Bears - Most Since 2013

Bears - Mom & Pop Investors Are Nervous

Investor sentiment is terrible. That's a good indicator stocks will do well in the intermediate term unless the fundamentals crater.

About 50% of retail investors think the stock market will be lower in the next 6 months. Even though some bears claim investors are always buying the dip because they have been trained to do so in this bull market, retail investors are actually nervous.

Bears don’t want retail investors to be nervous because that’s a bullish indicator. The reading of retail investors expecting a decline in the next 6 months is the highest since April 11th, 2013.

Bears - Last time sentiment was this suppressed, the market rallied 16% into the end of the year.

As you can see from the chart below, the AAII survey shows 20.9% of investors are bullish and 48.9% are bearish. The percentage of bulls is above the 2016 low, but the percentage of bears is the highest since 2013.

Investors are panicking about a recession even though there isn’t one coming in the next 6 months. This makes some believe there could be a final rally in this bull market.

Personally, I’m much more confident that there won’t be a recession in the next 6 months, than I am that there will be a recession in 2020.

If there is a recession in the next 1-2 years, it will be the most anticipated recession ever.

However, just because everyone is following the yield curve flattening doesn’t mean it won’t be correct. An inversion may encourage a recession. Investors will sell, and banks will tighten their lending standards.

(Click on image to enlarge)

Bears - Core Inflation Increases

Many investors been excited about the November CPI report ever since oil cratered. We knew it would be great for real wage growth which will help retail sales this holiday shopping season.

However, in terms of Fed policy, this report didn’t change anything because core CPI was strong. Let’s get into the details.

Month over month headline CPI was flat which met expectations and was down from 0.3% growth in October. Year over year headline inflation was 2.2% which met estimates and was down from 2.5% in October.

Energy and gasoline prices fell 2.2% and 4.2% monthly. Energy prices might rebound early next year because global inventory has shifted from a huge glut to a slight shortage.

The strength of inflation depends on how you look at it. Headline inflation fell, but that’s on a strong dollar and collapse in oil prices.

As you can see in the chart below, year over year median CPI was near the cycle high in the summer. It is also closing in on the peaks in the last 2 cycles.

Bears - Core inflation was strong, but a weak comparison helped it.

Specifically, core inflation was 0.2% month over month which met estimates and October’s growth rate. Year over year CPI without energy and food was 2.2% which met estimates and was above October’s growth of 2.1%.

Because of the weaker comparison, the 2 year core CPI stack was only up 3 basis points from last month. The comparisons will get tougher every month for the next 8 months. I wouldn’t be surprised to see core CPI fall below 2% in the next 6 months.

Apparel, transportation, and education/communications prices were down 0.9%, 0.8%, and 0.5% monthly. Housing and medical care were up 0.3% and 0.4%.

As you can see from the pie chart, housing and medical care combine to be slightly over half of headline CPI. They are an even larger portion of core CPI. I have been expecting shelter inflation to moderate because of the weak housing market. But housing was still strong enough to drive core CPI higher.

If the housing market continues to weaken, we should see core CPI fall in the next few months.

Bears - The Fed’s Problem

Core CPI of 2.2% doesn’t seem like much because it will likely fall if the housing market is weak. However, it supports the Fed’s rate hikes this year, and hawkish guidance as of September.

It counters the volatility in the stock market and the flattening of the yield curve. Also it is pushing the Fed to hike rates in December and possibly hike them multiple times in 2019.

I think the Fed’s hikes this year still haven’t had their full effect on core inflation. However, the Fed might disagree that it has done enough and hike further next year.

Powell has stated that he doesn’t care as much about the yield curve as he does about where the Fed funds rate is in relation to the neutral rate. For example, if the yield curve were to fully invert this week, he would still want to hike rates because the Fed funds rate is below all the FOMC members’ estimates for the neutral rate.

One more hike would put us at the low end of the estimates for the neutral rate. Some FOMC members with high estimates will need to take those down if the economy starts to weaken more in 2019.

Bears - Labor Market Not Full

It’s in the Fed’s DNA to hike rates when the labor market is at full employment.

