As Stocks Surge, Treasuries Flash An "Ominous Sign"

With both the Dow, and the broader market saved - for now - from an embarrassing Quad Witch slump by news that Boeing is set to roll out a software upgrade for its 737 MAX airplanes (how a software update will fix what many now see as a hardware issue is unclear, nor is it clear how Boeing effectively admitting guilt for the death of hundreds of people which will unleash billions in lawsuits is bullish), bond yields will have none of it and as we showed earlier, the buying ramp across asset classes is the latest confirmation that equities are not trading on fundamentals (as bonds price in the continued deterioration in the US economy), but merely frontrunning QE4.

That trade got a boost today after industrial production for February disappointed consensus at 0.1% MoM vs. 0.4% survey and -0.4% in January. Meanwhile, manufacturing production contracted for the second straight month despite forecasts of slight expansion, declining -0.4% MoM. This brings capacity utilization back to its lowest level since last July, having declined three straight months (and four of the last five).

The data comes on the back of another miss in the form of Empire manufacturing for March, which disappointed at 3.7 vs. 10.0 survey and 8.8 prior, which to BMO portends "potential weakening more broadly in the manufacturing sector through Q1 despite the loosening of financial conditions that has occurred since December." All in all, as BMO's rate strategist Jon Hill, noted "a variety of disappointing releases which will continue to push yields lower."

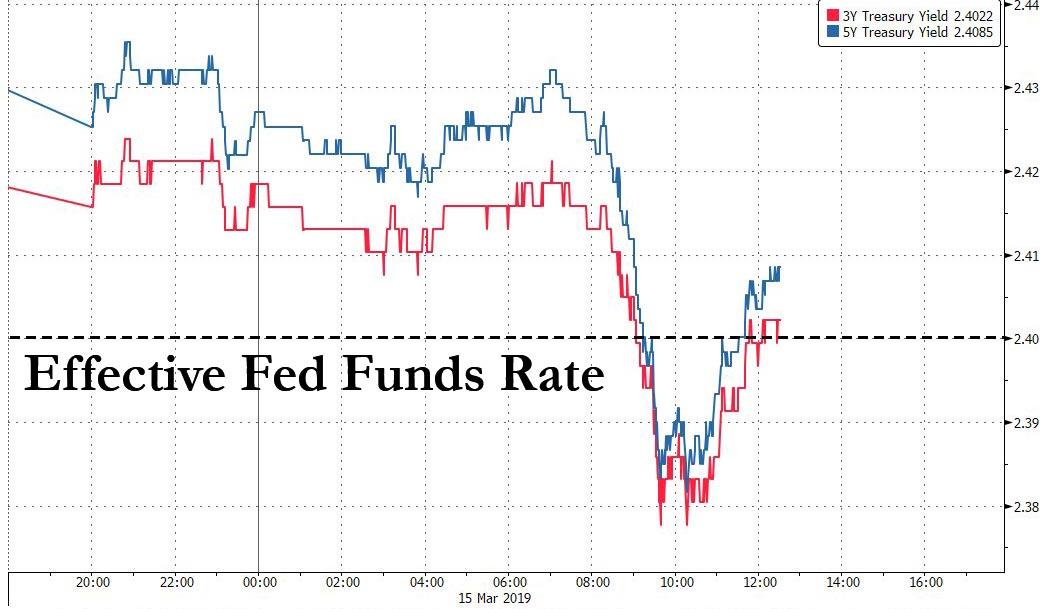

And speaking bizarre moves during "Freaky Friday", shortly after the data was released, and the resultant tumble in yield, 3- and 5-year yields inverted modestly vs. fed funds, which according to Hill, was "a self-evident ominous sign."

(Click on image to enlarge)

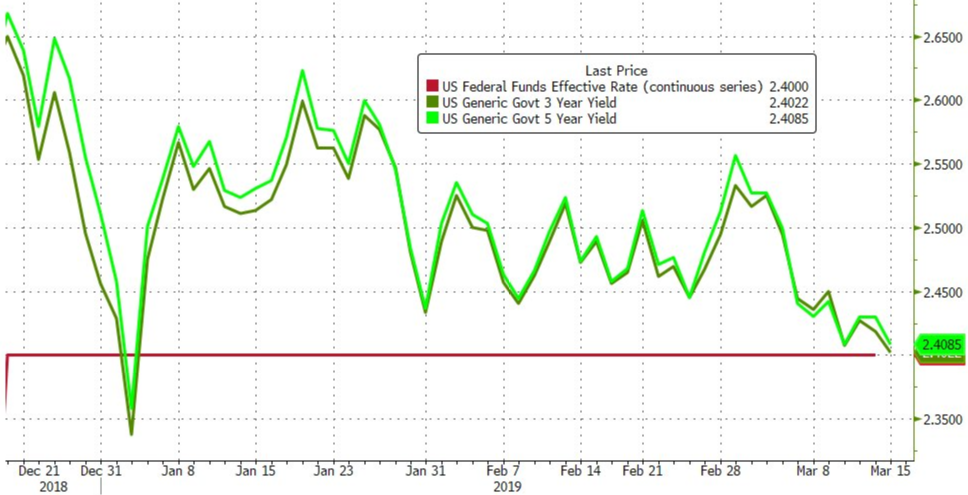

The last time 3s and 5s dipped below the Fed Funds was at the start of the year when the VIX soared and equities tumbled. The big difference now is that not only is the VIX plunging, but the S&P is now rapidly approaching the all-time highs hit last September.

(Click on image to enlarge)

Finally, and the latest divergence observed today between risk-free assets and safe havens is that today's 10-year yields tumbled to the lowest levels since the beginning of the year, with the post-CPI intraday bottom now breached.

In short: just as another BMO strategist, the bank's chartiest Russ Visch noted on Wednesday, "the bond market certainly hasn't been buying into this week's strength in equity markets either. The divergence between the S&P 500 and the U.S. 2-year yield (which have traded in lockstep for many months now) is only getting worse."

His question, and perhaps the only question that matters "Who has it wrong here? Bonds or equities?"

The answer will determine what happens after today's quad witch is over.