Boeing Is A Strong Buy

A) Introduction

With a growing backlog of orders and a stellar last quarter earnings release, Boeing Co. (NYSE:BA) is primed to outperform the market in 2015. Yet, on Tuesday, February 25th, Goldman Sachs downgraded it to a "sell" from a "hold" and lowered their price target from $146 to $132. This has resulted in Boeing falling from a high of $158 to a close of just under $151 on Friday. In our opinion, this dip in price offers an attractive entry point for the long-term investor. We don't believe the Goldman Sachs downgrade was warranted, and instead believe in the opinions of Sterne Agee and Stifel, both of whom have recently raised price targets on the stock.

While Boeing faces currency headwinds given its status as the biggest exporter in the US, the stock's combination of value, growth, and industry tailwinds sets it up for another big year in 2015. This report will start with a quantitative breakdown of Boeing's relative valuation, focusing on traditional measures of value that have been academically shown to have predictive ability. Next, we'll analyze Boeing's growth profile and analyze how the company has historically performed, relative to analyst expectations. Lastly, we'll conclude with a qualitative discussion of business risks and growth catalysts, before ending with our conclusions.

B) Valuation Breakdown

We take a quantitative approach to investing, preferring to focus our analysis on metrics that have strong predictive ability. Thus, we tend to analyze academic papers and perform historical back tests on different metrics before including them in our analysis. We will provide links to the academic papers we draw inspiration from as we progress through our breakdown of the stock, so investors can see for themselves what we base our conclusions on. We'll start by analyzing Boeing's value profile. This is important to look at, as Nobel laureate Eugene Fame found that,

Value stocks have higher average returns than growth stocks.

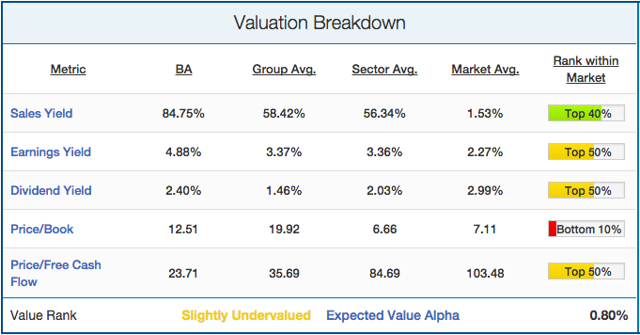

Boeing's valuation profile is shown below:

Source: Quanitified Alpha

Even after its incredible run the last few years, Boeing remains relatively undervalued. On a revenue basis, the company's sales yield (opposite of price/sales ratio) of 85% is significantly higher than both the Aerospace industry group (58%) and Industrials sector (56%) averages. This number means investors can get $0.85 of sales for every $1 they invest into the stock, which is solid value for a company growing both sales and EPS. The stock also looks attractive on an earnings basis with an earnings yield a shade under 5%. This is much better than the average Aerospace stock (3.4%), and is more than double the yield one could get from a ten-year US treasury. Similarly, the stock's price to free cash flow ratio of 23.7 is significantly below the Aerospace, Industrials, and overall market averages. While the company only pays out a 2.4% dividend, the company has over $12 billion in cash sitting on its balance sheet. It should be noted that Boeing does look expensive when looking at the stock from a book value basis, though that is largely a function of the strong earnings power of the stock. Overall, we rate Boeing as "Slightly Undervalued" and see this undervaluation helping the stock outperform the market over the next twelve months.

C) Growth Breakdown

There are a variety of different growth metrics that have been shown to predict stock returns. Most important among them is price momentum. Winning stocks keep winning, and losing stocks tend to keep losing. Boeing's growth profile is shown below:

Source: Quantified Alpha

On every metric provided above, Boeing looks very strong. The stock recovered from a slow 2014 by gaining 19% in the last six months, with the entirety of the run coming over the last month. As we will talk about later, Boeing's strong earnings report in late January was the catalyst for this run. Both its six- and twelve-month performance is within the top 30% of the entire market, cementing its status as a market leader. Part of this outperformance reflects the outperformance of the Aerospace industry group, which has returned just less than double the average of all stocks (5.38%) over the last six months. Boeing's management team is doing their job well, as evidenced by their outstanding return on equity (42%). Again, this partly reflects an overall industry group trend, with the average Aerospace stock returning 18.5% on equity. Boeing is also seeing moderately strong profit growth, with annual EPS growing 24% year-over-year. Overall, our platform ranks Boeing as a "Strong Growth" company and expects it to see significant outperformance over the S&P 500 (+4.4%) over the next twelve months because of it.

D) Earnings Breakdown

Trying to gauge future earnings releases is absolutely critical for investors that plan to hold onto their stock through earnings, as stock prices react very strongly depending on how earnings come out relative to analyst estimates. Echoing a sentiment shared by Zacks, one of the most important things in predicting whether a company will beat earnings estimates is the stocks' prior track record of earnings. Companies that have a track record of beating analyst expectations are statistically much more likely to beat estimates in the future. Boeing's track record of beating estimates is shown below:

Source: Quantified Alpha

Boeing crushed last quarter estimates, beating consensus EPS estimates by 12% and revenue estimates by 3%. As we said before, this was the catalyst to the stock's strong run over the last month. Boeing has strung together a streak of 12 straight EPS beats and now has beaten revenue estimates eight times out of the last ten quarters. For next quarter EPS, analysts are expecting $1.92. We rate the stock as "very likely" to beat these estimates and expect a very big upside surprise (+7.5%). Additionally, we expect a small beat on the consensus revenue estimate -$22.75 billion.

E) Qualitative Analysis and Conclusions

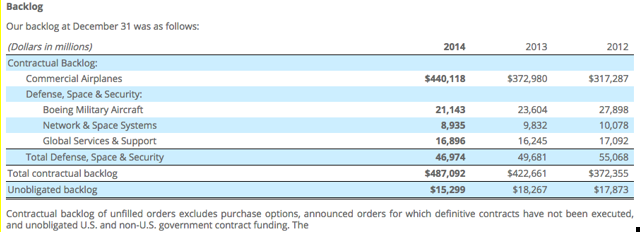

We'll now supplement our quantitative analysis with a qualitative discussion of some of the major growth catalysts and risk factors that could impact the stock price in the near future. As we mentioned at the start of the article, Boeing is currently nursing a huge backlog in its commercial airplanes segment (shown below).

(click to enlarge)

Commercial airplane backlog has now reached $440 billion, which is about 5 years worth of total sales. On top of that, backlog growth (18%) has outpaced the overall growth of revenues (5%). The company clearly has the demand capacity needed to continue ramping up production and keeping growth on track. It's also likely that this backlog will continue to grow, given the trends in air traffic and increasing demand for its 787 Dreamliner planes (which make up bulk of new orders). Boeing seems to have learned from its mistakes regarding the Dreamliner planes, as news of production problems regarding the plane have come to a standstill over the last few months. Rather, most reports coming out about Dreamliners nowadays are about how Boeing is in the process of "cranking up production". Production problems are still a potential downside threat to the stock, though less so than in the past. Instead, it's likely that Boeing will continue to ramp up production on the higher margin Dreamliner series and continue its run of crushing analyst earnings estimates.

Overall, we rate Boeing as a "Moderate Outperform" due to its attractive combination of value, growth, and momentum. Boeing is nursing a gigantic, growing backlog of commercial airplanes and has mostly resolved the production problems that hamstrung its growth before.

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in BA over the next 72 hours. The author wrote this article themselves, and it expresses their ...

more