Alarm.Com IPO Lock Up Expiration Could Ring The Bell For Short Sellers

Alarm.com Holdings (NASDAQ:ALRM) - Sell or Short Recommendation - PT $15.50

December 23, 2015, concludes the 180-day lockup period on Alarm.com Holdings (NASDAQ:ALRM).

We previewed the event on our IPO Insights platform.

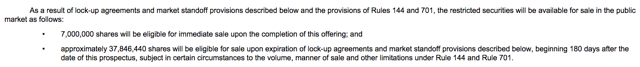

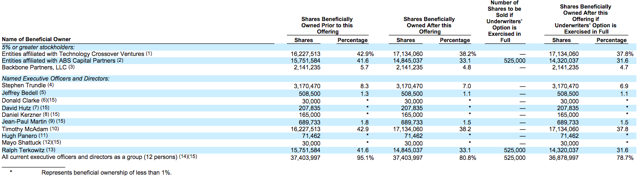

When the lockup period ends for ALRM, its pre-IPO shareholders, directors and executives will have the chance to sell their ~37 million shares. The potential for a sudden increase in stock available in the open market may cause a significant decrease in ALRM shares.

(Click on image to enlarge) (Source)

The event could open a short opportunity for aggressive investors.

Early Market Performance: Strong Start

Alarm.com Holdings priced its IPO at $14 per share, at the mid-point of its expected price range of $13 to $15. The stock opened on the first day of trading at $16.05 and closed at $16.88 for an increase of 20 percent. Since then the stock reached a low of $11.45 on September 29 and a high of $19.14 on November 25. Currently, the stock trades at $16.78 (afternoon sessions 12.9.2015).

(Click on image to enlarge)

(Nasdaq.com)

Business Summary: Technology Platform for Connected Home and Business Security Services

Alarm.com provides a technology platform for connected services that operate residential and commercial security systems. Its intelligent cloud-based services integrate with mobile and other devices to deliver interactive security, energy management, video monitoring, access control and other automation solutions through a single, intuitive mobile app. The company serves its customers through a network of dealers in the United States and internationally.

Alarm.com's SaaS platform gives families and business owners the capability to control a wide array of connected devices including garage doors, door locks, video cameras, flood sensors, water valves, security sensors, solar panels, shades, lights, image sensors, and thermostats. The company has over 2.3 million subscribers that connect over 25 million devices. The company notes that in 2014 its subscribers generated over 20 billion data points through the Alarm.com platform, which made it the largest connected home platform that year in the US.

Between 2010 and 2014, the company grew at a 46 percent compound annual growth rate and for the first quarter of 2015, the rate of SaaS and license renewals grew between 91 percent and 94 percent.

The company partners with more than 5,000 security service providers who sell and install the Alarm.com software platform.

Alarm.com recently announced the launching of Voice Over LTE (VoLTE) in partnership with Verizon (NYSE:VZ) to provide direct communications from central stations into a business or home during an emergency over Verizon's 4G LTE Network. This provides users with hands-free, two-way voice communication to security personnel to call for emergency services. In addition, the company announced a strategic partnership with Securitas, which is the second largest security company worldwide with operations in 53 companies. Alarm.com expects to deploy services in parts of Europe by the middle of 2016.

Financial Highlights For Q3 2013

The following highlights ALRM's early success - and the opportunity for its major pre-IPO shareholders to take initial profits on a growth trajectory.

- Total revenue increased 26 percent to $54.0 million, Q3 2014 showed $42.8 million.

- Net income was $3.2 million in contrast to $2.7 million for the third quarter of 2014.

Competition: Nest Labs, AT&T, Honeywell, Comcast and Time Warner Cable

While Alarm.com is the largest provider of connected home and business protection, it faces significant competition from other companies such as Nest Labs (from Google (NASDAQ:GOOG) (NASDAQ:GOOGL)), AT&T (NYSE:T), Honeywell (NYSE:HON), iControl Networks, Time Warner Cable (NYSE:TWC), Comcast (NASDAQ:CMCSA) (CMCSK) and ADT (NYSE:ADT).

Management Team Overview

President, CEO and Director Stephen Trundle also serves as CEO and President of Alarm.com Inc. Mr. Trundle has been Vice President of Technology since July 1997 and served as Director of Technology from 1994 to 1997. His prior experience includes senior positions at MicroStrategy. He also served at Bath Iron Works on the Aegis Destroyer program from 1991 to 1992. Mr. Trundle holds an A.B. in Engineering and an A.B. in Government from Dartmouth College.

Jennifer Moyer is CFO of Alarm.com Holdings. Her previous experience includes positions at Washington Post Newsweek Interactive Company as Chief Operating Officer and VP of Finance and Controller. She also worked at Price Waterhouse LLP from 1993 to 1998. Ms. Moyer is a Certified Public Accountant with a BBA in Accounting from Temple University.

Conclusion: Short ALRM Ahead of its IPO Lockup Expiration

On December 23, 12 individuals and three firms, including Crossover Ventures, ABS Capital and Backbone Partners, will have a first chance to sell their ~37 million ALRM shares, restricted from trading since ALRM's IPO.

(Click on image to enlarge)

As ALRM initially offered just 7 million shares - if even a portion of the above insiders decide to sell, they could send the stock price tumbling down.

We suggest shorting ALRM prior to its lockup expiration.

Disclosure: None.