As Q1 Peak Earnings Season Kicks Off, Many Concerns From 2015 Begin To Dissipate

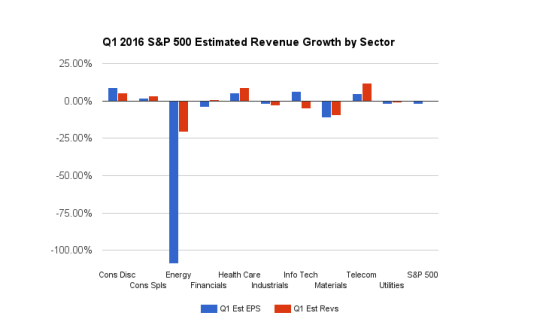

We head into peak earnings season with some good news and some bad news from U.S corporations. First up, the bad news. The S&P 500 index is expected to show a first quarter profit decline of 2.3% year-over-year (YoY). This would be the second consecutive quarter of negative EPS growth for the index, which could heat up rhetoric on the impending earnings recession (3 consecutive quarters of declining growth). This is also the lowest growth rate since Q2 2009, during the Great Recession. Revenue growth looks slightly better at -0.2%.

On the bright side, and it is still very early, but 67% of companies that have reported have beaten the Estimize EPS consensus thus far, higher than the historical beat rate of 58%. The Wall Street beat rate is even higher at 71%. Revenues are also trending higher than in quarters past, at 53% vs. the historical beat rate of 47%. A lot of this has to do with the types of companies that report early on in the season, mostly consumer facing names such as Nike (NKE), Darden Restaurants (DRI), Carnival Cruises, Lennar and Hasbro from the consumer discretionary sector. Even a transport name like FedEx (FDX) relies heavily on consumer activity for bottom-line growth, and they blew their numbers out of the water thanks to a strong holiday season.

Q1 2016 Themes

The Dollar

Some of the themes already emerging in Q1 press releases are all too familiar, but many of the concerns expressed are likely to wane as the year goes on. The strong dollar rears it’s ugly head once again, with nearly half of all reporting companies mentioning it as having a negative impact. This is understandable as the S&P 500 is made up of large multinational companies which gain nearly 50% of their sales from overseas, and the repatriation of those sales back to the US dollar undercuts profits. However, the dollar is stabilizing, having hit a peak of $100 in March of last year, vs. a peak of only $95 in January of this year. As the dollar drops, this should be the last quarter it is mentioned as a major headwind, something that seems to be reflected in forward earnings which look much more optimistic at this point.

Oil

Another positive for corporate earnings in 2016 is the fact that oil is off its lows. For the last two weeks Brent Crude oil has been above the $40/barrel mark, a nice recovery from the under $30/barrel seen in January. Futures prices even have Brent Crude hitting $50 by the fourth quarter, something that’s starting to be reflected in earnings and revenue estimates for energy companies for the remainder of 2016.

China

The last big concern to carry over from 2015 is weakness in China, but even that seems to be dissipating. At this point, no companies that have reported have mentioned China as a big issue in Q1. In fact, several S&P 500 corporations have mentioned seeing strength in China, including Nike, Micron (MU), Alcoa (AA), McCormick (MKC) and others. It is still too soon to tell, but early signs seem to be suggesting that stimulus is paying off in that country. Despite the fact that GDP slowed to 6.7% in Q1, the slowest pace since early 2009, economic indicators for March such as retail sales, industrial output and exports all came in stronger than expected. While China still has a ways to go, these positive signs have at the very least reduced some of the panic and removed the urgency around loosening monetary policy and cutting interest rates.

Q1 Losers

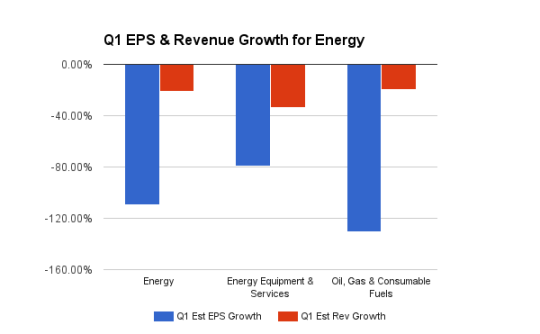

Energy

Kicking off the laggards for Q1 is none other than the energy sector. It should come as no surprise that energy is expected to post a decline in YoY profits of 109%! This has more than doubled from what was estimated at the beginning of the year. Revenues are also down drastically from the year-ago period at -20%. However, this should be as bad as it gets for these names, with every other quarter of 2016 expecting modest improvements, while growth still remains negative. In fact, energy is such a drag on the overall index, that if it is removed, EPS growth for Q1 pops up to 3.1% from the current -2.3%.

