014

And all it took was $5 trillion in global liquidity!!!

Source: Bloomberg

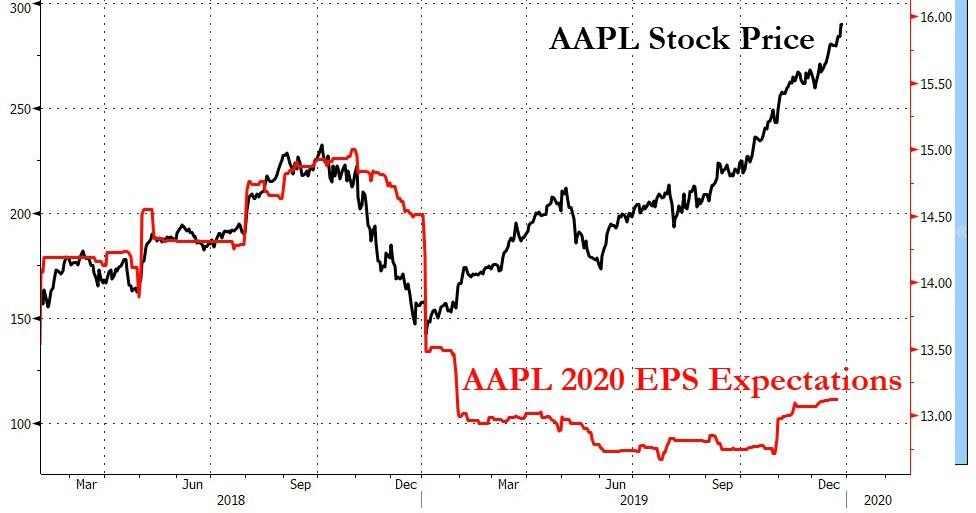

Remember, correlation is not causation... especially when your salary depends on it...because this rally in stocks is all about the fun-durr-mentals...The S&P 500 is up almost 30% and earnings expectations are down almost 5% on the year...

Source: Bloomberg

Chinese stocks were unchanged on the week...

Source: Bloomberg

US majors started weak today, rebounded, then ended weak... Nasdaq ended its winning streak...

US Small Caps lagged on the week as Nasdaq soared (the S&P is on the verge of its best year since 1997)...

Nasdaq bounced perfectly off 9,000 intraday...

The Dow bounced off unchanged twice...

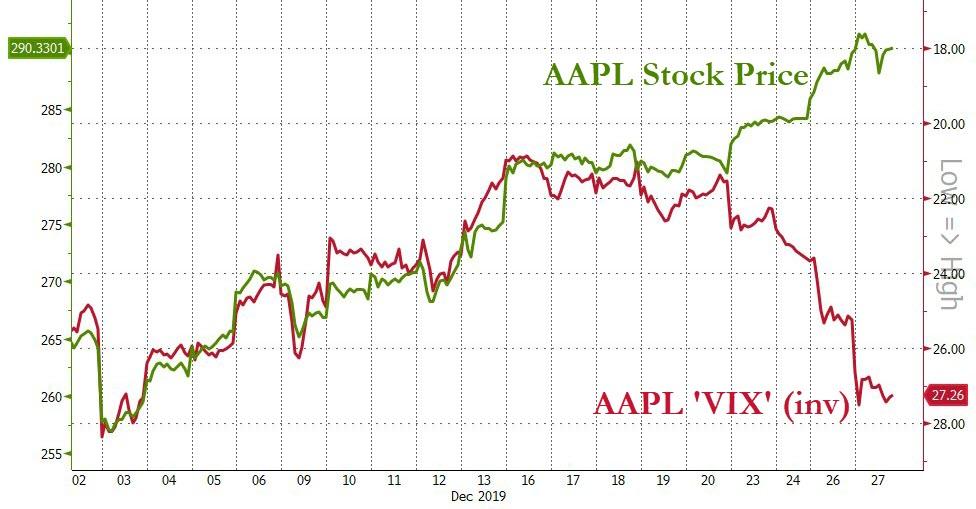

AAPL had a more volatile day than normal... was the guy in charge of buybacks taking some time off?

