Better From Bulls - Shorts Failing To Apply Pressure

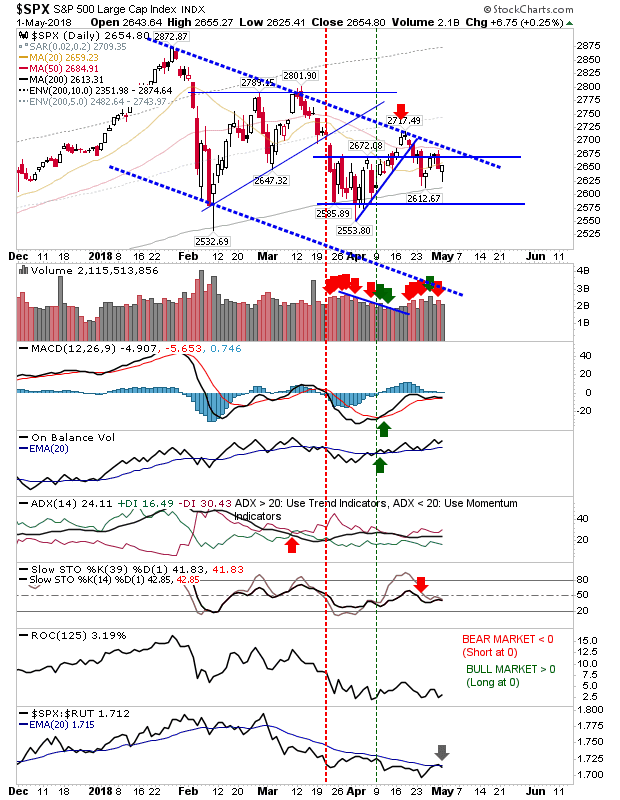

Since the breakdown in wedge support it had looked easier for bears to push indices down to 200-day MAs or lower channel support but action over the last week with two bullish hammers suggests longs may have a launch pad to work with.

The S&P is offering a nice setup with the 'bullish hammers' just above the 200-day MAs. The only disappointment was the 'sell' signal in relative performance in the Russell 2000.

The Dow Jones posted a doji which tagged the tweezer low - and nearly the 200-day MA - while maintaining a close price above the downward channel. This continues to offer itself as a good bullish setup despite weak technicals and an even sharper drop in relative performance (vs the Nasdaq 100).

The Russell 2000 created a solid 'bullish hammer' but it also came with weak technicals and a downturn in relative performance. Price action remains key and if the Russell 2000 can post a gain tomorrow it will set up an opportunity to challenge triangle resistance.

The Nasdaq remains closest to declining resistance and unlike other indices it enjoyed an uptick in relative performance. The bearish 'black candlestick' has still to be challenged (and negated) but a break of declining resistance should be enough to do so.

The weakest index - Semiconductors - found support at the 200-day MA although it remained below rising trendline support. It still has work to do to recover support but today offered a sound basis for this.

The prior short setups, while not negated, don't look like they are going to deliver. Longs have the edge in the short term (< 3 weeks). Beyond that, larger trading ranges are still in play and a new trend has yet to emerge.