Blind Spots

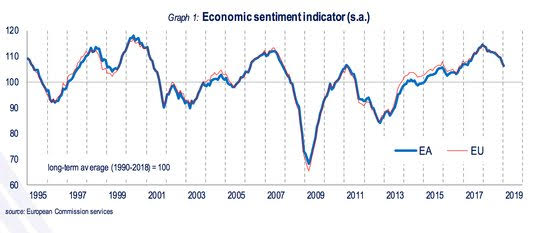

We all have blind spots, things that we can’t see, but know maybe set to derail out best laid plans. Today brought so much economic data that the world of investors are likely to ignore it all despite the surprises of better French GDP, better Japan retail sales, better German confidence. There was plenty of weaker stories to offset all this – with the EU Commission Economic Sentiment clearly hitting home the idea that Europe is suffering a significant slowdown. The FOMC decision today tops the focus for investors but plenty of other economic and political headlines make clear that trading in this environment has more blind spots than clear vision. Let’s start with the non-economic news flows:

- UK Brexit votes yesterday drives GBP lower now flat. What changed with the amendments? – most analysts suggest nothing. The risk for a no-deal exit from the EU remains in play (Goldman lifts the odds from 10% to 15%), hope for EU talks on the Irish border issue seems misplaced.

- Japan Cabinet sees fiscal surplus in 2026. This is better than the 2027 from last year, and part of the forecasts released today with 1.3% GDP for FY2019 – even with the VAT tax plans intact. The budget of $900bn is a new record high. Also markets worried about the new 10-day Golden Week announcement April 27-May 6 will be the longest break ever for shares and bonds as they celebrate Crown Prince Naruhito becoming emperor. Closing a market for nearly 2 weeks puts bonds and stock liquidity at risk.

- US/China talks restart today with CNY bid - The hope for talks on trade leading to a deal drives the CNY to 6-month highs today even as Huawei CFO extradition requests typify the intellectual property problem

- Apple earnings provided global relief for equities with MSCI all-country World up 0.1%. The firm didn’t report further bad news after its revenue warning linked to US/China trade fears hit markets earlier this month. CEO Cook noted US/China trade tensions have eased.

- Turkey central bank vows to keep “right” policy. The central bank governor Cetinkaya said that inflation was expected to be 14.6% at the end of 2019, a figure revised down from the previous forecast of 15.2%. He cited lower global oil prices, weaker domestic demand and the stronger currency after last year’s meltdown in the lira for the downward revision.

With all of the focus on GBP and the US/China trade has left the FOMC a bit of a window to do little and wait for more data and geopolitical news. Whether that patience is supported by the market now matters to the USD. Many are more bullish the EUR but struggle to see the ECB or growth there driving it more than old-fashioned equity and bond buying flows driving it. The CNY move to key 6.71-6.73 support is another factor and the link to China growth continues to dominate. So the focus today is likely on how the USD handles the Fed doing nothing with all the blind spots at play about growth, confidence and the rest of the world.

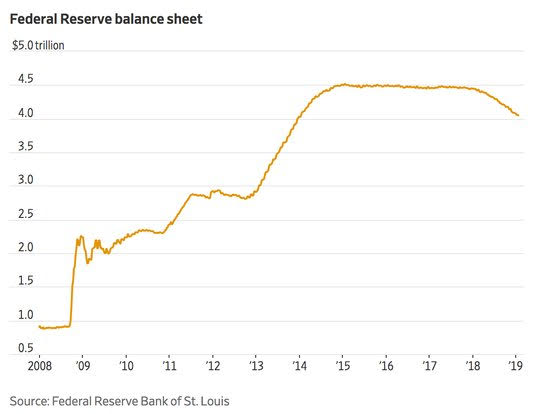

Question for the Day: Is the FOMC today all about the balance sheet? Expectations are for the FOMC meeting today to leave rate policy unchanged, to have a statement that is lightly changed to show financial conditions are tighter and a Powell press conference where the Chair offers some clarification on the balance sheet. The issue of just how many bonds and what duration the central bank holds of debt matters despite the best hopes of the Fed to put this “normalization” on autopilot. The rising risk in the market is that US bond yields go up not done. If we aren’t going into a recession fast, then the massive government spending and debt will squeeze on corporations and lift the level of yields. The 2.55% bottom seems to be in place unless we get some seriously bad economic news. The FOMC will need to talk about the balance sheet and how it sees the process moving forward as this will be the curve trigger and focus for many today.

What Happened?

- Japan December retail sales rise 0.9% m/m, 1.3% y/y after -1.1% m/m, +1.4% y/y – better than 0.8% y/y expected. Clothing rose 4.1% and appliances 4.4% y/y leading the spending. November sales were revised lower from -0.8% m/m.

- Japan January consumer confidence fell to 41.9 from 42.7 – weaker than the 42.5 expected. All four components fell with a livelihood -0.5 to 40.1, income down 0.3 to 41.4, employment -1.5 to 44.3 and willingness to buy -1.1 to 41.7.

