After Emergency Rate Cut From The Fed: How Dovish Can The US Central Bank Be On Wednesday?

On March 3, the Fed announced an emergency rate cut to counter the negative economic consequences which have, and will continue to, result from the Coronavirus pandemic.

Then on March 15, there followed a massive new series of developments: the US central bank cut rates to 0.0%-0.25%, launched a massive QE program of USD 700 billion, announced swap lines with global central banks to make sure that enough US dollars are available, and cut reserve ratios for banks down to 0.

The impact on Equity markets, however, was limited. But, European indices dropped like a stone, indicating that the trust in the central bank has not just enormously suffered over the last decade, but also that market participants didn't see any reason why a looser monetary policy should contain the impact from a pandemic virus.

The Fed's first emergency cut since the Lehman crash of 2008

The seriousness of the situation is seen not just by the financial markets' fear index VIX hitting its highest levels since the 2008 Financial Crisis, but by the fact that this was the last time an emergency rate cut like this came from the Fed.

When talking and listening to market participants and hearing what they think about this emergency rate cut, general feedback is mixed to negative.

Former top Fed economist Robert Eisenbeis e.g. called the cut a waste. David Kelly, chief global strategist at JP Morgan Asset Management, said that it's not clear whether this standard monetary remedy is the right approach for an epidemic-induced economic downturn.

In addition to the fears and panic around the Coronavirus, global financial markets were hit by another risk-off wave last Monday, after oil prices collapsed due to Russia resisting Saudi Arabia's push for deeper production cuts at the OPEC meeting in Vienna.

With oil prices dropping more than 25%, further losses are to be expected, and many US oil companies from the fracking industry are threatened by potential bankruptcy. This could carry a significant negative impact on the (US) banking sector, and the US economy as a whole. Global equity markets also dropped sharply, putting even more pressure on the Fed to act once again today, at the next meeting.

So, from whatever direction you look at it, US yields should remain under pressure. Not only short-, but also mid-term, and thus yield sensitive, currency pairs like the USD/JPY see another chance to drop lower, and go for an attack of the psychologically relevant region around 100.00 JPY.

Is the USD/JPY an attractive Short candidate?

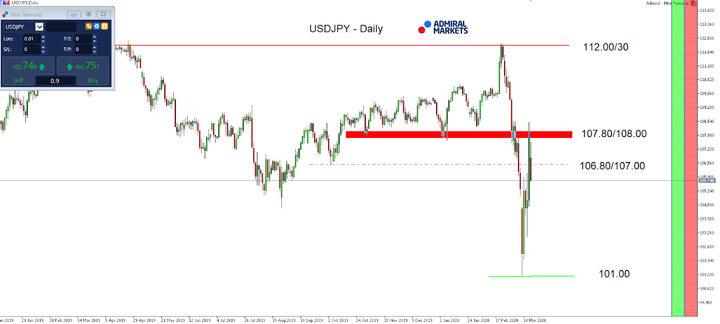

(Click on image to enlarge)

Source: Admiral Markets MT5 with MT5-SE Add-on USD/JPY Daily chart (between January 7, 2019, to March 16, 2020). Accessed: March 16, 2020, at 10:00pm GMT

As a potential short-trigger, with the target to position ourselves in direction of the current Short mode, we consider the region around 106.80/107.00 of interest. This region also has a 50% Fibonacci retracement level from the down move, coming from the February 2020 highs to the March 2020 lows.

For a slightly more attractive risk-reward ratio, a deeper corrective move into the region around the 61.8% Fibonacci retracement around 107.80/108.00 provides also an interesting Short trigger.

With a stop above the February highs around 112.30, and targeting for 101.00, such a setup as this delivers a risk-reward ratio around 1 to 1.3:

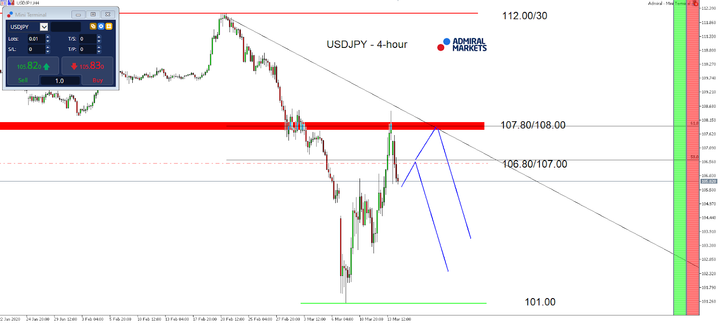

(Click on image to enlarge)

Source: Admiral Markets MT5 with MT5-SE Add-on USD/JPY 4-hour chart (between January 22, 2020, to March 16, 2020). Accessed: March 16, 2020, at 11:15am GMT - Please note: Past performance is not a reliable indicator of future results, or future performance.

In 2015, the value of the USD/JPY increased by 0.5%, in 2016, it fell by 2.8%, in 2017, it fell by 3.6%, in 2018, it fell by 2.7%, in 2019, it fell by 0.85%, meaning that after five years, it was down by 9.2%.

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter "Analysis") ...

more