American Sands Energy: A Revolutionary Unique Oil Sands Play

Note from editors: This article discusses a penny stock. Penny stocks are easily manipulated; please do your own due diligence.

The Good, Bad, and the Ugly

I. The Good

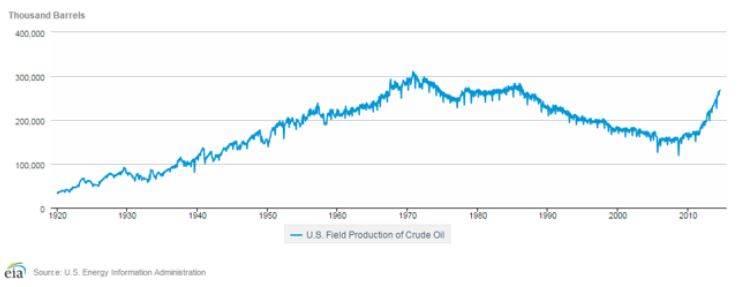

It is not much of a debate: the past few years America's entire economy has been held afloat due to increased jobs and production in the energy market. It's no surprise that five out of the ten fastest growing economies in the USA are oil producing states.

(Source: EIA)

The politicians are ecstatic as the U.S. trade deficit shrinks by the help of oil imports being reduced due to the increased domestic production.

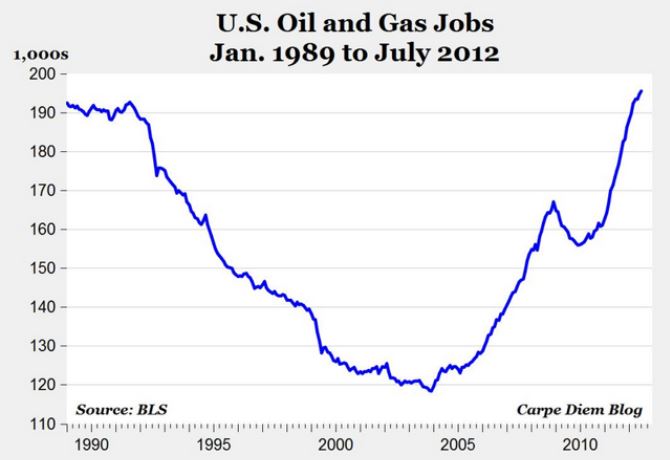

(Source: BLS)

Also on the plus side, the added supply of oil being produced in the U.S. will put downward pressure on oil prices, which will drive down costs in many manufacturing countries, especially the agriculture markets that use oil as an input (huge amounts of electricity for pumping water, etc) and of course the average families that will have more disposable income left over instead of paying for higher vehicle gasoline.

II. The Bad

Unfortunately prices are a double-edged sword; a family which purchases cheaper oil means an investor who loses profits.

Countries that are heavily dependent on oil production for income, such as Iran, Russia, Venezuela, and Saudi Arabia, are getting strangled by lower oil prices. If these countries balanced their budgets at $100 dollar-per-barrel, how will they make up for the lost revenue?

It should also be no surprise that most oil producers in the U.S. are marginal and high cost, which will suffer if oil stays below $85.

"If prices fell suddenly to $60 a barrel, the production growth [in the United States] would turn negative," Ed Morse - Citigroup's head of global commodities research.

The last thing the U.S. politicians want are all those jobs and the production that has lifted the anemic economy to fade away. And the last thing investors want is to have their oil rigs producing at costs that exceed global crude price (production costs > sale price = insolvent).

III. The Ugly

Along with the fracking boom, a Pandora's box opened.

With the environmental contamination/damage and the heavy costs of fresh water used in fracking, especially in times of droughts plagueing parts of the U.S., people have started to question the tradeoff between the domestic oil productions pros and cons.

Oil sands in Alberta, Canada have also brought prosperous effects in the economy, but the negatives are mounting. With a rise in greenhouse gas emissions, the destruction of wildlife breeding grounds, and water contamination from tailings, there are many unforeseen consequences that have been caused by the oil boom.

"Greenhouse gas emissions are higher for oil sands production than for conventional oil production," Simon Dyer, The Oil Drum.

IV. The Dilemma and Solution and Choice

Dilemma: Oil supply will be affected by the growing environmental concerns and the plummeting oil price, directly contradicting America's desperately needed energy boom to continue for employment, revenues, and oil independence. What can the investor do in this predicament?

