As Bill Ackman Shorts Credit, CDS Payouts Soar To Highest Level Since 2009

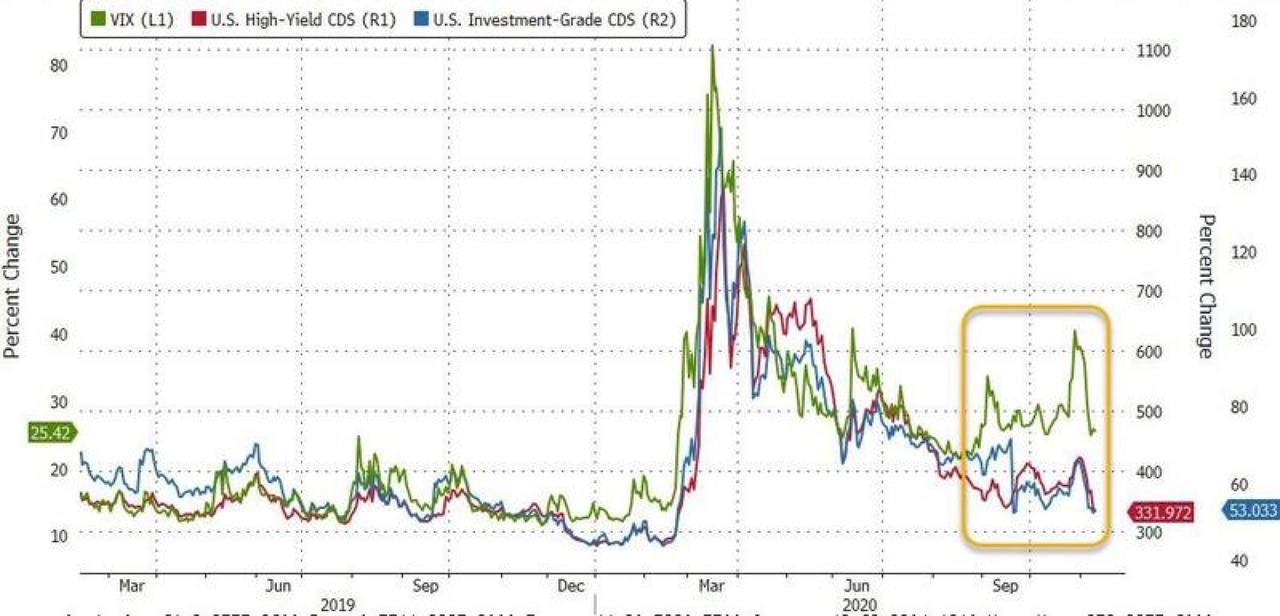

It was reported this week that billionaire hedge fund manager Bill Ackman had placed another massive bearish bet in credit markets as the resurgence of COVID-19 cases risks another nationwide lockdown, especially if Joe Biden is in the White house.

Ackman's Pershing Square Capital Management recently bought credit protection on various global investment grade and high yield credit indices to hedge against another downturn.

Earlier this year, Ackman pocketed $2.6 billion in profits on a (credit) hedge amid stock market complacency ahead of its March collapse.

With Ackman expecting markets to crash again, it makes sense why the billionaire would be buying credit-default swaps, as he must protect some of his gains this year. Pershing is up 44% year-to-date.

Ackman's dabbling in CDS markets comes as contracts linked to 19 borrowers have been settled this year - the highest since 2009 - and with looming lockdowns and the reimposition of strict social distancing measures - more companies are expected to stumble into bankruptcy or restructuring.

Bloomberg notes U.K. restaurant chain PizzaExpress and U.S. retailer J.C. Penney Co. paid out approximately 100% of the value insured this year. Data via Bloomberg showed protection buyers had recovered at least $6 billion globally this year, more than three times the total for all of 2019.

"If you own CDS, you are really getting paid," said Sean George, chief investment officer at hedge fund manager Strukturinvest in Stockholm. "In times of stress, it's a go-to product, and we've seen a lot of stress this year."

Jochen Felsenheimer, managing director at XAIA Investment in Munich, said trading activity in CDS markets is surging this year. He said central banks are buying securities to stabilize markets, making it easier to trade swaps than bonds.

"Central bank purchases are sapping liquidity out of the bond market, so credit swaps have become the place to be," he said. "CDS is having a very active year."

While the cost of credit protection is dramatically cheaper than equity protection - Ackman and other savvy investors - are placing their bets that the virus pandemic could rupture credit markets once more.

Meanwhile, this year's high rate of defaults and soaring payouts have been stressful for fund's selling swaps on investment-grade and high-yield bonds as the virus pandemic risks unleashing the next massive default wave.

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more