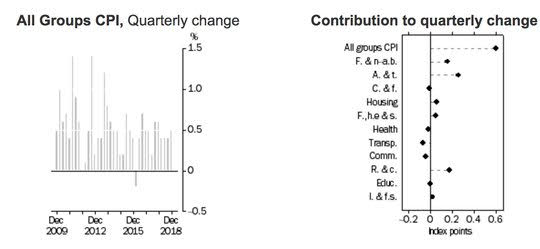

- Australia 4Q CPI up 0.5% q/q, 1.8% y/y after 0.4% q/q, 1.9% y/y – more than the 0.4% q/q, 1.7% y/y expected. The RBA trimmed mean CPI was unchanged at 1.8% y/y while the weighted mean CPI was also unchanged at 1.7% y/y.

- German February GfK consumer confidence seen bouncing to 10.8 from revised 10.5 – better than the 10.3 expected and after January revised higher from 10.4. The GfK forecasts consumption rising 1.5% for 2019 now. Income expectations and propensity to buy have once more exceeded their already high level. Conversely, general prospects of economic growth were assessed less optimistically for the fourth time in a row.

- German December import prices -1.3% m/m, +1.6% y/y after -1% m/m, 3.1% y/y – less than the -0.8% m/m, 2.1% y/y expected. The import prices ex energy -0.4% mm, +1.8% y/y.

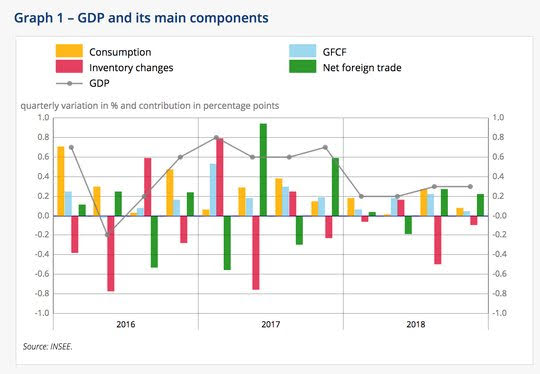

- French 4Q preliminary GDP up 0.3% q/q same as 3Q – better than 0.2% q/q expected. Household Consumption fell to 0% from 0.4% q/q, business capital formation slowed to 0.2% from 1.0% q/q bringing overall final domestic demand ex inventories 0.1% after 0.5% in 3Q. Trade added 0.2pp after 0.3pp in 3Q while inventories -0.1pp after -0.5pp.

- French December household consumption -1.5% m/m after revised -0.1% m/m – worse than the -0.2% expected. November revised higher from -0.3%. This downturn was mainly due to a sharp drop in energy consumption (−4.3%) and purchases of manufactured goods (−1.9%).

- French December PPI -1% m/m, 1.2% y/y after +0.2% m/m – worse than the -0.3% m/m expected. This was the first monthly drop since May.

- Spanish December retail sales -0.6% m/m, 0.8% y/y after revised 0.3% m/m. 1.1% y/y – weaker than the +0.3% m/m, 2.1% y/y expected – November revised lower from 0.4% m/m, 1.4% y/y.

- Sweden January consumer confidence drops to 92 from 96.1 – worse than the 96 expected. All of the questions except for personal finances over the past year contributed to the fall. Consumers are particularly pessimistic about the outlook for the Swedish economy over the next 12 months. The business confidence also lower 100.3 from revised 103.4 – weaker than the 103.6 expected. The consumer CPI expectations were unchanged at 3.4%.

- Italy January business confidence 102.1 from 103.4 – worse than the 103 expected – however, the consumer confidence rose to 114 from 113.2 – better than the 112.5 expected. All the components bettered: the economic one from 129.5 to 130.8, the personal one from 107.0 to 108.9, the current one from 110.0 to 112.4 and, finally, the future one from 116.1 to 117.4.

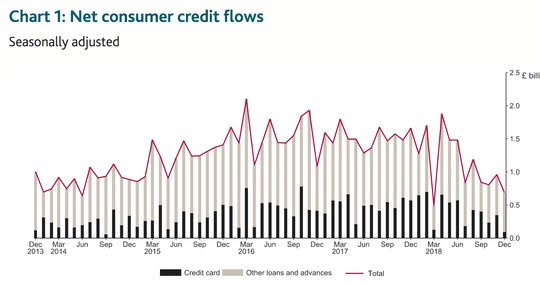

- UK December BOE mortgage approvals slow to 63,790 after 63,950 – still better than the 63,000 expected. Overall, consumer credit slowed to GBP687mn after GBP958mn – less than the GBP800mn expected – slowest rate since 2014.

- Eurozone January economic sentiment 106.2 from 107.4 – weaker than the 106.7 expected. The business confidence fell to 0.69 from 0.82 – also weaker than 0.73 expected – 2-year lows. By sector – consumer confidence -7.9 after -8.3; industry 0.5 from 2.3, services 11 from 12.2, retail -0.6 from 0.2 and construction 5.3 from 5.1.