Solution: Look for low cost producers with a long asset life that are environmentally cleaner.

Author's preferred choice: American Sands Energy Corp (AMSE) could give investors the solution (above) they need to prosper even within the dilemmas (above) facing the oil market.

American Sands Energy - A Revolutionary Project

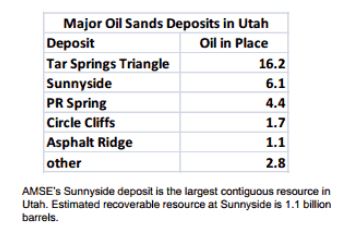

American Sands Energy Corp is pre-production oil sands company with resources located in the safe jurisdiction of Utah. The iconic property, the Sunnyside deposit, has an impressive 150 million barrels that is under the company's lease, but has the potential to be upwards of 650 million barrels. It had been controlled in the past by Chevron (CVX) and AMOCO (BP) and had a combined $40 million for drilling on the property.

(Source:DOE/FE/NETL 2006)

Since this is an oil sands deposit there is no decline curve that traditional oil companies use for their wells. Obviously energy and mine companies have a constantly depleting asset, meaning overtime as they are extracted they must find more reserves or run out of resource. The Sunnyside deposit is a mining extraction, not an oil well extraction (link to a video of the mining process). This means that the company plans to extract 5,000 barrels per day worth of oil out of the ground and it will constantly stay at this pace until management increases the amount of decreases the amount. And with the size of the asset it will have a mine life at 5,000 barrels per day of roughly 30 years. They will also not have to spend capex to drill for more holes, significantly reducing discovery costs.

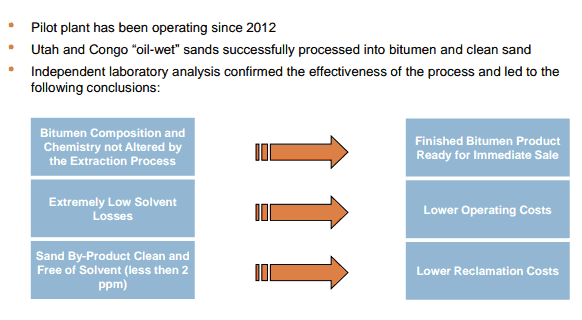

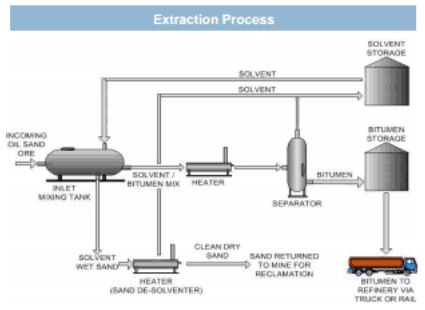

But what separates the company apart from many others is the unique proprietary process it uses to produce bitumen i.e. oil.

The Innovative and Economical Process

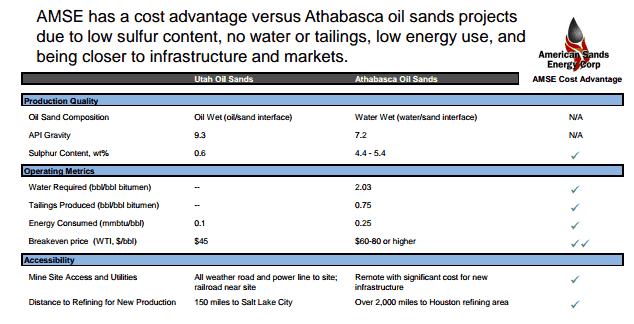

(Source:AMSE Presentation)

This revolutionary process allows the following:

- A water-free extraction process which will produce oil without water contamination as many of the other oil sands projects do.

- The process will require no tailings ponds because there is no water used and all the solvent used will be recovered and recycled.

- The sand once separated from the oil is a dry clean sand with non-toxic byproducts and could be sold as an value added product instead (see photo below).

- The process also does no discriminate against other types of oil sands, giving the companies process a globally competitive advantage as it could work in other countries.

As the above list states, the process is clean, which will satisfy the environmentalists.

The following list will discuss the economics of the process:

- Relatively low operational costs due to the absence of water in the process.

