AUD/USD Outlook: Risk Pressures Under 0.73 Despite Upbeat Q2 CAPEX

The AUD/USD price outlook remains bearish as the pressure mounts amid sour risk stemming from rising COVID-19 cases in the country.

The AUD/USD pair is at 0.7264, down 0.14% on Thursday, at press time.

The second quarter’s Private Equity Expenditure (CAPEX) in Australia was 4.4% higher than the market consensus but below previous readings of 6.3%. However, the upbeat figures could not impress the Aussie as poor risk sentiment continues to pressure.

Markets in Asia-Pacific seem to be headed for a continuation of the recent spike in risk. Wall Street rose on Wednesday, with the S&P 500 index rising 0.22 percent. Risk appetite in equity markets contributed to a decline in the risk-mitigating US dollar. In the meantime, the risk-sensitive Australian dollar gained against most of its peers.

In Jackson Hole, the meeting on economic policy will kick off today. Jerome Powell, chairman of the Federal Reserve, will speak on Friday. Fed Chair Powell is expected to signal asset purchases, but others expect announcing this to happen at the FOMC meeting next month. The likelihood of the event moving the market will make traders extremely attentive.

The Australian (FXA) dollar benefits from buoyant market conditions, but Australia’s ongoing viral outbreak is a warning that good times aren’t guaranteed. Wednesday was a record-setting day for COVID. According to government data, there were 919 new infections in New South Wales (NSW). As a result, hospitals in the Greater Sydney area are under pressure, and vaccination efforts need to be stepped up.

At the same time, US Treasury yields for the 10-year bond (SPTL) are struggling with an increase of 1.34%, the steepest in three weeks, while S&P 500 futures fell 0.13%.

AUD/USD Price Technical Outlook: Pressured Under 0.7300

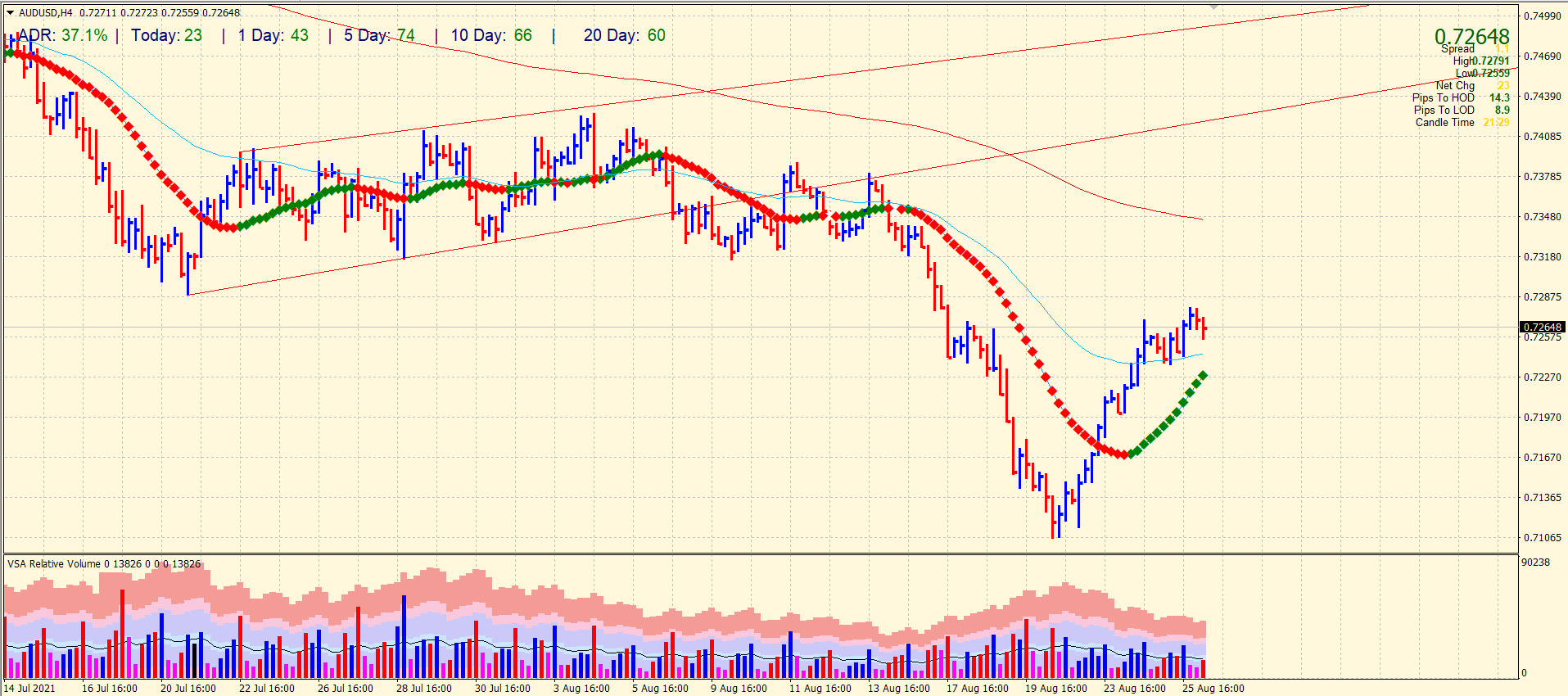

AUD/USD 4-hour price outlook

The AUD/USD price lies above the mid-0.7200 area and the 50-period SMA on the 4-hour chart. However, the pressure seems mounting as the pair lacks follow-through momentum to continue the three-day rally. The immediate support lies at 0.7225-50 area, a confluence of 20-period and 50-period SMAs.

On the upside, the 0.7300 level provides an immediate hurdle ahead of 200-period SMA at 0.7350.