ADRs Best And Worst Report - September 29, 2014

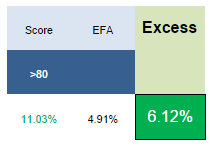

The best scoring ADRs from one year ago (9/30/2013) returned an average 11.03%, 4.91% better than the MSCI EAFE index EFA. The best performing from our list have been SHPG up 120%, TTM up 69%, and GGAL up 50%.

The MSCI EAFE has gained in eight of the past 10 Q4's, returning a median 5.49%.

busss.png)

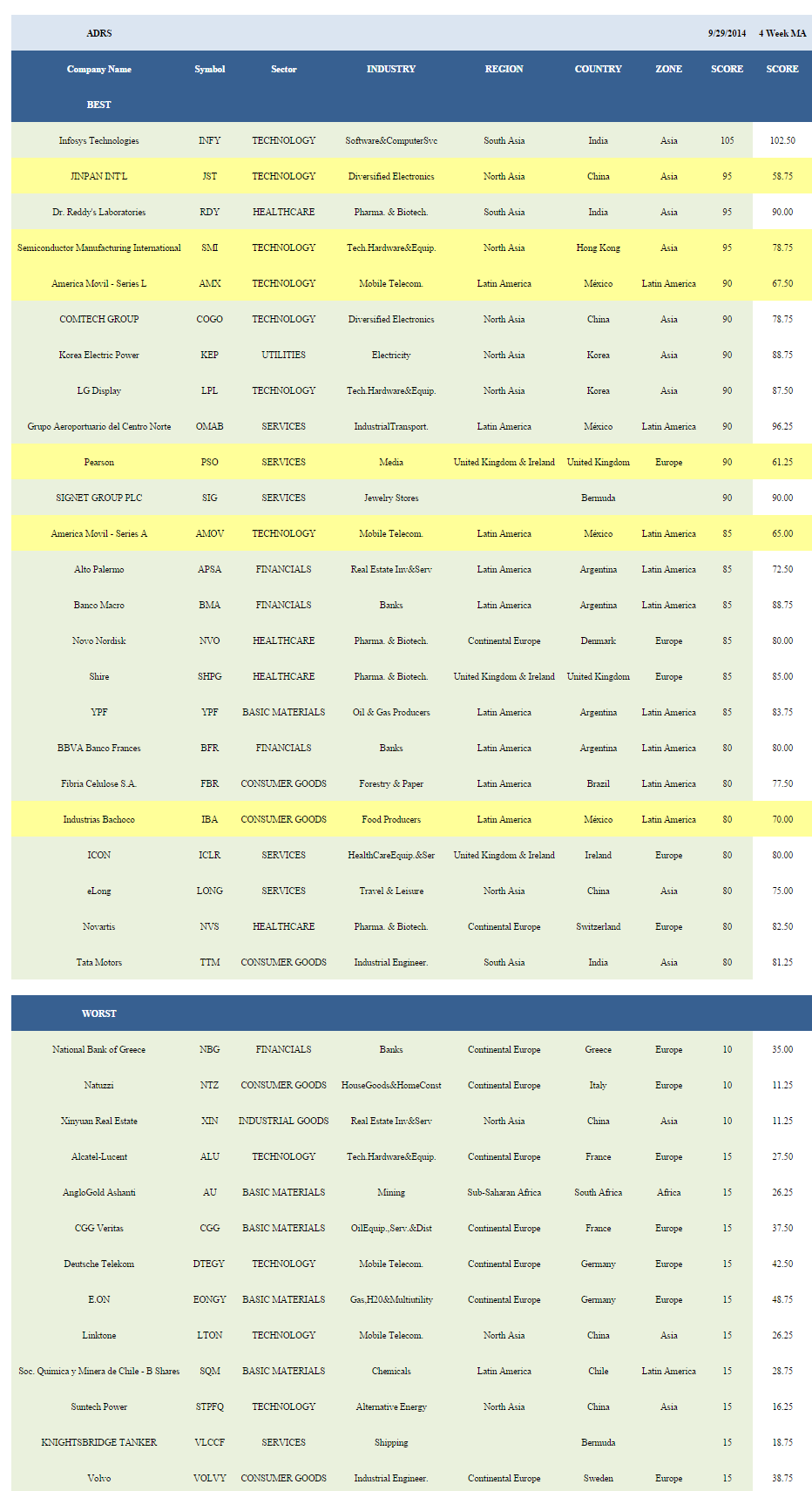

The average score across our ADR universe this week is 47.69, below the four week moving average of 52.55 and the eight week moving average score of 54.17. The average ADR is trading -20.76% below its 52 week high, -3.85% below its 200 dma, has 4.07 days to cover held short, and is expected to post EPS growth of 18.23% next year. NOTE: Scores have shifted to reflect Q4 seasonality.