- There is 60% less energy used using this process compared to the "water wet" (Canadian) oil sands operations.

- Low relative initial capital costs for the entire project to be built requiring only around $75 million.

- Break even at roughly $49 barrel of WTI crude oil. Many Canadian oil sands companies are having costs around $100 per barrel.

(Source: AMSE)

"Even riskier financially are the oil sands, or tar sands, of western Canada, which are profitable only if crude prices are as high as $150 a barrel," CTI (Carbon Tracker Initiative of London) said.

With the environmentalists at ease with the AMSE process, now the investors are impressed with the project's economics. With oil even at $70 dollar per barrel, AMSE will have a $20 per barrel net income.

The company has accomplished a difficult task: create a low cost, high margin project while not desecrating the environment.

Catalysts - Pending Permitting

In March 2014, the company had applied for its mining permit so that hopefully once approved it can raise capital to begin construction. In a recent interview the company's CFO, Daniel Carlson, spoke about the nearing of the end of the permitting phase. It is an interactive process in which the company speaks with the Utah Department of Oil, Gas, and Mining to answer their questions.

Currently the company has been making key progress on gaining permits.

Once the company is approved for the permit, they will proceed with the financing. These are two of the most important risks facing AMSE. And every step closer to permitting is also de-risking the company, creating clearness for skeptical potential investors.

Financing and Income

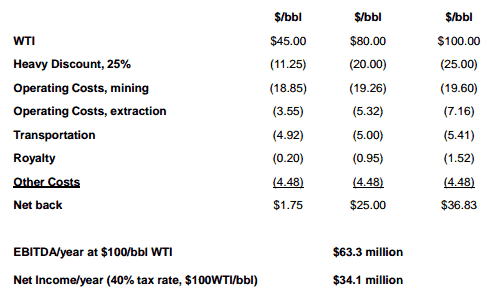

The company hopes to be in production within 16 months after the financing. Again they estimate raising roughly $75 million. Look at the income chart below:

(Source: AMSE)

The investor can assume that if oil prices were even to stay at $80, AMSE could still be very profitable. At 5,000 barrels/day at $25 dollar net profit/barrel, the company would clear $125,000 per each operating day. That is almost $900,000 per week. Which multiplying 52 operating weeks per year would transcend to almost $47,000,000 before EBITA.

The Pilot Plant Experience

In late July of this year I was invited by company CFO, Daniel Carlson, to visit the company's one-ton (12 barrels-per-day) pilot plant in Phoenix, Arizona. Thankfully I live in Scottsdale and was only an hour drive to the demonstration. We made arrangements for me to visit the following day.

(Source: AMSE Presentation)

The day came and I departed to the location in the early afternoon. I arrived at the facility and parked. I wandered around looking for an entrance when I was approached by a man with sunglasses standing by a car.

"Excuse me, but are you Adem Tumerkan?" he asked.

"Indeed I am," I answered.

"Nice to meet you, we spoke on the phone earlier. My name is William Gibbs (AMSE's CEO)."

"Thank you for having me, I greatly appreciate this."

We shook hands and continued through the back gate. I was very impressed that the company's CEO greeted me, and how enthusiastically of his company he spoke.