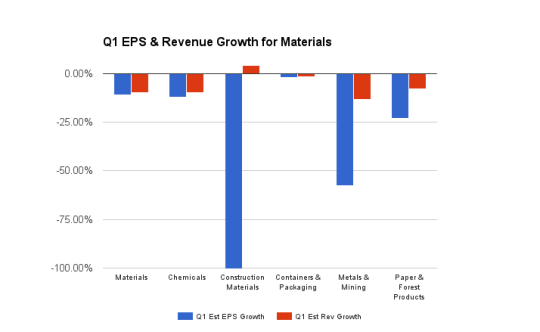

Materials

Another weak quarter is ahead for materials as well, which have been negatively impacted from the metals and mining industry. Materials is expected to show a profit decline of 11.1%, with revenues falling 9.6%. Most of the weakness has been seen in base metals, which are used as a proxy for global growth and the health of manufacturing. These include steel, aluminum, and iron ore, which are all used for industrial purposes. Miners tend to do well when economies are strong and there is less uncertainty, often accompanied by contracting credit spreads and a flattening yield curve. The primary culprit of falling demand for metals has been softening in China, the world’s largest importer of commodities, making it the biggest driver of global demand. Similar to the energy sector, the picture for materials looks to be getting brighter as the year goes on, and concerns around China subside.

*Construction Materials EPS is off the chart at -603%.

Q1 Winners

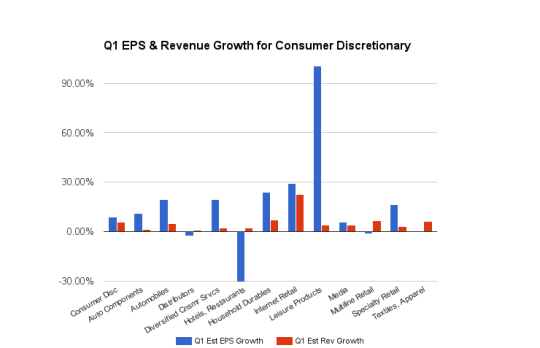

Consumer Discretionary

The first quarter will present many of the same winners that were seen in 2015. Starting with consumer discretionary.

Consumer discretionary is currently at the top of the leaderboard, expecting EPS growth of 8.7% and sales growth of 5.6%. This is first time the sector will edge health care out of the top spot in 5 quarters. Lower oil has come as a benefit for many names in this space, although the overall trend of consumers allocating discretionary income to other places outside of traditional retail, such as tech and health care, remains. The industry winners within this sector continue to be internet retail, household durables and automobiles. The latter two point to consumer’s confidence in the ability to invest in large ticket items. Homebuilders such as Lennar (LEN) have been on a good run as home prices appreciate, during which time homeowners tend to invest in their properties, is which also good for home improvement retailers like Home Depot (HD). Lower oil has also helped the auto manufacturers as consumers are no longer shying away from gas guzzlers such as SUVs and trucks, both which have been incredibly strong sellers.

*Leisure Products EPS growth is off the chart at 141% thanks to Hasbro’s (HAS) big win yesterday.

Information Technology

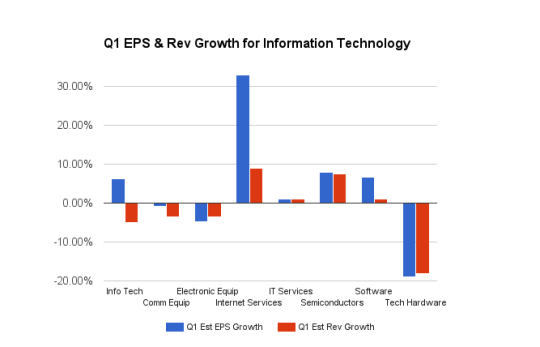

Surprisingly, health care isn’t even in second place for EPS growth this season. That spot has been seized by information technology, expected to grow 6.2% on the bottom-line, but decrease 5.1% on the top-line. Strength for the sector comes from the Internet Software & Services industry which is looking for profit growth of 32.9% and sales growth of 8.9%. Names like Facebook (FB) and Alphabet Inc. (GOOGL) are anticipated to be the big winners there. Computers & Peripherals on the other hand is the biggest loser, predicting both the top and bottom-line to fall by over 18% YoY. The main culprit here is Apple (AAPL), which has already made it clear that their fiscal Q2 would be the weakest of the year due to slowing iPhone sales. Apple’s shear size and negative expectation drag on the entire sector.

Health Care

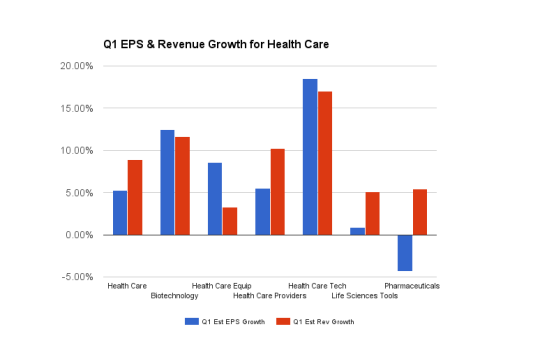

After leading all 10 sectors for the last 5 quarters, health care takes a bit of a back seat in Q1, with analysts calling for EPS growth of 5.3% and higher revenues of 8.9%. Once again, biotechnology leads the way with EPS expected to increase 12.5% and revenues up 11.6%. Health care technology is even a tad higher, with EPS growth anticipated to come in at 18.5% and revenues of 17.0%, however, only Cerner (CERN) is contained in that industry.

This week things heat up as the first peak week of the season gets underway with 91 S&P 500 companies scheduled to report.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.