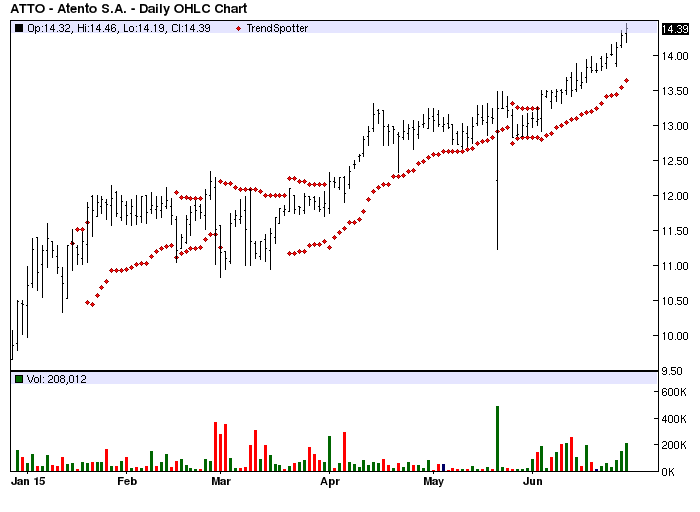

Atento - All Time High

The Chart of the Day belongs to Atento (NYSE:ATTO). I found the outsourcing stock by using Barchart to sort today All Time High list for the stocks with the highest technical buy signals then used the Flipchart feature to review the charts. Since the Trend Spotter signaled a buy on 6/3 the stock gained 7.29%.

Atento S.A. is a provider of customer relationship management and business process outsourcing (`CRM BPO`) services in Latin America and Spain. Its CRM BPO services include customer service, sales, credit management, technical support, back office, and service desk, as well as other BPO process services, such as training activities, workstation infrastructure, interactive voice response port implementation, telecommunications infrastructure, application development, and others. The Company's clients are mostly multinational corporations in sectors such as telecommunications, banking and finance, health, consumption and public administration, among others. Atento S.A. is based in Luxembourg

The status of Barchart's Opinion trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com web site when you read this report

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 20 new highs and up 12.08% in the last month

- Relative Strength Index 80.09%

- Barcart computes a technical support level at 14.00

- Recently traded at 14.39 with a 50 day moving average of 13.70

Fundamental factors:

- Market Cap $1.06 billion

- Revenue expected to decrease by 12.30% this year but grow again by 5.50% next year

- Earnings estimated to increase 1.80% this year, an additional 23.70% next year and continue to increase an an annual rate of 17.10% for the next 5 years

- Wall Street analysts issued 3 strong buy and 5 buy recommendations on the stock

The 50-100 Day MACD Oscillator has been a reliable trading strategy for this stock and should continue to be used for entry and exit points.

Disclosure: None.