Still doesn't really matter eh?

Source: Bloomberg

We also note that AAPL rejected the Fib 161.8% extension of the late 2018 collapse...

Source: Bloomberg

Something has changed in the last couple of days with AAPL...hedging the huge gains into year-end?

Source: Bloomberg

Even TSLA was red today but has a long way to catch down to un-exuberant bonds...

Source: Bloomberg

VIX has notably decoupled from stocks this week...

Source: Bloomberg

The open was yet another short squeeze but it didn't last and stocks dumped. But were rescued into the European close by another squeeze...

Source: Bloomberg

Treasury yields ended the week 3-5bps lower

Source: Bloomberg

10Y yields broke back below 1.90%...

Source: Bloomberg

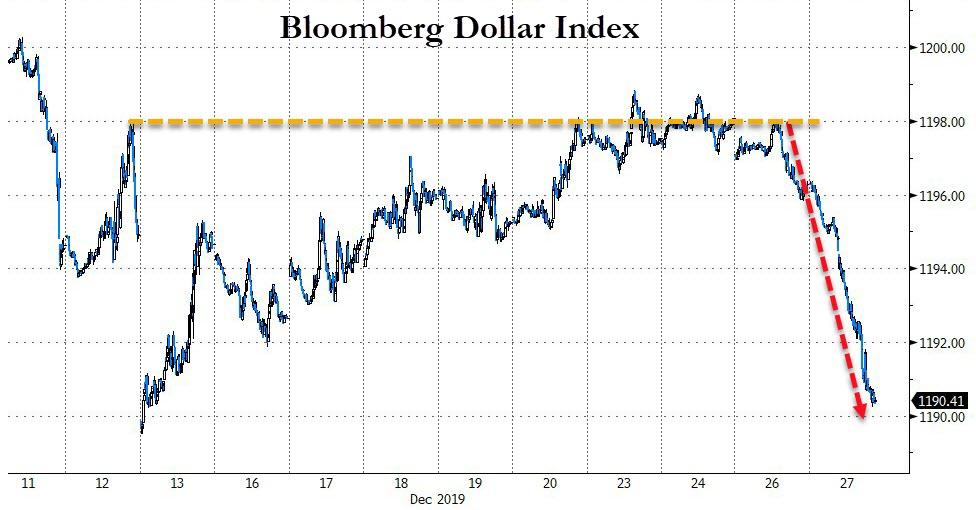

The Dollar plunged today (biggest single-day drop since Sept 4th)...

