AUD/USD Price Outlook: Aussie Bounces From Big Support Ahead Of Fed

The Australian Dollar is down more than 2.7% against the greenback month-to-date with price trading just above confluence technical support into the weekly open. These are the updated targets and invalidation levels that matter on the AUD/USD charts heading into FOMC interest rate decision.

AUD/USD DAILY PRICE CHART

(Click on image to enlarge)

Technical Outlook: In my latest AUD/USD Weekly Technical Outlook we noted that Aussie was, “carving its monthly opening range just below technical resistance an leaves price vulnerable to further losses while below 7385. From a trading standpoint, look for a reaction on a move into Fibonacci support at 7163,” – where the 61.8% retracement of the late-October advance converges on pitchfork support extending off the yearly lows. Price registered a low at 7151 last week before rebounding and the focus is on reaction off this confluence support zone heading into FOMC on Wednesday.

A break below this threshold exposes former channel resistance (currently ~7120s) and the yearly low-day close at 7087. Initial resistance stands with the 100-day moving average with a breach above the 25% line around ~7260s to mark the resumption of the broader uptrend. Critical resistance steady at 7327/36.

AUD/USD 240MIN PRICE CHART

(Click on image to enlarge)

Notes: A closer look at price action highlights the near-term support confluence around 7160/63- IF Aussie is going to hold the October advance, we’ll want to see things stabilize above this threshold. Interim resistance stands at 7200 backed by 7223 and 7244/43- look for a break there to test the median-line.

Bottom line: Aussie is testing multi-month uptrend support and price would need to stabilize above 7160 IF the October advance is to remain viable. From a trading standpoint, I’m looking for downside exhaustion on a move into this zone with a breach/close above the 100DMA needed to suggest a more significant near-term low is in place. A break lower would keep the focus on the yearly low-day close.

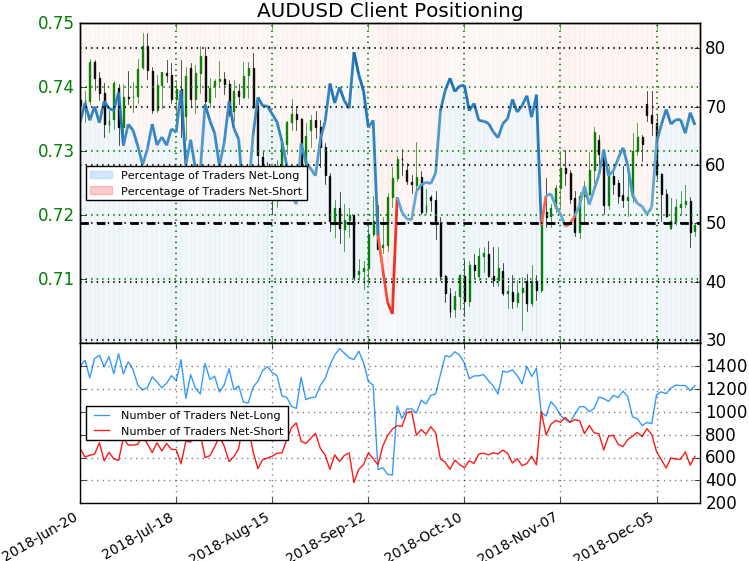

AUD/USD TRADER SENTIMENT

(Click on image to enlarge)

- A summary of IG Client Sentiment shows traders are net-long AUD/USD - the ratio stands at 2.02 (66.8% of traders are long) – bearish reading

- Traders have remained net-long since December 4th; price has moved 2.2% lower since then

- Long positions are1.1% higher than yesterday and 7.7% higher from last week

- Short positions are 17.8% higher than yesterday and 13.2% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Yet traders are less net-long than yesterday but more net-long from last week and the combination of current positioning and recent changes gives us a further mixed AUD/USD trading bias from a sentiment standpoint.

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more