Bob Shiller Drops Bombshell: "Wouldn't Be At All Surprised" If US Home Prices Started Falling

Nobel laureate Robert Shiller sat down with Bloomberg this week to discuss narrative economics, which is how a story or a series of related economic events can drive animal spirits in an economy. Shiller talks about the trade war, consumer spending, and even drops a bombshell of why he thinks the housing market could be entering a downturn.

Shiller warned that the surge in the recent recession fears, driven by economic narratives such as the trade war and inverted yield curves, could be just enough negativity in the news to weigh on the animal spirits of consumers.

He suggested that the American Dream of spending money you don't have to keep up with the Joneses could be at a pivotal point due to the economic narrative of a worldwide recession. Considering the economy is 75% or so consumer-driven, any pullback in spending would likely result in a much broader slowdown, especially with an already manufacturing and transportation recession festering behind tShiller's warning comes amidst emerging signs of a slowdown in the housing market.

Last week, home sales, mortgage apps, starts, permits, buying sentiment, and home prices all missed expectations.

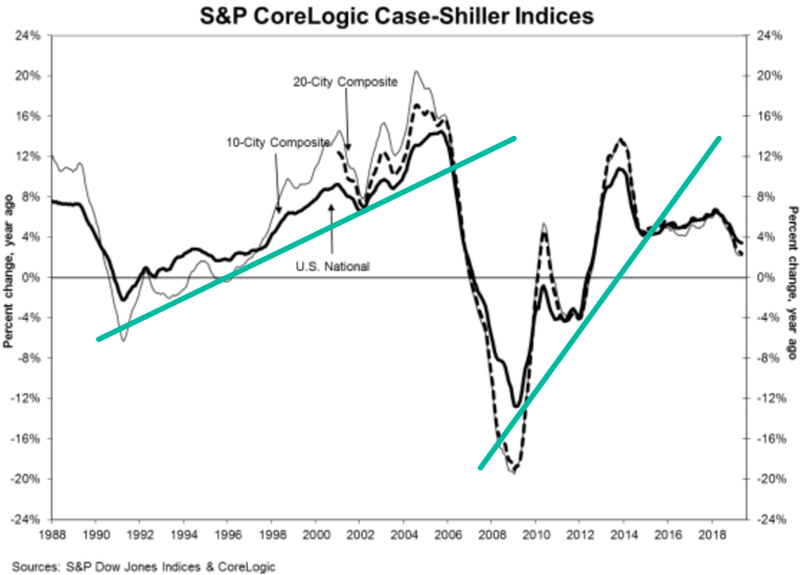

S&P CoreLogic (Case-Shiller) 20-City home price index rose just 0.11% MoM (half the expected 0.2% rise) and slowed to a 6.31% YoY gain - the weakest since Dec 2017.

And Shiller might be right about how the next housing bust could be imminent.

Nobel laureate Robert Shiller said he “wouldn’t be at all surprised” if U.S. house prices start to fall https://t.co/tqjfeGfo1l pic.twitter.com/mknbODH4Iq

— Bloomberg Economics (@economics) September 5, 2019

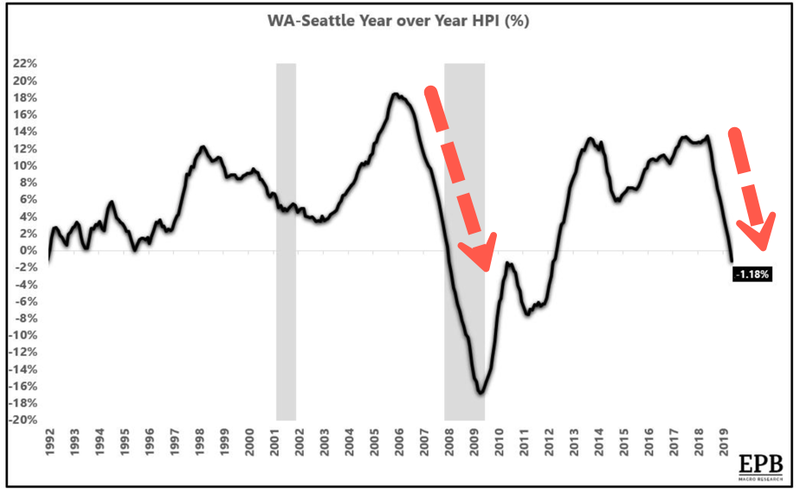

Around the 4:20 mark of the video, a Bloomberg anchor, asks Shiller if housing prices are due for a pullback. Shiller responds: "I wouldn't be surprised if home prices started falling, and it could be accompanied by a recession." Earlier last month, we reported the price of a Seattle single-family home in May fell 1.2% YoY, the first negative change in a major US city in this cycle.

Eric Basmajian, Founder of EPB Macro Research, said an industrial slowdown has moved into real estate and is now affecting some areas in services, has the potential to create "negative wealth effect," something that most Americans haven't seen since the last recession.

Basmajian warned if more cities experience negative home price growth YoY, like Seattle, this will undoubtedly put downward pressure on the domestic economy in the coming quarters.

As we warned previously, some scary housing market numbers were published over the past few weeks, or as Shiller told Bloomberg, "This could be the very beginning of a turning point."

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more