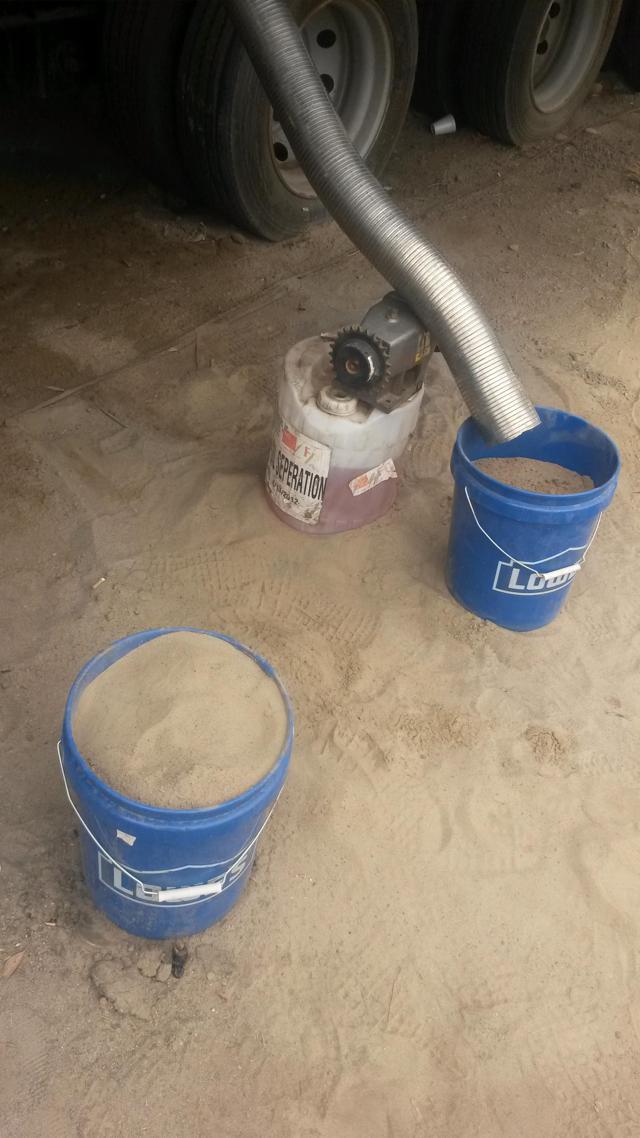

(Source: Adem Tumerkan Cellphone)

The facility was a large industrial plant with fences surrounding the place. The pilot plant was located in the back-left of the property.

Mr. Gibbs himself gave me an overview of the company and answered all of my questions. He informed me there was strong inside ownership of shares outstanding, an extremely underrated oil sand asset (150 million barrels currently, upwards of 650 million barrels), and most importantly an environmentally cleaner (no tailing ponds or enviromental hazards) and lower cost (net back at $49/barrel) process.

"Now, let's get to the most important part. Want to see liquid oil come from those dirt clods?" he said.

There were bags of what resembled black dirt clods. Gibbs had informed me these were oil sands from the Utah Sunnyside deposit, but also there were other bags of oil sands from other countries to test the proprietary process's magnitude.

(Source: Adem Tumerkan Cellphone)

The onsite engineer had informed us it will take thirty minutes for a fresh batch of oil sands to be processed, so we walked next door to the gas station to purchase drinks. I had no complaints as I underestimated Arizona's harsh heat and was wearing formal business attire, I was drenched in my own sweat standing outside. We spoke about the potential of the company's process and how it could be working on oil sand deposits globally without the use of water; a substantial feat.

We walked back to the pilot plant to be greeted by COO, Rob Gereluk, and another investor whose name I didn't get. All four of us watched as the engineers moved some levers and soon enough we watched oil pour out of the nozzle.

(Source: Adem Tumerkan Cellphone)

I thought to myself how intrigued I was with how the oil and the sand were separated.

(Source: Adem Tumerkan Cellphone)

The sand that came out of the other pipe was completely oil free. I was amazed how that dirt clod I saw earlier was shoveled into this machine and out came pure oil on the left nozzle and perfect sand from the right nozzle.

Gibbs looked at us and laughed.

"Pretty cool, right, gentlemen?"

"Very cool, indeed," I said.

Unfortunately my phone (with its camera) had died right before Gibbs handed me a small 16-oz glass jar that was filled with the oil to hold. Gereluk was continuing to answer questions that the other investor and myself had. The next steps were for the hopeful approval of Utah's permitting of the Sunnyside project and then the financing and construction, they emphasized.

After we spent some time discussing the oil market and any other questions we had, the heat had taken its toll on all of us and the nameless investor had to take a flight back to New York soon. We shook hands and parted ways.

On the drive home, I was thinking back on the experience I just had with AMSE. I was very pleased with management's knowledge and easiness to communicate with. I was very thankful also that the CEO and COO were both there to walk me through and give me a demonstration of the pilot plant in action.

And after seeing the process in person, I became ecstatic about the potential and future for the company, especially with those thick consistent margins.

The Investor Interview with Peter Epstein

The following is a transcript between a voice interview I had with Peter Epstein on October 30, 2014.

Adem Tumerkan: Peter, who are you and what are your credentials?

Peter Epstein: I used to work at a hedge fund where I was a senior natural resources analyst until 3 1/2 years ago. I left and started my own consulting business, MockingJay Inc, and that was in June 2011, since then I have been blogging and also in some cases helping companies get publicity.