After rolling scores to reflect the switch to Q4 seasonality, services (SIG, PSO, OMAB, LONG, ICLR, WNS, RUK, GSH), healthcare (RDY, SHPG, NVO, NVS, SNN, RHHBY), and consumer goods (TTM, IBA, FBR, SORL, HTHIY, CAAS, NSRGY, FMX, BUD, BTI) score highest. Technology, basics, financials, industrials, and utilities score below average.

ussese.png)

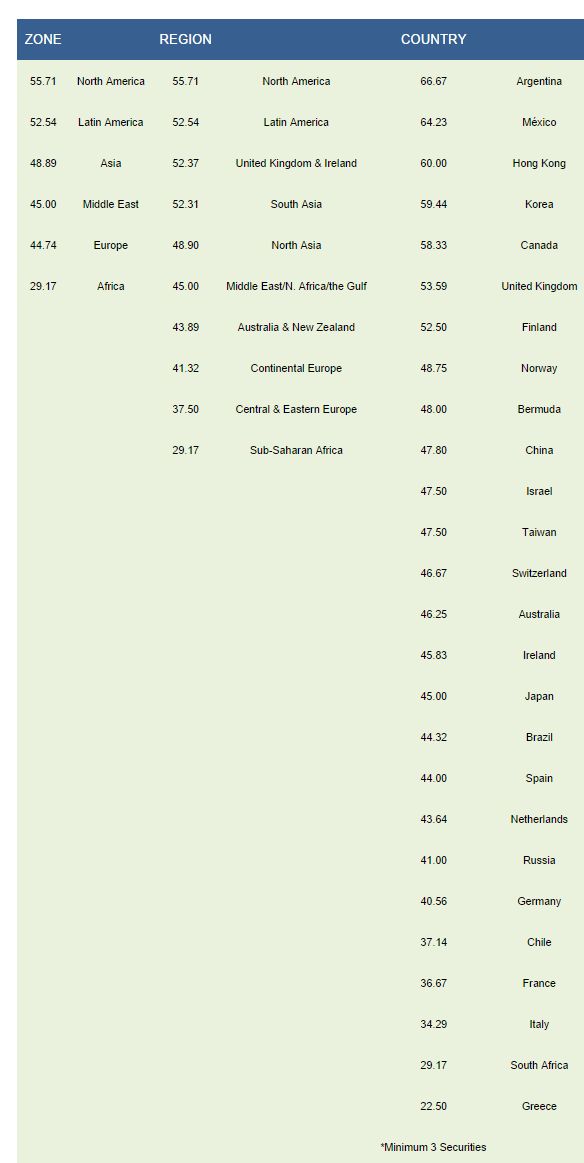

The top scoring zones are North America (RY, BMO, BCE, TU) and Latin America (AMX, OMAB, AMOV, BMA, APSA, YPF, BFR, IBA, FBR). North America, Latin America, and the UK/Ireland (PSO, SHPG, ICLR, ARMH, RUK) are the top scoring regions. Argentina (BMA, APSA, YPF, BFR), Mexico (AMX, OMAB, AMOV, IBA), Hong Kong (SMI, MPEL, HKTV), Korea (LPL, KT, SKM), and Canada (RY, BMO, BCE, TU) are the best scoring countries.

Disclosure: None.