Article Portfolio Performance: An Unbiased View

For a long time I’ve been thinking about the matter of accountability. As an investment writer, I believe my work is only worthwhile when I add value to my readers and followers. The main problem is that the tools available for performance evaluation are clearly flawed. Tipranks, for instance, has been classifying some neutral articles as long ones or even missing some articles, among other inconsistencies. Even, actually, the best tool I’ve found is stockviews.com. However, I started my stockviews account just 3 months ago, which means that my portfolio is not yet correctly synchronized with my articles. Therefore, I decided to write an article destined exclusively to sum up the performance of my long articles.

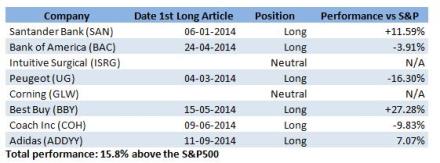

Table 1 – Article Performance by company since 1st long article was published vs the S&P500 (Reference date: 18-09-2014)

As you can see, my overall performance is 15.8% above the S&P500. The portfolio is being highly penalized by a bad timing on my 1st Peugeot article, but even so I think Peugeot will deliver and, in the long term, the portfolio will improve significantly. At the same time, this portfolio is really young. All of the stock picks have less than a year. If we add the fact that these companies are well regarded companies with strong brands, I think we have a huge potential in our portfolio. More than a value or growth portfolio, I think this is a quality portfolio. Let us now look at each stock:

Santander Bank SAN

Santander is the company that I have covered more extensively during the last few years. I have written about this stock way before starting writing for SA. My opinion is that Santander will consistently release value throughout the next few years. Therefore, I clearly rate it as a long term hold. You can read more:here, here and here.

Graph 1 – SAN stock performance since 1st long article vs the S&P 500

Bank of America BAC

Bank of America is a clear bet on the American economy. This bank has a huge customer base and a very strong brand that is already revealing its strength through a visible improvement in profits. The fact that there still is some uncertainty about ongoing lawsuits regarding mortgage loans has been a major drag in the stock market performance. However, it is my view that the perception about these problems will fade away and the stock price will improve significantly. You can read more about BAChere.

Graph 2 – BAC stock performance since 1st long article vs the S&P 500

Best Buy BBY

The rationale behind my investment in Best Buy is very simple: not all traditional consumer technology retailers will fail and Best Buy is one of the best positioned companies to respond to online retailers. The strategy presented by the current management is very convincing and it has already exhibited positive indications. You can read more here.

Graph 3 – BBY stock performance since 1st long article vs the S&P 500

Intuitive Surgical ISRG

I am neutral about this stock because the company has performed well in recent times (S&P500 + 5%), but I am not convinced about the company’s outlook. I wrote a neutral article about ISRG in January. At the time, I defined the company as being in a bad momentum but having a good underlying business. During this time, I have not acquired additional knowledge that might help me in going long or short. You can read more here.

Peugeot UG

A previous note: the graph provided by Google Finance does not include the rights value of Peugeot’s capital increase. If we account for the possibility of using the rights to buy additional shares at 7.5€, then, the average buy price would be around 12.22€. This means that the actual stock performance is around -7.38% and -16.3% against the S&P 500

This said, I believe entirely in the new management team and I think the stock has been too much penalized. The recent results presented by the company indicate that there are already some positive aspects in the ongoing turnaround. You can explore my opinions about Peugeot here and here.

Graph 4 – UG stock performance since 1st long article vs the S&P 500

Corning Inc. GLW

I have always regarded Corning as a good company and I think it still is. However, the company is trading at reasonable multiples (23x earnings) and there are other investment options at very attractive levels (Coach and Adidas). I may return to this company in a future opportunity. The company has underperformed the S&P by 10% since I wrote an article about the company in April. You can read more here.

Coach COH

In my opinion, Coach is a clear buy. The company has underperformed the S&P 500 by more than 50% during the last 12 months. Coach is a very well regarded brand and the company has a good track record for business performance. The company is suffering from a glitch in profits and sales, but I think in the end the company has what it needs to thrive again. You can read more about this company here and here.

Graph 5 – COH stock performance since 1st long article vs the S&P 500

Adidas ADDYY

Like Coach, Adidas has a very strong brand and has also achieved very good results in the past. Coincidently, Adidas is also going through a sales and profit glitch. Again, I think this company has what it takes to perform a successful turnaround. You can read more here.

Graph 6 – ADDYY stock performance since 1st long article vs the S&P 50

Conclusion

I believe this article clarifies my stances on the articles that I have written about several companies. On the other hand, it allows for a correct appreciation about the performance of the work I have been providing. As I said, the portfolio has been performing well and I believe it will continue in the future.