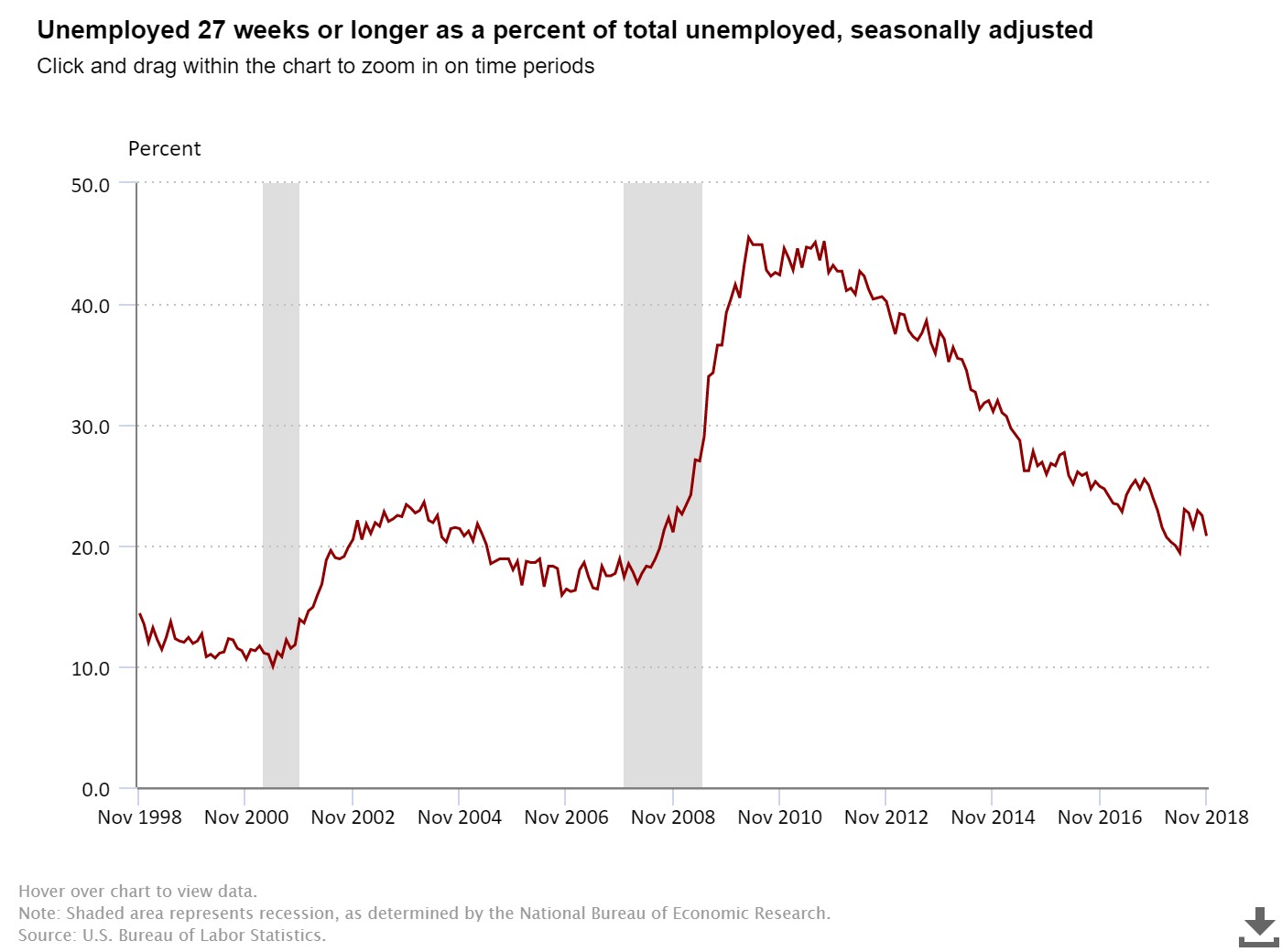

The chart below goes against their stance to hike rates if you assume the Fed needs to hike when there’s little slack in the labor market.

As you can see, 20.8% of unemployed workers have been unemployed for 27 weeks or longer. That’s above the previous cycles’ troughs which were 15.9% in October 2006 and 10.0% in May 2001 (during the 2001 recession).

This rate has over one year to fall before it signals the labor market is completely full.

(Click on image to enlarge)

Bears - Conclusion

Investors are starting to get nervous, especially retail traders.

Usually, it’s good time to buy when that occurs.

There won’t be a recession in the next 6 months. However, the Fed is about to invert the yield curve which means a recession is likely in about 1.5 years. Is this selloff the market pricing in a recession very early?

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more

I think the selloff has more to do with the concerns over trade wars and the global economy more than the Fed's actions. This is just that, a selloff at this point, not a bear market as many are hinting at.