AUD/USD Price Analysis: Death Cross On 4H Chart Points To More Losses

AUD/USD drops towards 0.7650, as the bulls failed to resist above the 0.7700 level earlier in the Asian session.

The downside in the Aussie could be attributed to the impressive bounce staged by the US dollar across its major peers, as the Treasury yields look to stabilize following a steep correction from 13-month tops a day before.

Image Source: Pixabay

The price action around the yields and US dollar continues to remain the main market driver, as markets look forward to the US CPI, bond auction and stimulus announcements. The Aussie bulls ignored the upbeat Chinese inflation figures amid risk-off market mood.

Looking at the spot technically, the bears look to extend their control amid a death cross confirmed on the four-hour chart after the 50-simple moving average (SMA) pierced through the horizontal 200-SMA from above.

The relative strength index (RSI) trends below the midline, allowing room for more declines. Therefore, a drop towards the horizontal trendline support at 0.7620 is likely on the cards, below which the 0.7600 level could be put to test.

On the flip side, the bearish 21-SMA at 0.7684 offers immediate resistance to the major.

All in all, the path of least resistance appears to the downside.

AUD/USD: Four-hour chart

(Click on image to enlarge)

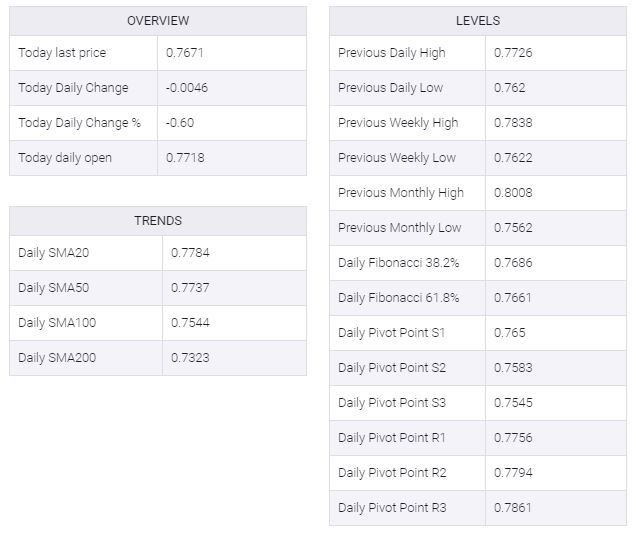

.AUD/USD: Additional levels

AUD/USD

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more