Biotech Year One: A Year Of Trials Tribulations And Discovery

This was our first year investing in the biotech sector. We had no idea how companies would respond to news, positive or negative. We had no idea what the market understood and how it interpreted data. We had no idea.

The market is its own beast, derived of the aggregate opinions and knowledge of the mainstream thought. And despite incredible advancements, the mainstream’s understanding of biology, physics, and biotechnology remains rooted in early 20th century ideology that has long been disproved.

We understand it is a bold statement to say the vast majority of PhDs, MDs and investors that make up this industry are wrong due to a fundamental flaw in their analysis, but after a year of investing in this space, we have been convinced of this simple yet powerful truth.

Even in the 21st century, with the amount of computing power and algorithms and modern tools available to companies, researchers and analysts, pharmaceutical development remains a trial and error based process. This is because they do not understand biology and physics’ role in biology. Anyone who has done a bit of research into quantum computing will also realize how poor our understanding of physics truly is but that’s a story for another time.

The point is that this trial and error approach and the mental models that support it have far reaching consequences to how biotechnology developments are interpreted by the market.

The market has incredible difficulty trusting new data that does not fit into these preconceived mental models. And because those models are so poor and so fuzzy even reasonably well understood trial results have to be proven again and again over larger patient populations.

The mainstream believes life is dumb and random, that cells are a liquid soup of biochemicals and seawater governed by nothing more than chance encounters driven by Brownian motion.This is no more evident in the hubristic subsector of gene therapy. These trial and error gurus believe it is life that has made the mistake that only they can correct. When in fact life (and in this case our bodies) are responding to environmental conditions. We hold the exact opposite view of the mainstream; we believe that life is intelligent and coherent down to the cellular level or as we like to say:

“Life does not play dice.”

Life uses natural genetic engineering, a complicated and remarkably intelligent system that far surpasses our artificial means of doing, in order to adapt to changing conditions of existence. Natural genetic engineering is specifically activated, targeted, and precisely executed. Living systems are quantum coherent and therefore “know” more information about themselves than we are capable of knowing through outside measurement.Artificial genetic modification invariably interferes with natural genetic modification. In fact, it depends on disrupting and overriding the cell’s own precisely regulated natural genetic modification, which explains its total lack of precision, with many uncontrollable and unpredictable effects.

We believe our edge in understanding biological processes and how it translates into biotechnology developments is peerless. But as it turned out, our sharpest sword was double edged. We could accurately predict trial results in our chosen companies but we could not predict how the market would respond. As if some sort of sick irony, our best results were the least rewarded and often penalized while our worst results (although still positive) were rewarded beyond our wildest expectations.

“To fight the bug, we must understand the bug.”

~Sky Marshal Tahat Meru

This has required us to go back to the drawing board in how we approach investing in this space. It is not enough to identify mispricings in the market. It is not enough to understand with near 100% conviction which drugs are breakthroughs, and which aren’t. The market might be stupid, but it is also right and must be respected. We cannot disagree with price and we must adapt to the market if we are to increase our returns over the long run.

At the start of the year we based position sizing primarily around 2 major factors:

- The price of the drug relative to its long-term value

- The timing of the next news release.

We naively believed that once the results were in, it would be “obvious” to the market that certain drugs offered breakthrough potential. Boy, were we wrong.

“Any sufficiently advanced technology is indistinguishable from magic.”

~Arthur C. Clarke

Breakthroughs by their very nature are without precedent. And without a precedent the analysts, the company executives, and the market in totality are unable and incapable of accurately pricing in such information.

In our view, the market has a binary, linear, and overall simplistic approach to trial results ignoring the context in which each trial is conducted. Either the drug works, or it doesn’t. If the drug was believed to have “failed” once, it’s more likely to be seen as a failure going forward. If the drug does not show promise at the interim results, the final results are more likely to be discarded despite any promise.

What this means is that in lieu of just sitting in our favorite drug companies and waiting some five to ten years for them to pay off, we have to incorporate the limitations of the market into our process.

“And so, without further gilding the lily and no more ado…”

~Jeffery Chaucer, A Knight’s Tale

Biotech Overview:

Back in October,we auspiciously called the the top in biotech back in October with the blog post titled “Biotech is not a Bubble“.

Oops.

But we also identified a few long term structural trends that suggested the bull market in biotech was just beginning.

- China, the largest growing market for pharmaceuticals has begun and continued to open up itself to foreign pharmaceutical companies.

- The world in particular the emerging world is getting richer and will be able to afford more pharmaceutical drugs.

