Are Times Finally Changing For Plug Power Investors?

This article originally appeared on Iknowfirst.com

I have been a Plug Power (PLUG) bear for quite some time now. The stock has declined considerably since I first covered it. Missing estimates, history of unprofitability and overpromising results has been the primary reasons why I have recommended investors to sell/short Plug Power over the years. And as you can see from the image below, my bearish stance on Plug Power has yielded over 34% returns.

(Source: TipRanks.com)

Why I have been bearish on Plug Power

I have always advised investors to short companies that have a track record of non-profitability. I have previously recommended shorting the likes of Yelp, SolarCity, and Westport Innovations that have struggled to make a profit and my short calls have been successful.

Plug Power hasn’t recorded a profitable year in over 20 years of its existence, which was the primary reason why I recommended shorting the stock. The company had a negative gross profit margin meaning that it spent over $1 to bring in $1 of revenue, which is why the company has been making huge losses.

Apart from the loss-making, another reason why I was a Plug Power bear was the company’s fake promises. Over the years, Plug Power’s CEO Andy Marsh has made some very bold promises and has failed to deliver on them time and again. For instance, in 2009, Marsh said, “The company will achieve a gross margin percentage in the mid-teens.”

Then again in 2011, Marsh claimed that Plug Power’s margins will jump to 20% in 2012 and then increase further to 30% in 2016. Fast forward three years, and the company is still struggling to reach positive margins.

Amid this fiasco, Plug Power investors have suffered due to excessive dilution. Plug Power has lost almost $1 billion since its inception. Due to the piling losses, Plug Power’s cash reserve gets exploited very fast, and the company resorts to further dilution so as to keep its business going longer. Plug Power’s outstanding share count has increased consistently over the past, and the dilution fiasco has destroyed shareholder value.

Are Things Changing?

After overpromising and under delivering for years, it finally looks like Plug Power is on track to achieve one of its goals. Plug Power had boldly promised investors that it will reach $100 million in annual sales in 2015. The company added several clients to its list in 2015, and that has contributed to its goal. Big-name clients like Nike, Wal-Mart, Home Depot, etc. have helped Plug Power attain its sales target, and things may be finally looking better for Plug Power investors.

In addition, Plug Power’s gross profit margin is also close to turning positive, albeit a few years late. Growing revenue and improving margins can definitely act as a tailwind for Plug Power. $100 million in sales signify a more-than-50% year over year increase in sales, and the company’s strong revenue growth shouldn’t stop anytime soon as it plans to add new clients in 2016.

For 2016, Plug Power aims to deliver sales of $150 million and targets contract bookings of $275 million. Another 50% year over year growth will definitely propel Plug Power’s stock higher if it manages to deliver on its promises.

Breaking even is also a big achievement for Plug Power. After decades of loss-making, investors will definitely be pleased if Plug Power manages to breakeven in 2016. The company’s gross profit margin has been increasing consistently for the last few quarters, and going by that trend, it may reach the breakeven point in fiscal 2016.

Attaining breakeven is the first step towards profitability for Plug Power, and there could be significant upside potential for the stock if it manages to achieve that in 2016.

Conclusion

After years of loss making and making fake promises, it finally looks like Plug Power is on the right track. The company has reached its goal of reaching $100 million in annual sales in 2015 and is expected to continue its strong growth in 2016 as well. Although Plug Power is still operating at a loss, it can break even in the upcoming quarters. Reaching break-even point will be a big achievement for Plug Power especially since it has been losing millions of dollars every quarter. And if the company manages to breakeven in the near future, the stock will definitely move a lot higher from the current levels. Plug Power is expected to release its quarterly report next month and investors looking to invest should keep a close eye of the gross margin metric. If the company is on track to attain a breakeven quarter, then I think the stock may have bottomed.

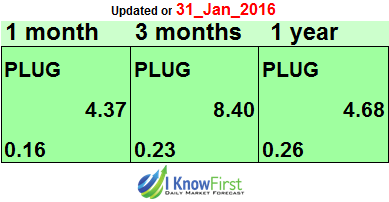

The algorithm generates a forecast with a signal and a predictability indicator. The signal is the number at the center of the box. The predictability is the figure at the bottom of the box. At the top, a particular asset is identified. This format is standardized across all forecasts. The middle number indicates strength and direction, not a price target or percentage gain/loss. The bottom figure, the predictability, signifies a confidence level.

As you can see from the chart above, the green 4.37, 8.40, and 4.68 forecasts for the respective time periods suggest that Plug Power’s shares will move higher in the future. This suggests that Plug Power’s shares have bottomed, and the upside will be likely propelled by a good earnings report and a good guidance.

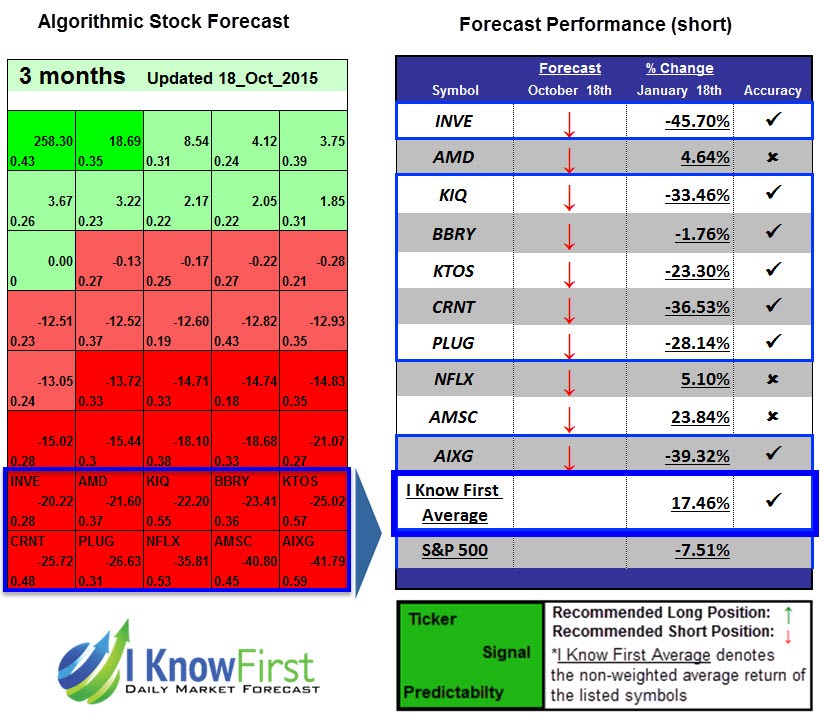

I Know First has had success predicting the movement of Plug Power’s stock price in the past. In this three-month forecast from Oct 18th, Plug Power had a bearish signal with a signal strength of -26.63 and a predictability indicator of 0.31. In accordance with the algorithm’s prediction, the stock price decreased by -28.14% during that time.

Disclosure: This article originally appeared on I Know First, a financial services firm that ...

more