Adem Tumerkan: If I am not mistake, you like oil and energy companies. What do you look for in your potential investment prospects?

Peter Epstein: Near term production. Low cost production and strong margins due to a world of rising cost. Non-declining production curve, which is what all oil sands companies have, but American Sands Energy especially has an easier and cheaper and less energy intensive process.

Adem Tumerkan: Mentioning American Sands Energy, the market just does not seem to care so far about them. What attracted you as an investor towards AMSE and cause your bullishness towards their project?

Peter Epstein: Well I had experience with a previous company, RedLeaf Resources (private company), and I got to know the Utah mining space and how friendly it is towards mining. There's a lot of oil and gas mining and potash in potential in Utah. It is also a very mining friendly place.

The thing I also really like about AMSE is that they are in a place where there is so much resource that competition won't hinder them or investors. AMSE has competition, don't get me wrong, but even if 2 or 3 companies are successful, there is so much resource that all the companies could potentially prosper for decades. And with AMSE in particular, they can use their proprietary process all around the world for other oil sand deposits.

Adem Tumerkan: Now from my understanding AMSE is relatively environmentally cleaner due to the absence of water in their proprietary process, could you elaborate on this significance and as an investor why that is important?

Peter Epstein: Well because the only reason that oil sand production in the US is not happening yet is because of the tarnished publicity from the environmentalists and the acres and acres (thousands) of tailings ponds (information for "what is a tailing?"). You simply don't have any tailings ponds with AMSE. That's just one example of why they're environmentally cleaner, they also have less emissions because the temperature and pressure at which the solvent extracts the sand is fairly low. And that's why you can get something of upwards 60% less energy used relative to the Canadian oil sands producers. That is greener and more cost effective which is ideal.

Adem Tumerkan: Very interesting. Tell me a bit about the oil business in Utah.

Peter Epstein: Again, the key points are that if the oil sands in Canada weren't damaging to the environment, it would be some of the best business in the world and many players would be involved and many people would be happy. The only thing holding it back is the environmentally damaging publicity. So here, in the Utah, another reason is because there is such a huge abundance of oil sands located there as mentioned above, with no water involved because it's an arid location. And the reason that oil sands is such an attractive investments is because there is a zero production decline, whereas most oil production has a decline curve. For example, shale (specifically fracking) can produce the oil well but after a year or two the production can be down 50% or greater. Whereas oil sands is more of a manufacturing process and mining process instead of the traditional oil well route. For starters there are no need to drill holes and investors don't have to worry about dry holes; reducing finding costs and capex.

Adem Tumerkan: Even in this highly uncertain oil market, are you comfortable being a shareholder of AMSE?

Peter Epstein: Yes. Because they just reiterated in a press release that they have a break-even of $49 dollars per barrel. That is safely above the current beaten-down price. The oil sand project itself has huge blue sky potential. There is high inside ownership (34%) as well, which is reassuring.

Once they reach a number up to 5,000 barrels per day, they can expand potentially to 50,000 barrels per day, even though that could take a few years to reach. Another thing is, the de-risking of the permitting. The obvious risk still remains of raising the capital and the mining operation itself, but that is true with all projects.

Adem Tumerkan: In your opinion, why should the market care?

Peter Epstein: Because AMSE can be tremendously profitable and once their technology is producing, not only will they be able to grow in the rich oil sands of Utah, but they will be able to deploy elsewhere. And that really has the bluest sky potential. They could have a joint venture with other oil companies or royalty arrangements in the future for their proprietary process in other countries.

Adem Tumerkan: Can you offer me some parting advice as being an investor in the current energy market?

Peter Epstein: Patience is key. And follow the investment thesis you made before investing. Listen to what management says, see if they work on their intended goals and follow through. And if they fail to execute? Then you reassess your investment proposition. At $49 cost per barrel, a huge oil sand asset, the safe jurisdiction, and competent management, the thesis is there.

Adem Tumerkan: Thanks Peter for your time, greatly appreciated.

Peter Epstein: Anytime Adem.

Conclusion - Limited Downside with Extreme Upside

AMSE is a company with a unique process and engaging project economics. The company also accomplished something rare: satisfying environmental concerns while satisfying investors. With the price of oil weak and many fracking companies that are high costs, it would be logical for investors to begin looking for phenomenal assets with long production lives at low costs; high margins. There are some serious questions that investors must contemplate:

- The U.S. is aiming at becoming oil independent and, with added pressure from turmoil in the middle east and the sanctions between Russia, how else will this be achieved without allowing new projects to open?

