AUD/USD May Fall Down Under Amid The RBA, GDP

This was the week: Strong USD, mixed China, trade, and more

With very few Australian figures, China dominated the scene. At first, the official Chinese Manufacturing PMI missed expectations with 49.2 points, weighing on risk sentiment and the Aussie. China is Australia’s No. 1 trade partner. However, the independent Caixin Manufacturing PMI beat projections with 49.9 points, helping the Aussie recover. The independent number does not surpass the government figure very often.

China remained in the news also due to trade talks. As expected, Trump extended the deadline for imposing new tariffs on the world’s second-largest economy, allowing more time for talks. While his Economic Adviser Larry Kudlow saw a historic deal in the making, Trade Representative Robert Lighthizer said that buying US goods is not enough for a deal: structural changes are needed. It may still take some time.

The greenback got a boost from upbeat GDP figures. At 2.6%, markets are much calmer and the effect of a stronger USD was countered by a risk on sentiment that helped the Aussie. However, the Manufacturing PMI fell short of expectations with 54.2 points, casting doubts about the strength of the economy.

The failed second summit between the US and North Korean leaders Trump and Kim had a short-lived adverse impact on AUD/USD.

Australian events: RBA, GDP, Retail Sales

Australian housing figures kick off the week in Australia. The recent plunges in building permits and new home sales are of growing concern. They serve as a warm up to the main event on Tuesday.

The Reserve Bank of Australia left the interest rate unchanged at 1.75% since mid=2016 and in the last rate decision in February, also refrained from altering the text of the statement. However, Governor Phillip Lowe and the Statement of Monetary Policy (SOMP) both sent a new message: the next move in rates may be up or down rather than up. The A$ suffered as a result.

Will the new message be reflected in the fresh statement? This is the critical question for this rate decision and everything can happen. Lowe will speak on the other side of the day.

The second substantial event in Australia is the GDP report for Q4 2018. Australia publishes its growth data only once, contrary to three publications in the US. After enjoying rapid growth in the first half of 2018, growth slowed quite substantially in Q3 with only 0.3%. A similar pace is on the cards now for both quarterly and yearly growth figures.

Australia releases retail sales and trade balance numbers on Thursday. If both go in the same direction, they could mount to a considerable move on AUD/USD. The disappointing retail data for December weighed on the Aussie.

Chinese data closes the week. The trade balance and its components will be watched by Aussie traders which will want to see increases in both.

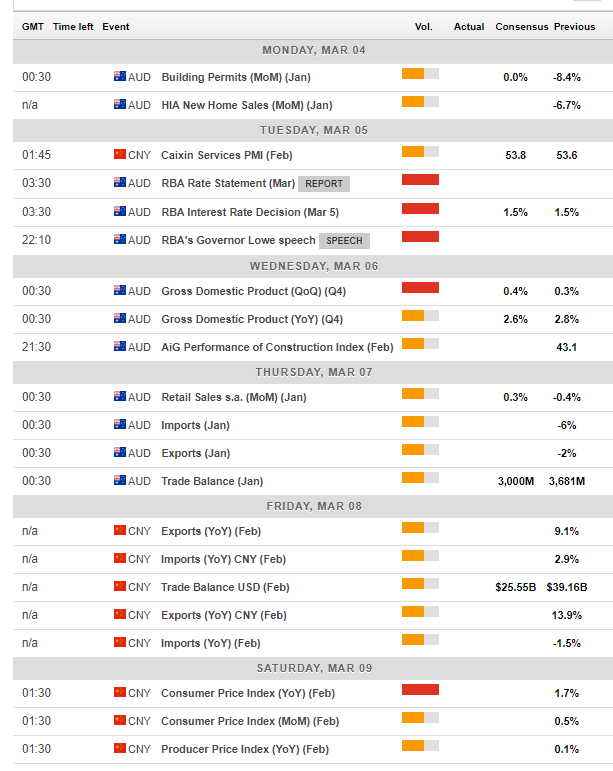

Here are the upcoming events in Australia and China, from the FXStreet economic calendar:

(Click on image to enlarge)

US events: NFP buildup, trade talks

After the disappointing US Manufacturing PMI, the Non-Manufacturing PMI may drop as well. Both serve as hints to the all-important Non-Farm Payrolls report on Friday. The long-awaited New Home Sales number for December is set to drop from the highs, aligning itself with other housing sectors.

A brighter picture is likely in the ADP NFP report on Wednesday. The labor market has been quite robust of late. Fed officials will be able to respond to the data before the all-important jobs report is released.

After a blockbuster leap of 304K positions in January, a return to the averages is on the cards. However, wages are set to continue accelerating, to 3.3% this time. The jobs market keep the Fed happy and the dollar bid.

In addition, AUD/USD will continue moving on any news from US-Sino trade talks. An announcement about a long-awaited summit between Presidents Trump and Xi may boost the pair, while a complication in negotiations can send it to lower ground.

