Bank Of Nova Scotia Is A Strong Buy At These Prices

Introduction

The Bank of Nova Scotia (NYSE:BNS), also known as Scotiabank, is trading near its 52-week low today, nearly 27% below its 52-week high. The stock is undervalued, and is a good opportunity for any long-term investor who favors dividends. While we don't see the stock as a huge growth opportunity, the historical stability of the dividend payout and the highly regulated Canadian bank environment make it a less risky investment. We feel that the price is being weighed down by a number of fears that are overblown over the long term. These overblown fears include the anticipated imminent burst of the Canadian "housing bubble", the effect of lower oil prices on the bank's books, and finally, its exposure to the falling euro due to its presence in Europe. The strongest bear argument that we've heard is the relative weakening of the $CDN. However, we are not in the business of speculating on currency fluctuations, and advise any investors to do their own research in this matter when considering buying shares in international companies.

We will begin by breaking down the company's relative value, then we'll analyze its "smart money" profile, and will conclude with a qualitative discussion of potential catalysts and risks. We should note here that we base our quantitative analysis purely off of academic research, thus restricting our analysis to metrics that have been empirically shown to predict stock returns. For a detailed breakdown of prominent academics and the insights revealed from their research, click here.

Valuation Breakdown

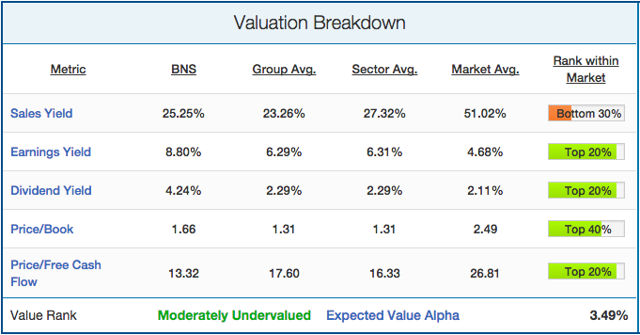

We start with a breakdown of relative valuation, as valuation metrics have been repeatedly shown to be some of the best predictive indicators. There is a reason that most of the best investors tend to be value investors. Over the long term, cheap stocks beat expensive stocks. The following breakdown shows Scotiabank's valuation profile, looking at five traditional value metrics that have strong predictive ability:

(click to enlarge)

(Source)

As mentioned before, the real draw with BNS is the consistency with which its dividends have grown. The dividend has grown each of the last 10 years (other than 2010, where it stayed flat), and has grown by an average of 6.2% over the last 5 years. In fact, Scotiabank just announced another 3% increase to its quarterly dividend to $CAD 0.68/share on March 2, 2015. At over 4.20%, BNS is well above the average dividend yield of the commercial banks group, the financials sector, and the market averages. It is also trading at a much higher earnings yield (lower P/E ratio) than it has traditionally - at 8.80% it's well above its five-year average of 8.13% (P/E of 11.36 vs. 12.3, respectively). While its price/book ratio is slightly higher than its group and sector averages at 1.66, the stock is still relatively cheap compared to where it was at the end of the previous quarter (1.9 P/B). It's also important to note that though Scotiabank missed earnings estimates the last two quarters, its EPS did grow from Q12014 to Q12015.

Smart Money Breakdown

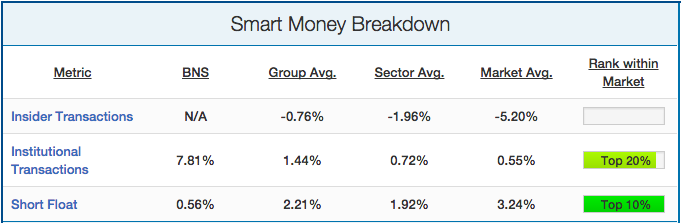

In addition to value and momentum, we will also analyze how the "smart money" on the Street is playing Scotiabank. "Smart money" stakeholders are short sellers, company insiders, and institutions. Each of these stakeholders tends to be much more sophisticated than the average investor due to their inherent advantages. Company insiders know the company inside out, while institutions and short sellers spend millions of dollars on research. We have found loads of academic research showing that short sellers, company insiders, and institutions all predict stock returns. BNS' "smart money" breakdown is shown below:

(click to enlarge)

With institutional ownership growing its stake in BNS by 7.81% in the last three months, versus a market average of only 0.55%, it's clear that now may be a good time to get on board. Another good sign of now being a good time to buy is the fact that the short float is only 0.56%, meaning the market is not anticipating a further decrease in price.

Qualitative Analysis

Firstly, it's important to note that BNS is widely regarded as the most globally diversified of the Canadian banks. This makes it more exposed to international issues, such as the fall of the euro and the underperformance of Latin American economies. However, the counter-argument is that it leaves the bank less exposed to domestic issues, such as the Canadian "housing bubble" and the Canadian oil sands. First, to address the housing bubble. Most pundits don't expect the bubble to burst until Bank of Canada hikes up interest rates. With the drop in oil prices and the lower $CDN, Canadian manufacturing has risen, and Bank of Canada recently lowered interest rates by over 25 basis points. If there is a bubble, it won't be bursting in the near future. Also, a good proportion of Canadian mortgages are insured by the Canada Mortgage and Housing Corporation (CMHC), thus lowering Scotiabank's exposure should the bubble exist and burst. Finally, Canadian banks are Basel III-compliant and well-capitalized, further lowering the riskiness of the stock.

As far as the exposure to Canadian oil sands goes, we believe that the market has priced in this risk, and that over the long run it won't affect the bank's ability to pay dividends, especially when the debt-to-equity ratio of 0.1 is considered.

Conclusion

We feel that the dividend yield for Scotiabank is well worth the investment for any long-term investor. Even if the price continues to fall - counter to what the "smart money" anticipates - the fundamentals of the business haven't changed, and there is little chance of the company canceling or lowering dividends given its historical track record. With the amount of regulatory supervision and a debt-equity ratio of 0.1, there is little chance of the bank going under, and thus, the risk is low. Unless you feel that the $CDN is going to drop to unprecedented levels, BNS is a low-risk stock guaranteed to provide a strong dividend yield and value in today's expensive market. With all of the noise surrounding the Canadian economy, now is a good entry point to take a position, collect your dividends, and hold on until things stabilize in the long run.

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in BNS over the next 72 hours. The author wrote this article themselves, and it expresses their ...

more