Market Recap:

Equities: The US S&P500 futures are up 0.4% after 2-days of losses (yesterday off 0.15%) with focus on Apple earnings after the close driving. The Stoxx Europe 600 is up 0.3% with a focus on US trade talks. The MSCI Asia Pacific fell 0.21% with mixed session.

- Japan Nikkei off 0.52% to 20,556.54

- Korea Kospi up 1.05% to 2,206.20

- Hong Kong Hang Seng up 0.40% to 27,642.85

- China Shanghai Composite off 0.72% to 2,575.58

- Australia ASX up 0.20% to 5,951.20

- India NSE50 flat at 10,651.80

- UK FTSE so far up 1.55% to 6,941

- German DAX so far off 0.3% to 11,186

- French CAC40 so far up 0.6% to 4,958

- Italian FTSE so far up 0.2% to 19,741

Fixed Income: Better equities in Europe, more supply from Germany and Italy – more doubts about growth and confidence – this puts the bond market in consolidation mode – German 10-year Bund yields up 1bps to 0.19%, France OATs flat at 0.61%, UK Gilts off 1bps to 1.26% while periphery mixed with Spain up 2bps to 1.26%, Portugal flat at 1.68%, Greece off 5bps to 3.94% with 5Y issue key. Italy off 2bps to 2.61%.

- Germany sold E3bn of 10Y Bunds at 0.2% after 0.29%

- Italy sold 5Y BTPs at 1.49% down from 1.79% previously - and 10Y BTP at 2.6% from 2.7%.

- US Bonds are lower with curve steeper waiting for Fed and more supply – 2Y up 1bps to 2.58%, 5Y up 1bps to 2.56%, 10 up 1bps to 2.72%, 30Y flat at 3.05%.

- Japan JGBs stuck with Abe budget and forecasts – 2Y flat at -0.16%, 5Y flat at -0.15%, 10Y flat at 0.01%, 30Y up 1bps to 0.66%.

- Australian bonds lower on higher CPI – 3Y up 4bps to 1.77%, 10Y up 1bps to 2.25% - risk for Nov hike back in play.

- China bonds continue bid – 2Y up 4bps to 2.72% but 3Y now inverts down 3bps to 2.71%, 5Y off 3bps to 2.93% and 10Y of 1bps to 3.14%.

Foreign Exchange: The US dollar index is flat at 95.80. In EM, Asia – KRW up 0.8% to 1116.70, INR up 0.3% to 71.16 while ZAR off 0.1% to 13.535 and RUB up 0.1% to 65.93.

- EUR: 1.1435 flat. Range 1.1422-1.1450 with risk for 1.1380 or 1.1520 high around the FOMC and likely watching US/China trade talk headlines. German CPI key as well – as expected at 1.7% means ECB can do nothing.

- JPY: 109.45 up 0.1%. Range 109.21-109.45 with EUR/JPY 125.10 up 0.1%. Mixed result with 110 still key, watching rates and equities.

- GBP: 1.3095 up 0.1%. Range 1.3060-1.3122 with EUR/GBP .8735 off 0.1%. The Brexit stalemate continues and the 1.3050-1.3250 range consolidation appears nearing the end.

- AUD: .7195 up 0.6%. Range .7150-.7204 with CPI the driver and RBA expected to be on hold still but some risks for 4Q rising - NZD .6835 up 0.1%.

- CAD: 1.3225 off 0.3%. Range 1.3218-1.3282 with commodities and China hopes key.

- CHF: .9970 up 0.3%. Range .9940-.9974 with EUR/CHF 1.1405 up 0.3%. SNB squeeze pla with 1.00 key pivot for USD.

- CNY: 6.7170 off 0.3%. Range 6.7030-6.7280 – talk hopes, more stimulus talk, investment push – 6.70 next key.

Commodities: Oil up, Gold up, Copper up 1.2% to $2.7435

- Oil: $53.81 up 0.95%. Range $53.09-$54.00 with Oil holding bid tracking equities and focused on Fed and US trade talks. API reported 2.098mb crude oil inventory rise after previous week rise revised to 6.55mb. Focus is on $55 WTI. Brent $61.90 up 0.95% with $62 pivot for $64 test.

- Gold: $1318.80 up 0.75%. Range $1315.50-$1320.80 with break of $1310 base now for $1340 next – watching USD and FOMC. Silver up 0.6% to $15.94 with $16 next block. Platinum up 0.5% to $820.30 and Palladium off 0.25% to $1300.30.

Conclusions: Will consumer confidence matter to the FOMC? The notable drop in US consumer moods for the US can be blamed on weather, US government shutdown politics, rest of the world issues or it can be part of a larger cyclical turn. How the Fed looks at such indicators today will be another factor to consider. The Conference Board release yesterday should be a cautionary tale for those jumping in hoping for 2Q significant growth bounces.

Economic Calendar:

- 0815 am US Jan ADP employment change 271k p 175k e

- 1000 am US Dec pending home sales (m/m) -0.7%p +0.5%e

- 1030 am US weekly EIA oil inventories 7.97mb p 2mb e

- 0200 pm US FOMC rate decision – no change from 2.5% expected.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.