Source: Bloomberg

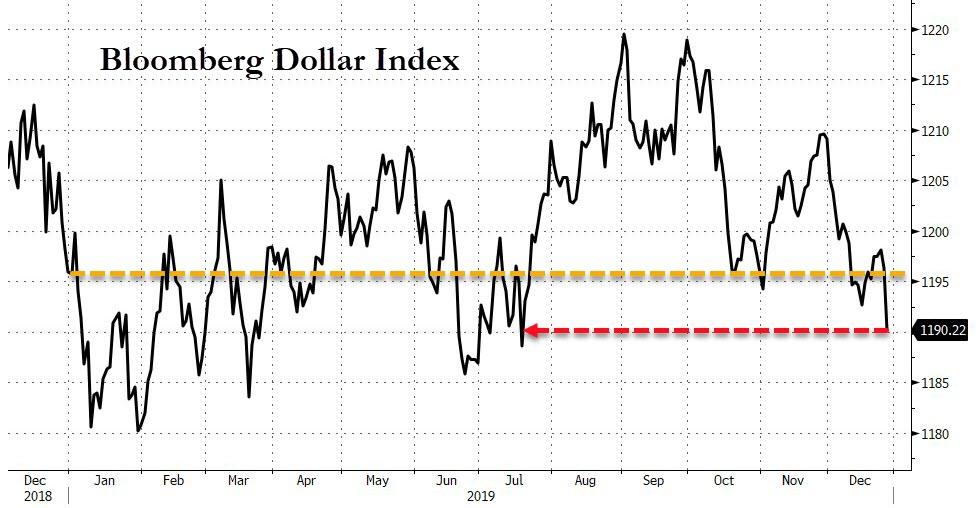

This is the 3rd weekly drop in the last 4 weeks, to its weakest close since July...

Source: Bloomberg

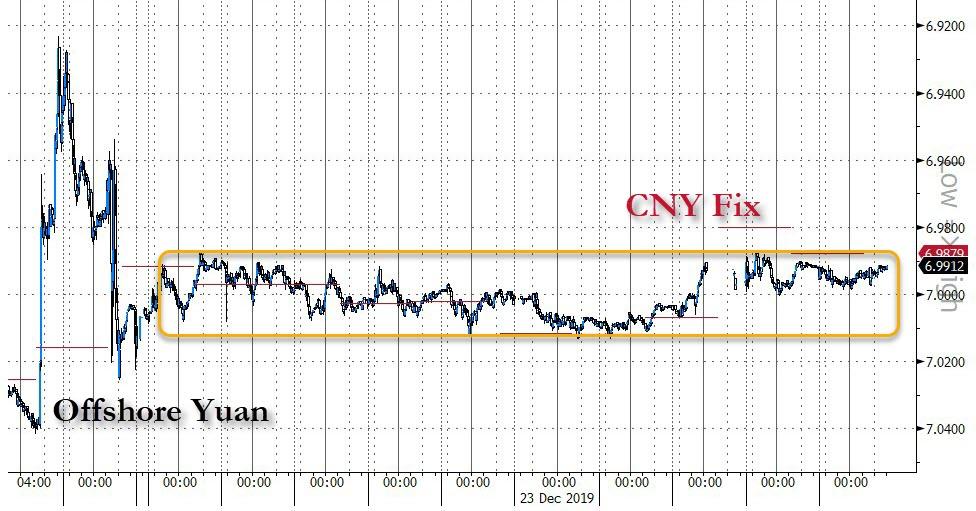

As the dollar has slipped, Yuan has drifted very quietly sideways, apparently pegged around 7.00...

Source: Bloomberg

The pound inched higher this week after last week's bloodbath, ending back at pre-election-spike levels...

Source: Bloomberg

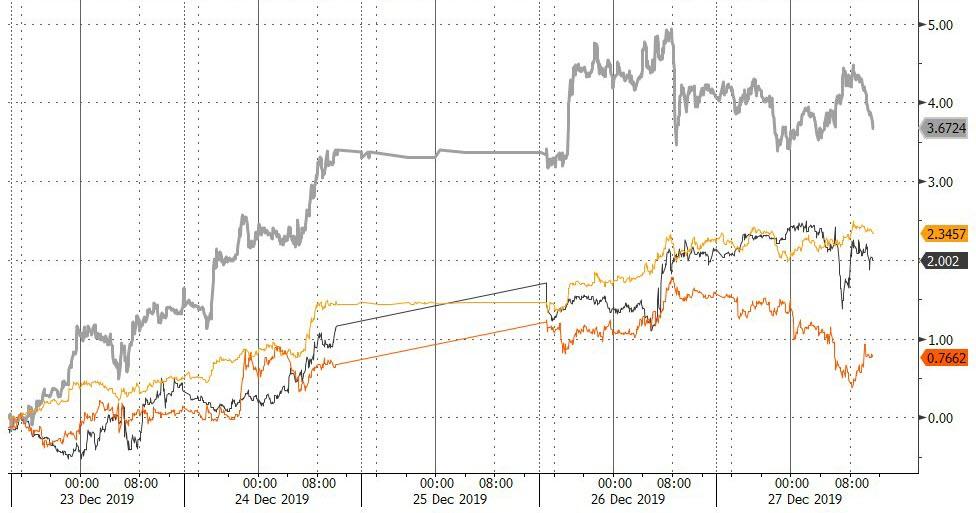

Bitcoin was unchanged on the week with Bitcoin Cash surging today to lead on the week; Ripple and Ethereum lagged...