- Populations due to pollution and poor lifestyles are getting sicker.

- Innovation drives renewed sentiment – Drug development over the last 50 years has largely been stagnant, that too is changing and will drastically improve sentiment.

Unsurprisingly none of these trends have diminished over the past 2 months. Price may have changed but the structural trends remain firmly in place. The world is getting wealthier and sicker at the sametime. Or said another way, our ability to afford the drugs we increasingly need is also increasing. China has continued its drive towards reforming its pharmaceutical market. The US remains the bastion of pharmaceutical development making biotech potentially one of the best short USD trades over the next 5-10 years.

And yet sentiment towards the space is incredibly negative. Despite XBI and IBB being up ~40% and 25% respectively inflows turned negative for the year.

For the week ended Dec 20, biotech had net outflows of $252M. We have turned negative for the year to -$59M!

— Brad Loncar (@bradloncar) December 22, 2017

$1.8B in total outflows so far in the fourth quarter. (Raymond James) pic.twitter.com/aeinGk0b3Q

Despite the solid returns in 2017, biotech remains historically cheap to the broader market.

Going into 2018 #Biotech is either a value trap or undervalued opportunity. S&P Biotech P-E relative to S&P P-E is near the trough readings in 1994, 1997, 2009 & 2016 $IBB $SPY @NextEdgeCapital @bradloncar pic.twitter.com/JeKU9OL4T4

— Eden (@EdenRahim) December 5, 2017

The low vol, ever rising broader equity markets might be partly to blame. High vol biotech equities remain a difficult place for investors to allocate capital when every equity market around the globe rises in lockstep to the tune of record low and falling volatility.

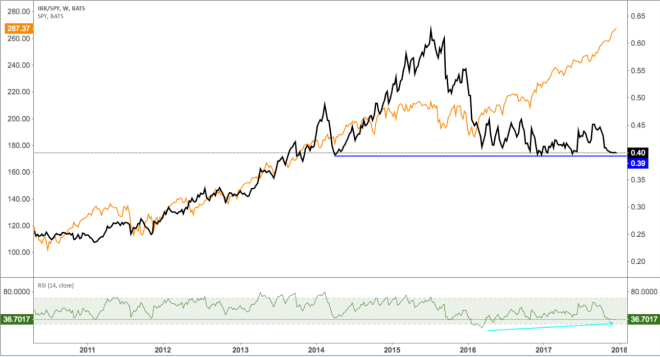

Perhaps it is not a coincidence that biotech’s best period relative to the broader market came after the broader market had stagnated (from late 2014 to mid 2015) and appeared to have topped out. SPY (orange line, LHS), IBB/SPY(black line, RHS).

We note that the previous 3 times biotech has been this cheap to the broader market marked a buying opportunity.

XPH, SPDR’s S&P Pharmaceutical ETF has lagged the XBI, and IBB, but may be key to showing renewed sentiment towards the space. These large cap pharma companies have struggled since Q1 2016 but we believe that may finally be changing.

We attribute a lot of the sideways chop to the growing divide between the winners and losers in this space. The FDA has approved drugs at a record rate this year which has gone a long way to increasing competition in the space.

‘ @SGottliebFDA, continuing efforts to promote competition in pharma, is perhaps the highest performing appointee of this administration. https://t.co/mEDbRn3geq

— John Arnold (@JohnArnoldFndtn) November 6, 2017

#FDA approves La Jolla’s low blood pressure drug, Giapreza. This is the 46th drug to get FDA approval this year, setting a new record for the last decade. More info via @JohnCendpts & @endpts https://t.co/MroiD4OGBs

— The Weinberg Group (@weinberggroup) December 22, 2017

This increased competition from new drugs has put a burden on the incumbent drug makers who have gotten fat off annual price hikes and patent trolling. TEVA’s generic drug business model has been decimated.

AGN appears to be having similar problems with its generic drug business.

While names like JNJ are probing new highs.

Some medium size names have taken some heavy licks but appear to have bottomed or in the process of bottoming. MYL.

Biogen, Merck, Incyte, Pfizer and BMY are other possible examples.

In our view, we’ve seen a good amount of creative destruction in the space. The initial damage has been done to some of the weaker components of the sector. The stronger ones have continued to thrive, and the middle of the pact may have already suffered the worst.Thus we could see some more consolidation but believe that with the benefit of tax cuts and time the trend should be higher from here. After all, it’s not like our population is getting younger or healthier.

Disclaimer: My blog is the diary of a twenty something hedge fund manager who has never stepped foot inside a wall street bank. I have not taken an economic or business course since high school ...

more