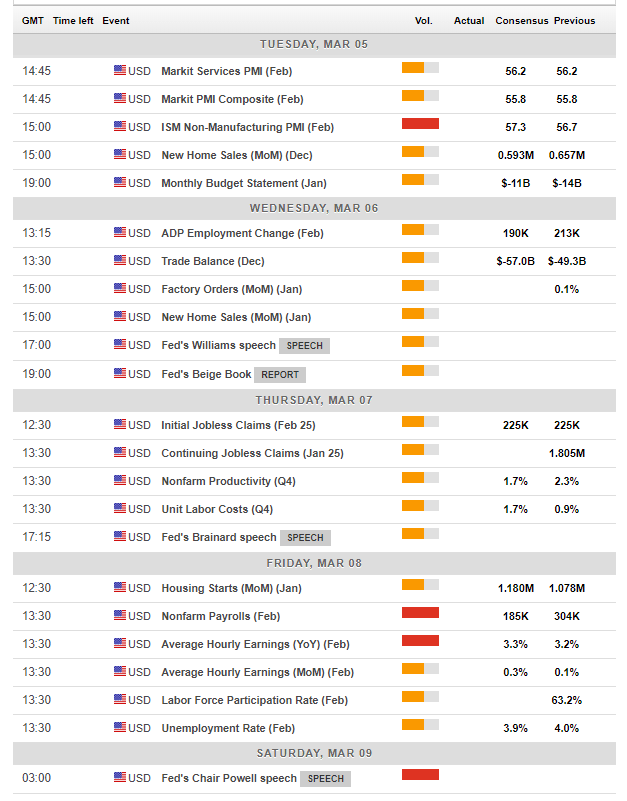

Here are the top US events as they appear on the forex calendar:

(Click on image to enlarge)

AUD/USD Technical Analysis

AUD/USD is trading within a narrowing wedge, or triangle. Uptrend support is young, beginning this year, while downtrend resistance dates back some ten months. The thick black lines on the chart show the wedge.

The bearish bias stems from the negative turn in Momentum and from the fall of AUD/USD below the 50-day Simple Moving Average. The Relative Strength Index is below 50, but far from 30, showing more stability.

Aussie/USD battles the 0.7100 level. Some support awaits at 0.7080 which was a low point in September and recently supported the pair. It is followed closely by 0.7070 that forms part of the uptrend support line and was a swing low in February. 0.7050 is next before the 0.7080 level seen early in the year.

Some resistance awaits at 0.7120 that was a pivotal line in recent days. 0.7165 was a swing low in November and also supported the pair afterward. The 0.7200-0.7205 region capped the pair in February and serves as fierce resistance. 0.7240 was a high point in early January and 0.7300 capped A$/USD in late January.

(Click on image to enlarge)

-636870485133154193.png)

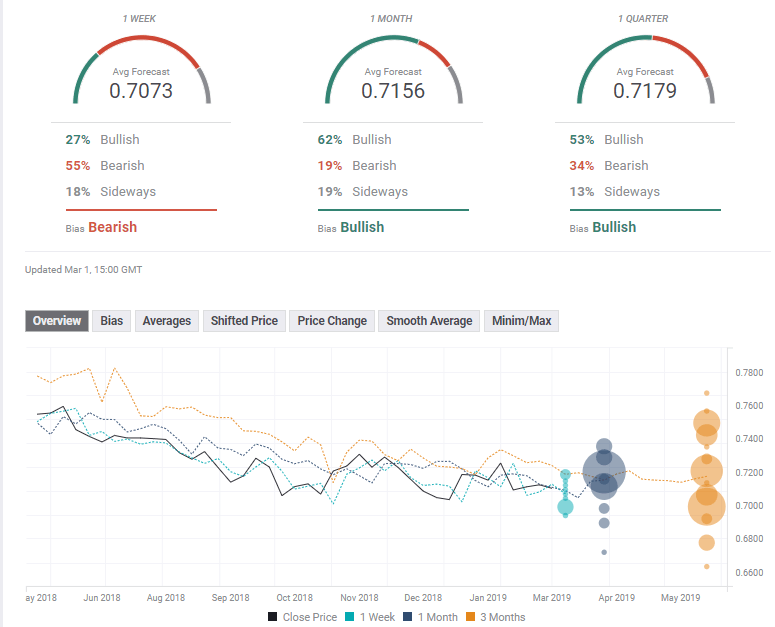

AUD/USD Sentiment

The Aussie cannot escape the gravity of the global slowdown. A deal of sorts between the US and China is mostly priced in. In addition, the RBA acknowledges the slowdown and could hit the Aussie when it’s down. All in all, there is room to the downside.

The FXStreet forex poll of experts shows a bearish bias in the short term and a bullish one afterward. Average forecasts have been upgraded medium and long terms but downgraded in the short term.

(Click on image to enlarge)

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more