Because It Filled The LVN Area - E-Mini S&P 500 VWAP Update (ESM0)

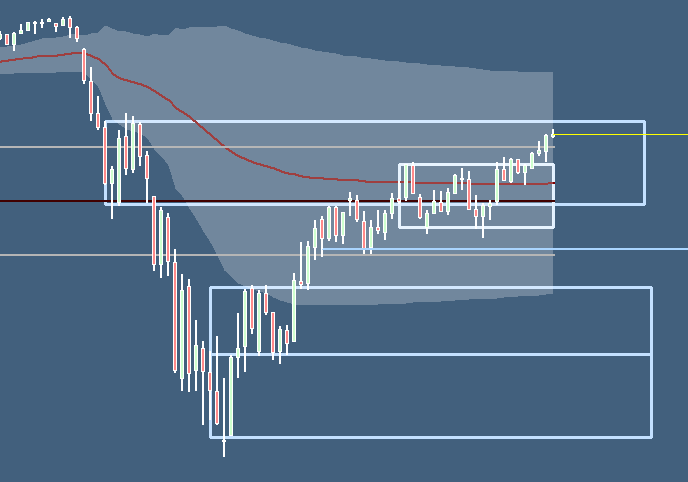

Looking at the ESM0 with the weekly VWAP on our hourly periodicity we can observe the mentioned pullback to fill the LVN area of the current week's volume profile followed by a supportive surge to higher areas which should be seen as a "repair" of the previous drop. Currently, we can see an upside to the flat slope of the weekly developing value (VWAP). This week's volume profile seems to be quite balanced, therefore we can lean us on the balance extremes to conclude a possible pullback again. For now, we looking to spot bearish patterns followed by possible support around DVAH, DVWAP, or DVAL. Area of interest should be the DVAL which is confluent with the intraday's VAL close level.

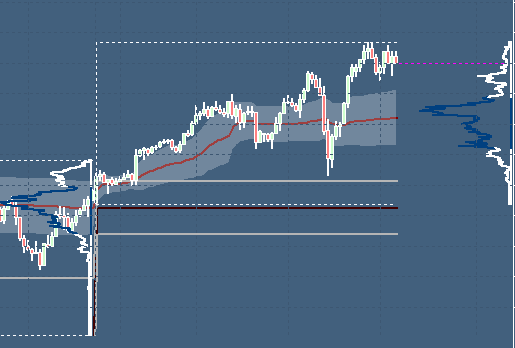

With a quick glance at the daily perspective, we can observe the break above the Year's VAH close level which could lead the market to the next bracket high. However, with a close look, we can identify yesterday as an outside bar which is a first of a possible change in the current overall market context (from bullish trending to balanced or bearish). Let's see how the market will develop over the next hours.

Visit our trading community to learn a more indepth analysis process with various tools such as the VWAP or Footprint chart.

Disclosure: ...

more