- With the price of oil weak, many high cost fracking and shale companies will suffer, straining supply. With much of the growth since the 2008 collapse being in energy, what will happen to the overall economy if marginal oil wells begin closing? Where can investors feel comfortable investing in America's continued energy independence if some companies begin closing?

- Or consequently with all the central banks globally keeping rates to nothing, 0%, and after launching trillion dollar/currency printing campaigns, what if inflation finally does arrive and oil prices explode upwards? With the Middle East conflicts growing, could that trigger oil prices to move north?

- The environmentalists' growing concern and complaints about the effects of rising carbon emissions, preserving wildlife, and the hazardous damage to the land from the intoxicated left over water, how can projects be permitted when the very people raising concerns are the ones whom elect politicians?

AMSE is still a speculation, but has a project where all the smart money and rationale seems to point. It will be in production located in a safe jurisdiction and operating profitably for decades. The company has stated in the long term it plans to extract 50,000 barrels per day. All this for roughly .50 cents per share currently.

If this isn't considered buying cheap for strong future value and thick margins, then what is?

Disclosure: None.

American Sands Energy is high risk, but a real company with a real chance of making it really big. Obtaining permits is the first big challenge/opportunity. Permits should be in hand within a few months. First oil in 2016 is a lot closer than it sounds, it's almost 2015....

Yes this is a speculation not an investment in my opinion. As all early oil development companies are extremely risky and need funding to survive. But AMSE has incredible deposit and cash costs that I dont believe can be ignored.

Oil is a finite resource, so inevitably it will be gone. What then will happen to the countries counting on the revenue derived from oil? The majority of US oil consumption was in the form of fuel for our automobiles and airplanes. Ultimately there will need to be an oil-less solution for that (hybrid, electric, etc.) and what happens to oil then? These solutions are also more environmental friendly. Instead of looking for an environmentally clean oil company to invest in, why not find an environmental company to invest in? (i.e. a company that is developing cleaner alternatives to oil) Seems to be more forward thinking in my eyes.

I agree we as people are a dynamic economy but how many people are going to sell their cars to purchase even more expensive energy efficient vehicles such as Tesla?

The hope is that with technological advancement, the cost of producing energy efficient vehicles will fall; thus allowing other companies to enter the market, and subsequently, offer lower priced alternatives to Tesla. Perhaps competition in the space will also cause Tesla to lower their prices. Not in the near future, but eventually I do see those vehicles becoming the norm; and people will eventually need to sell their car and slowly begin transitioning to energy efficient vehicles.

1) The US is still importing tons of oil due to current US oil company contracts thus leaving a surplus at home which they are now trying to export (a bit ridiculous).

2) The US oil collapse is coming. Now is not the time to invest in more production.

3) The oil price decline should have happened sooner along with everything else but the Federal Reserve is trying to prevent the natural price declines associated with a downturn which did nothing but prolong the downturn for years because the economy can't realign without the natural savings it gets from price declines.

4) Politicians and the government don't make jobs save ones that cost more jobs, they destroy them unless they cut taxes. Given they do not do that, they could care less if the US oil economy collapses or the rest of the economy. In fact a weak economy allows their banker friends to issue even more QE money and give them out like candy to them and the politicians. Thus, regardless of what everyone says, most bankers and politicians love the zombie economy. It means they get rich while you get poor.

1. The US only produces at most 9% of the world supply. Low cost producers are what need investing.

2. As marginal producers came online in America many countries have reduced oil output such as Syria and Egypt, Libya and Nigeria due to internal factors.

3. The with the Fed's war on deflation and cost of productions increasing, I doubt falling energy prices will be short. With many countries bypassing the US dollar in all oil trade anyways is growing worrisome.

4. I agree completely.

As you were just saying, oil prices will come down from globabl worries and growing supply and the feds "low" inflation.

But what will those high cost marginal oil producers do? They will turn off. Its not as if oil isn't a good business, its at what cost. And my argument is that AMSE will be a low cost producer with a great asset that could survive even $55 oil as many other producers in America go offline, which would inevitably lead to high prices anyway.