Analysts Provide Insight On Celgene Corporation And Receptos, Inc. In Light Of Acquisition Announcement

Oncology therapy company Celgene Corporation (NASDAQ:CELG) announced a definitive agreement on July 14 to acquire Receptos Inc (NASDAQ: RCPT). Under the terms of the agreement, Celgene will pay $7.2 billion in cash for the autoimmune drug maker. The boards of both companies have approved the terms of the acquisition and expect it to close before the end of the quarter.

Celgene is an integrated global pharmaceutical company engaged in developing drugs for hematology, oncology, and autoimmune diseases. The acquisition will allow Celgene to expand its Inflammation and Immunology portfolio and ultimately drive the company’s revenue. This deal comes at an important point as Celgene’s pipeline blockbuster cancer drug, Revlimid, is losing patent protection.

Celgene CEO Robert Hugin weighed in on the acquisition, noting, “The Receptos acquisition provides a transformational opportunity for Celgene to impact multiple therapeutic areas.” He continues, “This acquisition enhances our [Inflammation & Immunology] portfolio and allows us to leverage the investments made in our global organization to accelerate our growth in the medium and long-term.”

Receptos is developing a drug called ozanimod that is now in Phase 3 clinical trials as a treatment for multiple sclerosis and ulcerative colitis. Celgene executives see hope in ozanimod, which is Receptos’ prime asset. The autoimmune drug “is a potentially transformation oral therapy that has demonstrated robust clinical activity with impressive immune-inflammatory modulating properties,” said Scott Smith, Celgene’s president. Furthermore, Celgene’s executives said that ozanimod could have peak annual sales of $4 billion to $6 billion.

In reaction to the news, Celgene stock rose 8.3% to $133 in early morning trading on June 15 while Receptos jumped even higher by 10.5% to $228.85.

Nomura Securities analyst Ian Somaiya reiterated a Buy rating on Celgene and raised his price target to $165 on July 15, but downgraded Recpetos to Hold with a price target of $232 after the merger news. The analyst believes “Celgene got a good deal given our projections for peak ozanimod sales of $6.2bn in MS and UC alone.” He adds that this puts “the $7.2bn purchase price well below the 3-4x peak sales multiple (Figs 1 & 2) we have seen in recent pharma/biotech deals”

Somaiya points out that “ozanimod could enable theInflammation & Immunology franchise to double peak sales to $10bn and reduce reliance on Revlimid to drive future growth.”

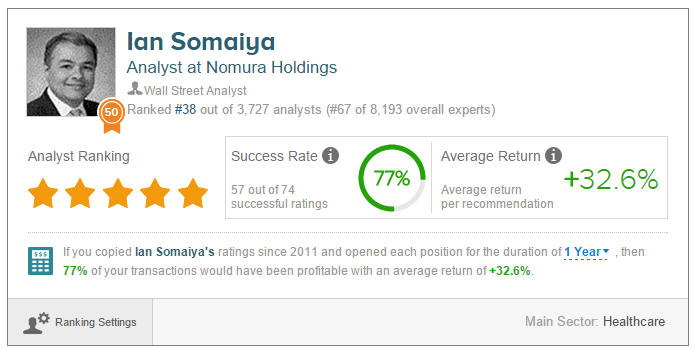

When measured over a one-year horizon and no benchmark, Ian Somaiya has an overall success rate of 77% recommending stocks, earning a +32.6% average return per recommendation. The analyst has rated CELG a total of 9 times since May 2009, earning an 89% success rate recommending the stock and a +42.3% average return per CELG recommendation.

BMO Capital analyst Jim Birchenough also weighed in on both stocks in light of the acquisition. The analyst reiterated a Buy rating for Celgene with a $191 price target while downgrading Receptos to a Hold.

Birchenough believes the deal makes “perfect sense.” He states, “We view ozanimod as a highly differentiated and high impact product with sales potential at the high end of CELG estimates.” The analyst concludes, “We believe that ozanimod greatly diversifies revenues beyond Revlimid and increases confidence on long-term guidance.”

When measured over a one-year horizon and no benchmark, Jim Birchenough has an overall success rate of 68% recommending stocks, earning a +42.9% average return per recommendation. The analyst has rated CELG a total of 8 times since June 2014, earning an 100% success rate recommending the stock and a +180.9% average return per CELG recommendation.

Out of 13 analysts polled by TipRanks, 11 analysts are bullish on CELG and 2 are neutral. The average 12-month price target for CELG is $150.15, marking a 14.28% potential upside from where stock is currently trading. On average, the all-analyst consensus for CELG is Moderate Buy

Out of 4 analysts polled by TipRanks, 2 analysts are bullish on RCPT and 2 are neutral. The average 12-month price target for RCPT is $228.50, marking a (-0.69%) potential downside from where stock is currently trading. On average, the all-analyst consensus for RCPT is Hold.

Cody Miecnikowski writes about stock market news. He can be reached at cody@tipranks.com