AUD/USD January Opening Range In Focus As RSI Sell Signal Emerges

AUD/USD approaches last week’s low (0.7642) following the limited reaction to the US Non-Farm Payrolls (NFP) report, and swings in investor confidence may continue to sway the exchange rate as the Reserve Bank of Australia (RBA) acknowledges that “the improvement in risk sentiment has also been associated with a depreciation of the US dollar and an appreciation of the Australian dollar.”

Nevertheless, the contraction in US employment may encourage the Federal Reserve to further utilize its non-standard tools as Vice-Chair Richard Clarida insists that the Federal Open Market Committee (FOMC) “will continue to increase our holdings of Treasury securities by at least $80 billion per month and our holdings of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward our maximum-employment and price-stability goals.”

The comments suggests the FOMC will retain the current course for monetary policy at its next interest rate decision on January 27, and the central bank may continue to strike a dovish forward guidance as Chairman Jerome Powell and Co. remain “committed to using our full range of tools to support the economy and to help ensure that the recovery from this difficult period will be as robust as possible.”

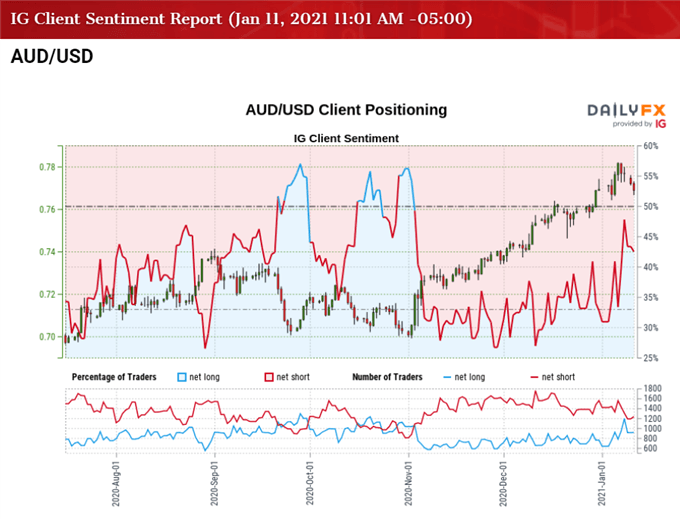

Until then, key market themes may influence AUD/USD as the US Dollar still reflects an inverse relationship with investor confidence, and the tilt in retail sentiment also looks poised to persist as traders have been net-short the pair since November.

The IG Client Sentiment Report shows 43.39% of traders are net-long AUD/USD, with the ratio of traders short to long-standing at 1.30 to 1. The number of traders net-long is 10.56% higher than yesterday and 28.68% higher from last week, while the number of traders net-short is 10.26% higher than yesterday and 13.41% lower from last week.

The decline in net-short interest comes as AUD/USD clears the 2020 high (0.7742) during the first week of January, while the jump in net-long interest has helped to alleviate the crowding behavior as only 37.72% of traders were net-long the pair during the previous week.

With that said, swings in investor confidence may continue sway AUD/USD ahead of the next Fed meeting as key market trends remain in place, but the exchange rate may threaten the opening range for January as the Relative Strength Index (RSI) falls back from overbought territory to indicate a textbook sell signal.

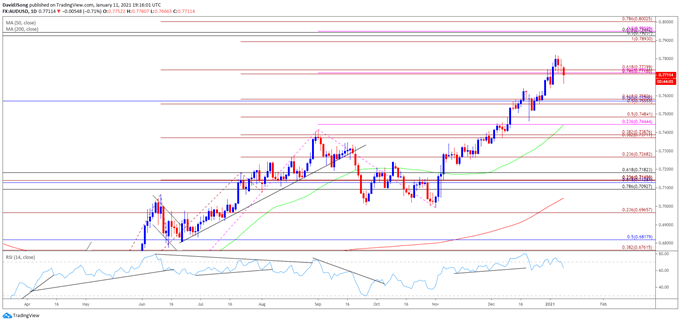

AUD/USD RATE DAILY CHART

(Click on image to enlarge)

Source: Trading View

- Keep in mind, the AUD/USD correction from the September high (0.7414) proved to be an exhaustion in the bullish trend rather than a change in behavior as the exchange rate cleared the October high (0.7243) in November, with the pair trading to fresh yearly highs throughout December.

- At the same time, developments in the Relative Strength Index (RSI)showed the bullish momentum gathering pace as the indicator pushed into overbought territory for the first time since September, with the break above 70 accompanied by a further appreciation in AUD/USD like the behavior seen in the first half of 2020.

- However, a textbook RSI sell signal has emerged as AUD/USD extends the pullback from last week’s high (0.7820), and the exchange rate may threaten the opening range for January as it struggles to hold above the Fibonacci overlap around 0.7720 (78.6% expansion) to 0.7740 (61.8% expansion).

- Failure to hold above last week’s low (0.7642) brings the 0.7560 (50% expansion) to 0.7580 (61.8% expansion) region back on the radar, with the next area of interest coming in around 0.7440 (23.6% expansion) to 0.7480 (50% expansion).

Disclosure: See the full disclosure for DailyFX here.