An Interesting Summer Awaits Us All

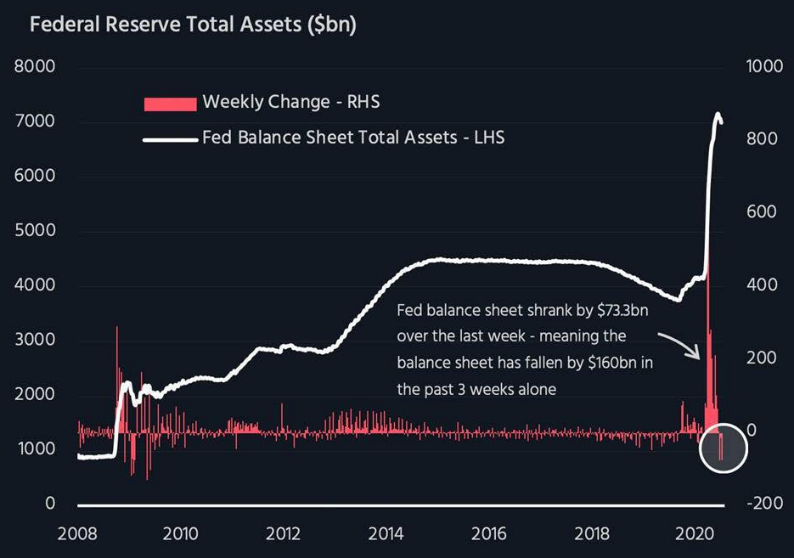

Since March of this year, the Federal Reserves balance sheet expanded from $4 trillion to $7.168 Trillion as the coronavirus spread played out.

But as of 2nd July 2020, the federal reserves balance sheet shrunk by $160 billion, which has been on account of Foreign Banks paying back the Swap Lines drawn in March.

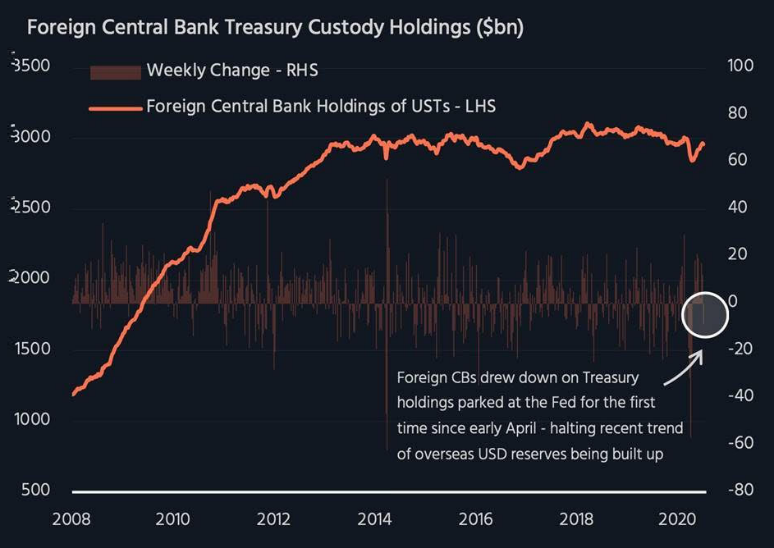

Foreign Central banks have again started selling treasury holdings which is concerning as this reverses the overseas buildup of reserves.

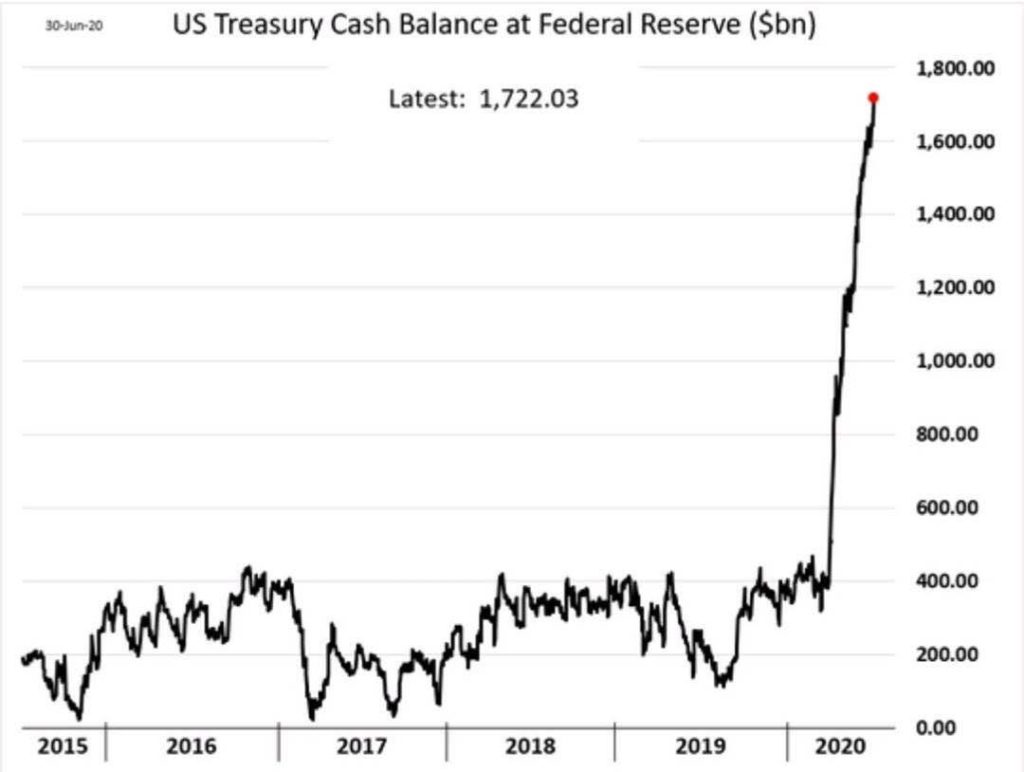

Meanwhile, the US Treasury has increased cash balance at the federal reserve to $ 1.72 Trillion which is extremely aberrant behavior. This can bode positive for the markets in the run-up to the election. But in the interim, till the money remains unspent and liquidity tightens in the banking system it can affect markets.

This is all indicative of the US Treasury preparing for a liquidity splurge in the run-up to the lection to support asset prices leading into the presidential election. For the treasury to achieve this objective it would have to start spending money in August which would lead to a new high in the market just before the elections.

The course of action would be to be cautious at these levels and wait for either price or time correction expected in the month of July to reduce cash levels and add risk to play for a massive rise in liquidity towards the US election.