AUD/USD Rallies Hard In Tandem With S&P 500 Futures, Regains 0.7100

AUD/USD stages an impressive comeback, rallying about 100-pips in the European session to clock fresh five-day highs at 0.7132.

The spot benefits from the return of risk-on trades in Europe, as markets are pricing in a Biden win in the US Presidential election, which is likely to remain supportive of the global stocks, in the wake of the expectations of a bigger fiscal stimulus package.

Amid the upbeat market mood, the aussie tracks the upsurge in its higher-yielding counterpart, the S&P 500 futures. The futures tied to the US stocks jump 1.35% to 3,350 levels. Meanwhile, the European equities rally nearly 2%, at the time of writing.

The reduced haven demand for the US dollar is also collaborating with the move higher in the major. Meanwhile, markets have moved past the dovish Reserve Bank of Australia’s (RBA) monetary policy decision, as all eyes remain centered on the outcome of the US election.

The RBA trimmed the official cash rate (OCR) to a record low of 0.10% from 0.25% previous, as widely expected. The central bank also announced an expansion to its asset purchases program, quantitative easing (QE), by AUD100 billion, in a bid to bolster the post-pandemic economic recovery.

AUD/USD technical levels

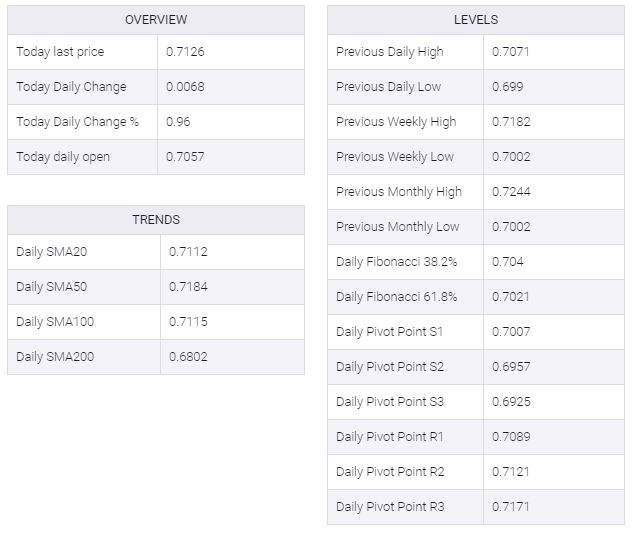

To the upside, stiff resistance at 0.7150 (psychological level) needs to be scaled for a test of the 50-DMA barrier at 0.7177. The support is aligned at 0.7106 (20-DMA), below which the 5-DMA at 0.7048 could be tested.

AUD/USD additional levels

AUD/USD

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more