Blistering 2Y Auction Sees Surge In Foreign Demand Despite Sliding Yield

Following several poor auctions, especially among the shorter-maturity tenors, to start the year moments ago the US Treasury sold $40BN in 2 year paper in what may have been the strongest auction in the past year.

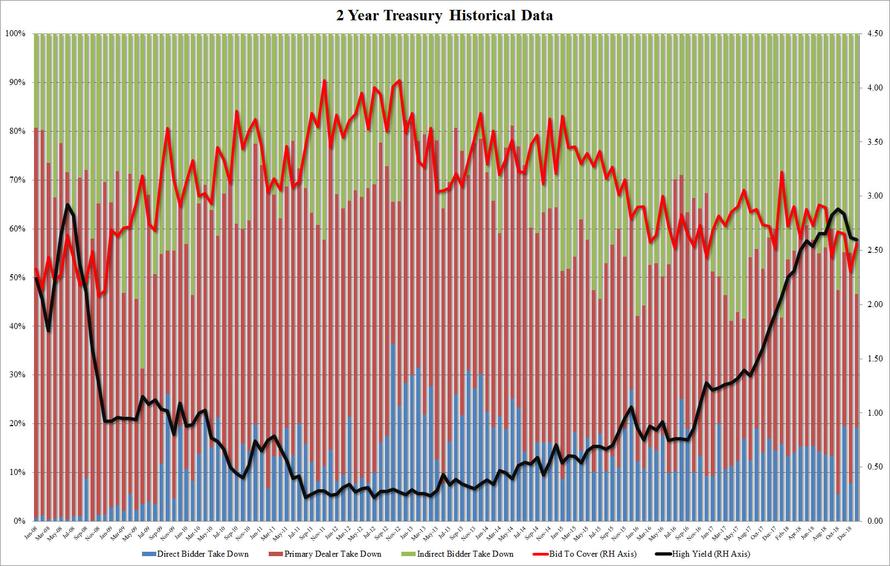

The high yield of 2.600% stopped through the When Issued 2.606% and was the lowest yield since June 2018.

The internals posted a sharp improvement from the December auction, with the bid to cover jumping from 2.307 to 2.564, if fractionally below the 6 auction average of 2.65.

But it was the surge in the buyside that was the most remarkable observation, with the Indirect takedown rising sharply from 45.0% to 53.4%, the highest since January 2018, and Directs more than doubling from 7.9% to 19.1%, leaving Dealers holding only 27.50% of the auction, far below the 42.4% recent average, and the lowest going back to July 2017.

Overall, today's auction was a dramatic improvement in demand, especially foreign, for short-term paper, and perhaps the latest confirmation that the market is increasingly convinced that no more rate hikes are coming down from the Fed for the foreseeable future.

(Click on image to enlarge)