Source: Bloomberg

Bitcoin has been relatively stable for two week weeks (despite the pump and dump)...

Source: Bloomberg

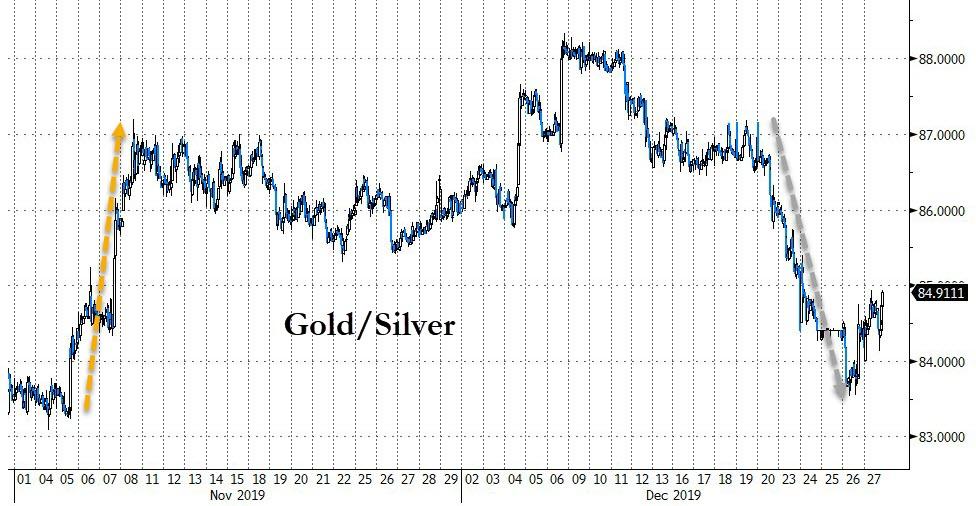

Commodities were all higher as the dollar tumbled, but PMs trumped crude and copper...

Source: Bloomberg

Silver topped $18 on the week (though fell back below today)...

And gold topped $1500 and held it...

Silver has outperformed gold for the 3rd week in a row...

Source: Bloomberg

And WTI Crude has accelerated beyond its uptrend channel...

Copper has now risen for 6 straight weeks - the longest streak since Sept 2017...

Source: Bloomberg

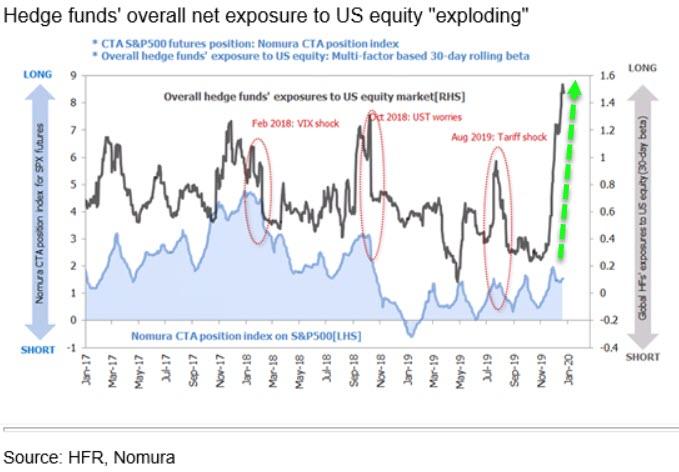

Finally, investor greed has reached peak-extreme...

And hedge fund exposure to the US equity market is exploding...

This won't end well.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more