American Airlines Is A Strong Buy

A) Introduction

Like its airline rivals, Delta Air Lines (NYSE:DAL), United Airlines (NYSE:UAL), and JetBlue Airlines (NASDAQ:JBLU), American Airlines (NASDAQ:AAL) has been on an absolute tear the last six months. American Airlines managed to scrap its fuel-hedging scheme just in time to take advantage of the collapse in crude oil, and has thus benefited tremendously from lower jet fuel prices. We believe the company offers the rare opportunity in which the stock combines an attractive valuation with strong price momentum, profitability, and growth. Each of these factors is good determinant of future success, and we will outline why as we progress through the analysis. The report will start with a breakdown of American Airlines valuation profile, then will proceed to an analysis of the price and profit growth, followed by an analysis of recent "smart money" transactions, and concluding with some qualitative analysis and conclusions.

B) Growth Breakdown

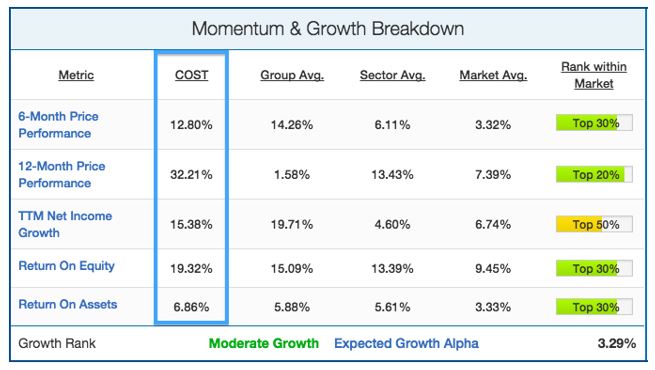

There are a variety of different growth metrics that have been shown to predict stock returns. Most important among them is price momentum. Winning stocks keep winning (based on six-month price performance), and losing stocks keep losing. American Airlines growth breakdown is shown below:

As we said before, American Airlines has been a beneficiary of lower jet fuel prices and its stock price has reflected that. AAL has gained 30% over the last six months and 42% over the last twelve, which puts it into the top fifth of the entire market in both metrics. AAL grew annual EPS by 135%, which is much stronger than the airline group (34%), sector (19%), and overall market (12%) averages. In testament to the strength of American Airlines company management, AAL returned 95% on equity. This is much higher than the airline group and overall market averages. Overall, we rate American Airlines as a "Strong Growth" company due to its combination of price momentum, EPS growth, and superior ROE.

C) Valuation Breakdown

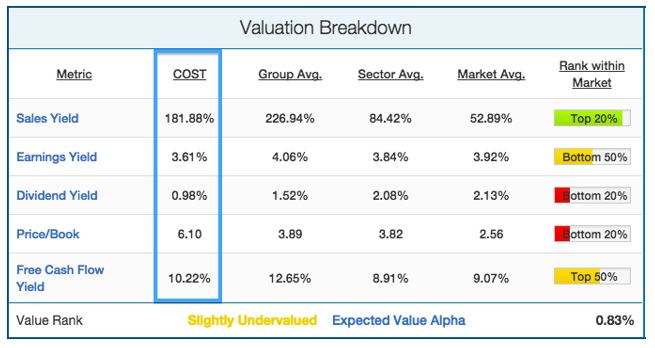

We'll now move on to an analysis of AAL's valuation profile. Value is important to look at as Nobel laureate Eugene Fama showed that "value stocks have higher average returns than growth stocks". AAL's valuation profile is shown below:

Looking at the traditional value metrics, American Airlines valuation comes out mixed. On a revenue and earnings basis, AAL looks relatively attractive. AAL's sales yield of 115% and earnings yield of 7.6%, show that the stock is currently trading at a discount relative to its airline peers. But the stock looks fairly overvalued when looking at it on a book value basis, with its price-to-book of 18.01 being significantly higher than the airline group average of 5.22. Overall, we rate American Airlines as "Slightly Undervalued" due to its attractive revenue and earnings yields.

D) Smart Money Breakdown

In addition to value and momentum, we will also analyze how the "smart money" on the street is playing American Airlines. We consider the "Smart money" to be short sellers, company insiders, and institutions. Each of these stakeholders tends to be much more sophisticated than the average investor and thus their transactions give good clues of what is to come. We have found loads of academic research showing that short sellers, company insiders, and institutions all predict stock returns. This "smart money" breakdown for AAL is shown below:

Relative to the market, the "smart money" on the street is pretty optimistic on American Airlines. Company insiders have essentially maintained their positions in the stock during its price run, while company insiders in other airlines have been dumping their positions (-13% in ownership over the last six months). Short interest on AAL has also been very low at 1.76%, which is also significantly below the airline average. Clearly, short sellers just don't believe in the short thesis regarding American Airlines. Institutions have been buying into the stock over the last few months, increasing their ownership percentage by 1.85%. Overall, we rate the smart money on the street as "moderately bullish" on AAL.

E) Qualitative Analysis & Conclusions

We'll now supplement our quantitative analysis with a qualitative discussion of some of the major growth catalysts and risk factors that could impact the stock price in the near future. As we discussed earlier, we believe American Airlines has a very solid management running the company (as evidenced by their track record of strong returns on equity). Management is aware that American Airlines is undervalued, and recently upped their share buyback program to $2 billion, scheduled to the end of 2016. This follows the early completion of their earlier $1 billion buyback program. Share buybacks - especially when the stock is undervalued - have been shown to be a very good indicator of future outperformance. While a point can be made about AAL introducing a buyback program (and a new dividend) while the company is still servicing a significant debt load. We don't believe AAL is at a significant risk of defaulting or experiencing a "debt" spiral, especially with the strong industry tailwinds of lower jet fuel prices boosting income.

Overall, we believe American Airlines offers a great opportunity to buy into a stock with great growth, strong management, momentum, an attractive valuation, and with strong industry tailwinds at their back. The share buyback program offers a good catalyst for further outperformance as well. The company releases earnings in about two months, with analysts expecting $1.78 in EPS and $9.95 billion in sales. Investors looking to learn more about our analysis can do so here.

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in AAL over the next 72 hours. The author wrote this article themselves, and it expresses their ...

more