Bonds Still Busted

Well, it’s green on the ES and NQ for yet another day, but at least it’s not by much. Let us instead turn our attention to bonds, which I continue to contend are in trouble. Here’s the long-term continuous chart, featuring the channel failure:

(Click on image to enlarge)

The same market, except by way of TLT, is shown closer up. As you can see, even with the hearty rally of the past couple of weeks, bonds have been carving out a steady series of lower lows and lower highs. That horizontal line is all that stands between here and whack-a-palooza.

(Click on image to enlarge)

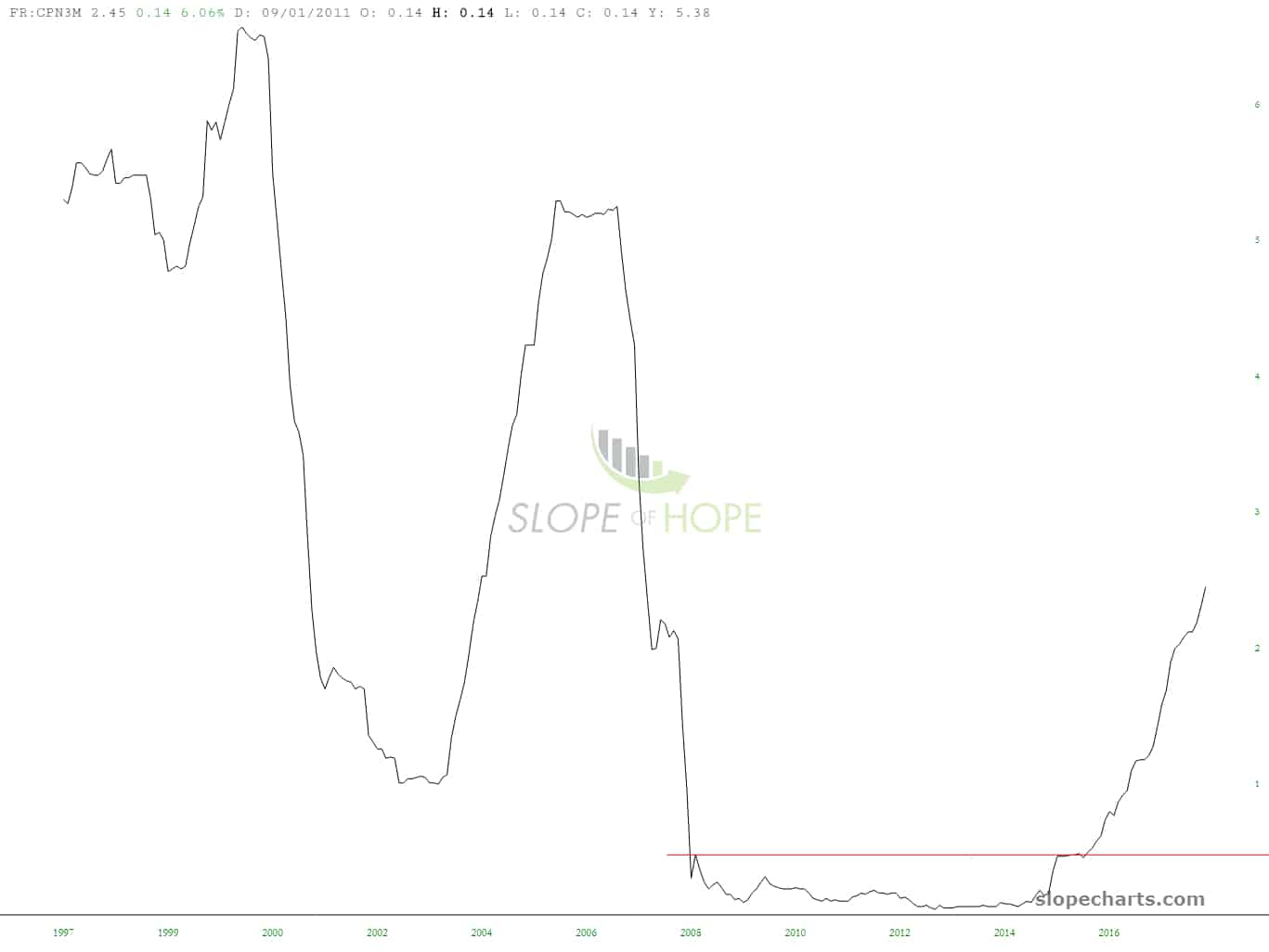

And, of course, interest rates in turn are all looking quite bullish. Powell might be a wimpy little simp, but the cold fact of the matter is that interest rates worldwide are strengthening.

(Click on images to enlarge)

And, importantly, the MISERY index has absolutely plunged to be at a level below even… let’s see, what was the month?… oh, here it is, March 2000. If memory serves, that was an interesting turn for markets too.

(Click on image to enlarge)