Bonds Are On A Roll

Bond ETFs have been in rally mode for months and investors need to understand the opportunities and implications of these moves.

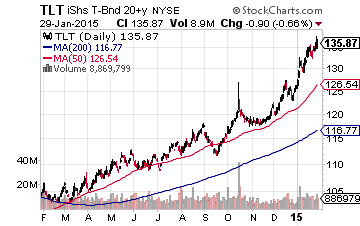

Who would have thought that between September 2, 2014 and January 29, the share price of the iShares Barclays 20+ Year Treasury Bond ETF (TLT) would have soared 17.48 percent, while the share price for the S&P 500 SPDR ETF (SPY) would have advanced only 1.71 percent?

During the same period, the share price for the iShares Barclays 7-10 Year Treasury Bond ETF (TLT) jumped 6.03 percent. Between the closing bell on New Year’s Eve and January 29, the price jump for TLT shares has been 7.90 percent.

Investors expect stronger gains from stocks and equity-based ETFs, because the higher risks are expected to bring higher rewards. Investors are willing to settle for more modest gains from investing in Treasuries and Treasury bond ETFs because of the “safe haven” which Treasury securities provide.

As you may recall, the stock market experienced a painful correction last autumn, which suppressed the price advance for the SPY ETF. Nevertheless, while the TLT ETF experienced a 7.90 percent 2015 share price advance as of January 29, the SPY ETF declined 1.72 percent.

At the heart of the run-up in bond prices is the anticipated “lift-off” of the increases to the federal funds rate by the Federal Reserve. Fear that stock prices could take a steep dive, once the Fed tightens the money supply, is already driving investors to Treasuries and away from stocks. Many investors fear that once the “lift-off” occurs, a significant stock selloff could follow.

Bond guru Jeffrey Gundlach of DoubleLine recently warned of the consequences which could result if the Fed began raising interest rates too soon. While it is widely assumed that “lift-off” will begin in September, Gundlach expects that the Fed will realize that it made a mistake by raising the federal funds rate at a point when the Fed’s own inflation target of 2 percent (personal consumption expenditures or PCE inflation) is still likely to be years away.

Earlier in January, Gundlach opined that the global economic slowdown will begin to impact the United States in the middle of this year. As the dollar continues to gain strength, America’s exports will likely be far out of reach for consumers in other countries. The slowdown could kill any chances of 3 percent GDP growth in 2015 or 2016, according to Gundlach.

Obviously, the reaction of institutional investors will have a dramatic impact on stock prices. The fact that the SPY ETF is already negative for the new year, while the 20+ year bond ETF has jumped nearly eight percent, should provide a significant hint that Jeffrey Gundlach is on the right track.

For investors interested in the bond market, popular bond ETFs include:

iShares 20+ Year Treasury Bond (TLT) which tracks the performance of the Barclays U.S. 20+ Year Treasury Bond Index.

iShares 7-10 Year Treasury Bond (IEF) which tracks the performance of the 7-10 year Treasury bond index.

For investors who are bearish bonds, inverse bond ETFs to consider are ProShares Short 20+ Year Treasury (TBF) and ProShares UltraShort 20+ Year Treasury Bond ETF (TBT) which are designed to move inversely to bond prices.

Global central banks have been calling the shots in financial markets for quite some time. They are now locked in a struggle against slowing global growth and deflation, and volatility and outsized moves in the bond markets are likely to continue in response to dramatic moves like those we’ve seen in recent weeks and months.

Disclosure: None